Poizner urged to get rid of aide

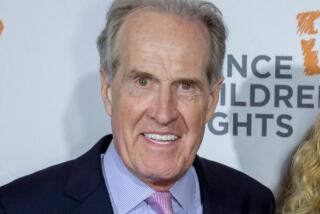

Consumer advocates called Thursday for state Insurance Commissioner Steve Poizner to fire one of his top aides “because he covertly assisted insurance companies in a lawsuit they brought against the commissioner.”

Harvey Rosenfield, a Santa Monica lawyer who wrote the landmark Proposition 103 insurance initiative, said that electronic mail messages obtained under the California Public Records Act show that Poizner’s special legal counsel, Bill Gausewitz, colluded with the insurance industry in its effort to avoid paying $300,000 in legal fees.

Gausewitz, a former insurance industry lobbyist, denied any wrongdoing. And a spokeswoman for Poizner said Rosenfield was “grasping at straws.”

The dispute began when insurance companies lost a lawsuit against the Department of Insurance dealing with automobile insurance rates. Consumer groups, which sided with the state, sought reimbursement for their attorney fees.

But the insurers balked, contending that the state, not insurance companies, should pay the consumer groups. At issue is what happened next.

As the insurance companies prepared their legal arguments for the judge, they asked Gausewitz for a legal declaration to be used in their court filing. He did so and it was submitted to the court Sept. 10.

The industry, Gausewitz and Poizner’s office said there was no questionable behavior. Such filings represent routine statements of fact, they said.

But Rosenfield, the founder of the Foundation for Taxpayer and Consumer Rights, called Gausewitz’s action a clear conflict of interest.

The e-mails “show that Mr. Gausewitz continues to work closely with and on behalf of the insurance industry, albeit in a covert fashion -- conduct that is utterly incompatible with your pledge of an independent administration,” Rosenfield said Thursday in a letter to Poizner.

Gausewitz, in an e-mail to some parties in the case, said his statement dealt with “historical information about the payment of advocacy fees” and was “prepared and executed by me at the request of one of the litigants.” He stressed that the statement did not reflect any legal position by the Department of Insurance in the case, which originally was brought by the insurance industry against Poizner’s predecessor as insurance commissioner, John Garamendi.

However, in a previous e-mail, Gausewitz had instructed an industry lobbyist to “prepare me a new declaration just like the one you provided me earlier.” He cautioned: “Please don’t talk about this to other folks until we have talked about it further.”

Gausewitz’s intervention in the insurance company lawsuit is “a very serious matter as far as legal ethics are concerned,” said Robert Fellmeth, executive director of the Center for Public Interest Law at the University of San Diego. “If the Department of Insurance wants legal work done, it should be doing it. It should not be adopting the work of industry and transmitting it as its own product.”

Insurers termed Gausewitz’s declaration a procedural move. “We needed evidence to support our argument” that in the past some fees paid consumer attorneys had come from the state,” said Sam Sorich, president of the Assn. of California Insurance Cos., one of the parties in the lawsuit. “The only place we could get that evidence was from the Department of Insurance.”

--

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.