Roche to take over Genentech for $47 billion

The pharmaceutical industry’s wave of consolidation hit California on Thursday with the announcement of two major deals, including Swiss drug giant Roche’s agreement to pay $47 billion to gain full control of biotech pioneer Genentech Inc.

Roche agreed to pay $95 a share in cash for the 44% of Genentech’s stock that it doesn’t already own. If approved by the owners of that minority stake, the deal would end an intramural tussle that began last summer when South San Francisco-based Genentech spurned Roche’s initial $89-a-share offer.

Also Thursday, Gilead Sciences Inc., best known for its HIV drugs, said it would buy CV Therapeutics Inc. for about $1.4 billion in a marriage of two Bay Area biotech firms.

Pharmaceutical companies, faced with a shortage of new drugs and needing to slash costs, have been buying one another at a torrid clip in recent months. This week, Merck & Co. said it would acquire rival Schering-Plough Corp. for $41.1 billion in cash and stock. In January, Pfizer Inc. said it would buy Wyeth for $68 billion.

Genentech, which had revenue of $13.4 billion last year, is the world’s second-biggest biotech firm in terms of sales, behind Amgen Inc. of Thousand Oaks. It makes two of the world’s best-selling cancer drugs, Avastin and Herceptin.

By taking control of Genentech, Roche would get the full benefit of those drugs and others developed by the biotech firm, as well as its respected research and development capabilities.

In addition, Roche said the deal would save $750 million to $850 million in annual expenses by eliminating overlapping operations. Roche, based in Basel, Switzerland, gave no specifics about potential job cuts. Analysts said administrative jobs at Genentech’s headquarters could be targeted.

“The cuts they will make in sales and marketing and general corporate overhead will be quite substantial, and more of the losses will probably be in South San Francisco, not Basel,” said Cowen & Co. analyst Eric Schmidt. About three-quarters of Genentech’s 11,000 employees work in San Mateo County.

Roche, which first bought a stake in Genentech in 1990, will have to tread carefully to ensure it doesn’t alienate Genentech’s prized cadre of scientists and researchers, analysts said. The California company has a reputation as a good employer, winning high marks in annual rankings of best places to work by such publications as Fortune and Working Mother.

“When you consider that Genentech has many top scientists, you always have the risk that they may leave -- that negative morale might affect all of the positives that lead to discovery and innovation,” said Martha Freitag, an analyst at Argus Research Corp.

Roche appears to be taking steps to minimize potential problems, saying it plans to consolidate its U.S.-based commercial operations at Genentech’s South San Francisco campus, maintain research and early development as an independent center there and retain the Genentech name.

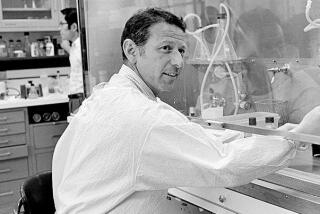

The future role of Genentech Chief Executive Arthur Levinson remains unclear.

“People realize that what our intentions are with research is to maintain and develop that very specific Genentech culture further and not integrate it into the Roche culture,” Roche Chairman Franz Humer said during a conference call, according to Bloomberg News. “I think that will be the decisive element in keeping the best of” Genentech’s scientists.

Completing the acquisition of Genentech would create the seventh-largest pharmaceutical company in the U.S. in terms of market share, with $17 billion in annual revenue and 17,500 employees, Roche said.

Genentech is said to have started the biotech revolution in 1976 when, as a start-up company with a single employee, it funded research at City of Hope National Medical Center in Duarte that produced the first biotech drug, human insulin. That partnership later led to a court battle that ended in a $500-million jury award against the biotech firm, which was later reduced to $300 million by the state supreme court.

The deal with Roche comes as Genentech awaits results of an independent study on the effectiveness of Avastin in treating early-stage colon cancer. A positive report could expand the market for the already popular drug.

Meanwhile, Foster City, Calif.-based Gilead said it would pay $20 a share for CV Therapeutics, based in Palo Alto. That tops the $16-a-share offer made by Astellas Pharma of Japan last year for CV Therapeutics, whose biggest-selling drug is the cardiovascular treatment Ranexa. Gilead makes the HIV treatments Atripla, Truvada, Emtriva and Viread.

Shares of CV Therapeutics rocketed $5.04, or 32% to $21.04, while Gilead climbed 39 cents to $44.43. An index of 20 biotech stocks gained more than 6%.

Genentech rose $1.75, or 1.9%, to $93.92. Roche’s U.S.-traded shares slipped 26 cents to $30.39.

--

martin.zimmerman@ latimes.com

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.