Never Thought Drug Cash Involved, Silberman Says

SAN DIEGO — Businessman Richard T. Silberman, charged with laundering $300,000 that had been portrayed to him as Colombian drug profits, admitted Wednesday that he went through with the two deals at the heart of the case, but said he never intended to commit a crime.

Testifying in his own defense, Silberman, who once was a top aide to former Gov. Edmund G. Brown Jr., said he thought the first deal, a swap of $100,000 for stock in his gold mining company, was a legitimate business transaction.

Tearily discussing the second deal, an exchange of $200,000 for U.S. Treasury bonds, Silberman said he was coerced into completing it by a government informer who threatened his family and left him “scared to death.”

Silberman said he never understood that the cash was purported drug money and maintained, despite testimony by FBI agents that he confessed upon arrest in April, 1989, in a San Diego hotel room, that he did no such thing.

Although Silberman occasionally fought back tears, he was more often composed and assertive while discussing his version of events. He said he “obviously made a mistake and did something stupid to get involved with this.”

But, later, during a savage cross-examination, Silberman was so subdued that U.S. District Judge J. Lawrence Irving had to ask him to speak up. Federal prosecutors pointed out that Silberman had been aware of references to drugs and suggested he had lied while doing the deals and was being untruthful--or his memory was fading--in court.

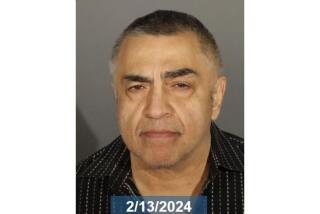

Silberman, 61, is standing trial on seven counts stemming from allegations that he laundered $300,000 that the undercover FBI agent--Peter Ahearn, who posed as Pete Carmassi, a front man for Colombian drug traffickers--characterized as narcotics profits.

If convicted, Silberman faces up to 75 years in prison.

After prosecutors spent two weeks playing dozens of secretly recorded tapes laying out the two deals in the case, Silberman’s lead defense lawyer, San Francisco attorney James J. Brosnahan, said Wednesday it was time for the San Diego financier to tell his side of the story.

The first deal, the swap of $100,000 for stock in a subsidiary of Silberman’s San Diego-based gold mining firm, Yuba Natural Resources, began Nov. 30, 1988, when Ahearn delivered the money in a shoe box. The second, the exchange of $200,000 for U.S. Treasury bonds, got started on Feb. 22, 1989, again with Ahearn’s delivery of the cash.

Silberman said he was motivated to make the first deal after being pressured by a Swiss money manager, Andre Michaels, whose clients were unhappy with Yuba’s financial performance. They were so unhappy, Silberman said, that Michaels badgered him into seeking buyers for his clients’ stock.

For help, Silberman called reputed mobster Chris Petti. A few weeks later, at a Nov. 9, 1988, meeting with Petti and government informer Robert Benjamin, Silberman was introduced to Ahearn at a Mission Valley coffee shop.

According to Silberman, Ahearn did not mention Colombians but said he represented Mexican investors who needed “confidentiality.” Silberman said he struck the deal with Ahearn to relieve pressure from Michaels and contended that Ahearn committed himself to the eventual purchase of $500,000 of Yuba stock.

Prosecutors allege that the $100,000 was broken into small sums and commissions were taken out. The $90,000 that was left, they say, was wired to a Hong Kong bank account that they contend Silberman controlled, then on to a Swiss bank.

At no time did Ahearn tell him drugs were involved, Silberman said. In addition, he said, the question of whether the money came from drugs never arose with Benjamin and Petti.

“If at any time I had heard drugs, I would have gotten up and walked out,” Silberman said.

Assistant U.S. Atty. Charles F. Gorder, the lead prosecutor in the case, pointed out to Silberman that the tapes show that, on Nov. 12, three days after the initial Mission Valley meeting, Ahearn, discussing his purported bosses, said to Silberman that “all they know is the coke.”

“I don’t recall hearing that,” Silberman said Wednesday.

In a Dec. 2 phone call, Ahearn mentioned the “drug types,” to which Silberman replied, “Let’s us not even, uh, use any of the words any more,” according to a tape recording of the call.

Silberman said Wednesday that he heard Ahearn say “drug types” and added, “I didn’t think he was talking about the source of the Mexican funds he had.”

Gorder also produced a letter Silberman wrote Feb. 14, 1990, that included this paragraph, which conflicted with his testimony that the question never came up: “Petti and Benjamin said Ahearn was a real estate investor and both said emphatically that the money was not drug-related.”

As part of the first deal, Silberman told Ahearn on several occasions that he himself had added $400,000 to the $100,000 the agent had supplied, making it a $500,000 transaction, since a larger deal would mean smaller fees along the way. But Silberman conceded Wednesday that he never did throw in an additional $400,000.

When Gorder asked him if he had lied, Silberman said he preferred to call it an “exaggeration.”

Gorder did not have time Wednesday to ask about the second deal but is expected to today.

Silberman insisted Wednesday that he had no interest in the second transaction and went through with it only after being coerced by Benjamin, the government informer who had been convicted of eight felonies, including bookmaking and bank fraud.

On Jan. 5, 1989, Benjamin called him and reported that “Ahearn was not going to do any more stock deals, he was going to do something else, and I was going to do what he wanted to do,” Silberman said.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.