BANKING/ FINANCE : Events Scuttle Sale of 75% of Irvine Bank’s Holding Company

The prospects for war in the Middle East, increased taxes and a general recession have scuttled a deal to buy 75% of Irvine City Bank’s holding company, said James P. Giraldin, the company’s president and chief executive.

Shareholders of Irvine City Financial Corp. were expected to approve the previously announced agreement at an annual meeting next Wednesday, but management now will simply tell them about the strengths of the Irvine-based savings and loan, a disappointed Giraldin said.

He would not reveal the proposed purchase price or the identity of the Orange County buyer or buyer group.

“They didn’t think that with the general economy they would feel comfortable instituting their banking plans,” Giraldin said. “They cited the uncertainty of war with Iraq, the congressional budget resolution that calls for more taxes and a recession in the economy as reasons for backing out of the deal.”

But the purchaser, he said, had no problem with Irvine City Bank’s operation, which has been restructured in the last year to comply with new regulations and the 1989 federal law that bailed out the thrift industry’s deposit insurance system.

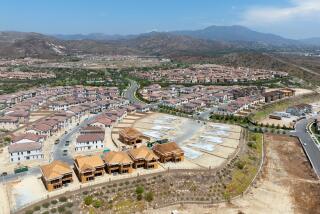

The small thrift, with $95 million in assets at the end of June, exceeds the three federally mandated tests for capital, but it lost $70,000 in its fiscal first quarter, which ended Sept. 30. Giraldin attributed the loss mainly to a slowdown in the sale of a housing project the thrift was helping to build. He said he expects the thrift to return to profitability by the end of its current fiscal year.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.