Tide of State Tax Revenues Ebbs, Indicating Recession : Economy: Of states’ three main taxes, the corporate income tax fared worst, with a 0.9% average decrease.

WASHINGTON — Sluggish state tax revenues, despite large rate increases passed by some legislatures, suggest that many states already are in a recession, according to a national survey.

A study by the Center for the Study of the States in Albany, N.Y., indicates that New England and mid-Atlantic states are experiencing the weakest tax revenues, in contrast to the Far West, where they are strongest.

In the three months from July through September, the average increase in state tax revenues was 5.4% compared to the same quarter a year ago. In half the states the increase was 5.1% or less, which is lower than the rate of inflation, the study said.

The revenue picture would have been even bleaker without large tax rate increases passed in Kentucky, Nebraska, New Jersey and Oklahoma. Excluding those four, the average increase was 4.9%.

“Such a small increase has important implications about both the health of the economy and the state of state finances,” said Steven Gold, the center’s director. “It implies that the economies of many states are in recession and that many state budgets are afflicted by fiscal stress.”

Of the three main state taxes, the corporate income tax had the worst results, with a 0.9% average decrease, reflecting sharply lower profits. Twenty-three of the 42 states with corporate income taxes reported decreased revenues from them.

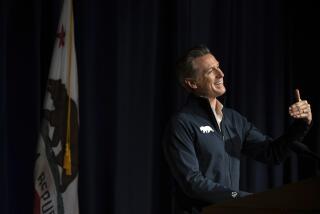

California reported a 2% decline in corporate taxes but fared much better than average with personal income tax revenue, up 8.2%; sales tax revenue, up 6.3%, and total tax revenue, up 8.4%.

Nationwide, general sales tax revenue was up an average 4.5% and personal income taxes were up 5.6%.

“The sluggish growth of the sales tax indicates that consumption spending is very weak,” Gold said. “The relatively small increase in the personal income tax reflects weakness in the growth of wages, salaries and other forms of income.”

States with the largest revenue increases, according to the report, were Nevada, Kentucky, Hawaii, West Virginia, Nebraska, Oklahoma, New Jersey, Texas, Missouri, Idaho, Illinois and South Carolina.

Overall revenue decreases were reported by Montana, Connecticut, New York, Massachusetts, Ohio, Wyoming and, due to an accounting change, North Carolina.

During legislative sessions this year, 10 states made tax changes expected to increase annual revenue by at least 5%, while seven more raised taxes by 1% to 5%, the study said. Most are already in effect.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.