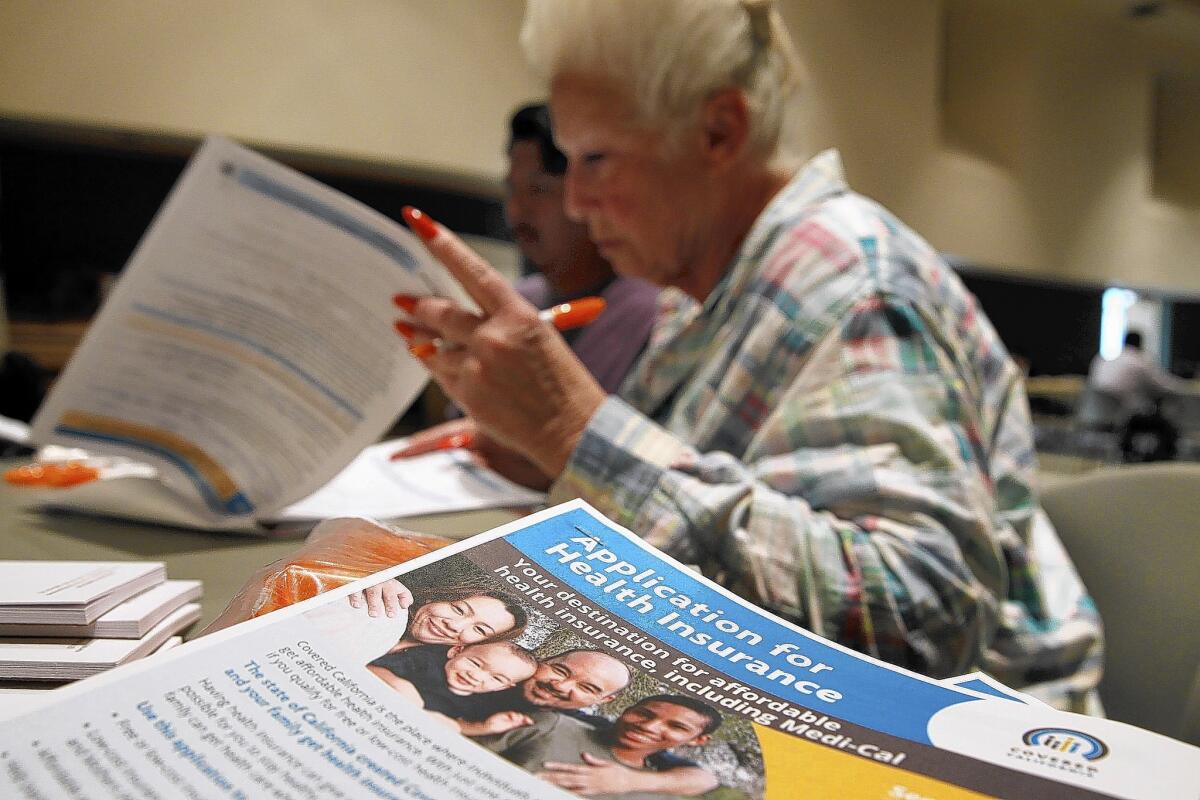

Obamacare benchmark silver plan’s cost to rise less than 1% in L.A.

- Share via

Obamacare premiums in Los Angeles will rise less than 1% next year for the most widely sold coverage, a new study shows.

Across the country, rates for a benchmark silver plan will actually go down slightly in 2015, according to an analysis of health insurance prices in 16 major U.S. cities released Friday.

The report by the nonprofit Kaiser Family Foundation found that changes in premiums will vary widely in the second year of the Affordable Care Act’s coverage expansion. The next open enrollment starts Nov. 15.

Nashville residents will pay nearly 9% more for the second-lowest-cost silver plan next year while rates will drop nearly 16% for similar coverage in Denver, according to the report.

“There is variation, but so far, premium increases in Year Two of the Affordable Care Act are generally modest,” said Drew Altman, chief executive of the foundation, which is not affiliated with HMO giant Kaiser Permanente. “Double-digit premium increases in this market were not uncommon in the past.”

The second-lowest-priced silver plan in each state is a key barometer because it helps determine how much premium assistance people can receive based on their income.

In California, 62% of people in the state’s health insurance exchange bought a mid-priced silver plan, which covers about 70% of a person’s medical bills.

Twenty-six percent of Covered California customers opted for a cheaper bronze plan, which generally covers 60% of healthcare expenses. More comprehensive coverage at a higher price is sold on the gold and platinum tiers.

Los Angeles didn’t fare as well nationally on the rate comparison for bronze coverage. The price of the cheapest bronze plan is increasing nearly 12% in the L.A. market, before taking into account any subsidies.

The report found the 16-city average was a 3.3% increase for bronze.

For a 40-year-old in L.A., the second-lowest silver premium for 2015 will be $257 a month on an Anthem Blue Cross HMO. The cheapest bronze plan would cost $210 per month from Kaiser Permanente.

Those figures don’t include any premium subsidies. Individuals earning less than $46,700 can qualify for financial help.

Statewide, Covered California announced in July that exchange rates were increasing 4.2%, on average, next year.

More than 400,000 people in L.A. County signed up for coverage in the health law’s initial rollout. That turnout surpassed the state enrollment totals in New York, Illinois and North Carolina.

Exchange officials and consumer advocates urge consumers to examine all their coverage options for next year rather than just renewing their existing policy. People can check proposed rates and plans at Covered California’s online calculator.

Also this week, Covered California began notifying about 98,000 families that they risk losing coverage if they don’t provide proof of citizenship or legal residency by Sept. 30.

For most enrollees, the state could verify citizenship or immigration status electronically with a federal data hub. But other consumers were lacking documentation.

“We want to clear these inconsistencies so that our consumers can have a smoother renewal process without any interruption in their coverage,” said Peter Lee, Covered California’s executive director.

Twitter: @chadterhune

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.