Roles on police shows don’t help Pat Crowley avoid grandparent scam

“Please Don’t Eat the Daisies” wasn’t the most important TV show from my childhood in terms of life lessons.

Those would probably be “The Brady Bunch,” which taught me about the dangers of throwing a football in the backyard, and “The Partridge Family,” from which I learned that musical ability isn’t required to be a rock star.

But there was one episode of “Daisies” in which the journalist mom, played by Pat Crowley, got her comeuppance for trying to trick people by using a pen name. I’ve taken that lesson to heart.

So how could I help but step up after receiving an email from Crowley detailing her recent experience with what’s known as the grandparent scam?

“Do I feel stupid? Yes,” she told me. “Would I have done the same for all five of my grandchildren? Absolutely.”

For the uninitiated, the grandparent scam typically involves con artists trying to trick seniors into wiring money to assist a loved one — usually a grandchild — who’s gotten into trouble with the law, often in some far-flung location.

The Federal Trade Commission said it’s received more than 30,000 complaints about the racket since the beginning of 2012. Victims of the scam have been duped out of about $42 million, the agency said.

In July, the Senate Special Committee on Aging held a hearing on what the committee’s chairman, Bill Nelson (D-Fla.), called a “despicable” practice that “preys on a senior citizen’s willingness to do anything to help a family member in trouble.”

Representatives of the FTC and the FBI told the committee that they’re committed to catching perpetrators of the scam. But Lois Greisman, a senior FTC official, acknowledged that because many of the scammers are based overseas, they can be difficult to track down.

The last time I wrote about the grandparent scam, I told the story of a Northridge man who was stopped by family members only moments before he was about to wire $1,200 to help a nephew he believed was languishing in a Greek jail.

What happened to Crowley shows how easy it can be for someone to fall for the deception and lose a big chunk of change — in her case, $2,000.

And she had a background in law enforcement, sort of.

“I was on both ‘Police Story’ and ‘Police Woman,’ ” Crowley said. “But I guess that was a long time ago. I was completely fooled.”

She said she received a call last month from what sounded like her 21-year-old grandson, Will, who lives in Santa Monica.

“Something bad has happened,” the caller said.

He told Crowley that he’d been arrested with some friends and that drugs were involved. He begged her not to tell anyone. A police officer, Crowley was told, would contact her in a few minutes.

Then came a call from a woman identifying herself as “Officer Lewis.” She told Crowley it would take $2,000 to bail out her grandson.

Crowley was instructed to get the money from the bank and then go to a nearby CVS store and purchase four Green Dot MoneyPak cards worth $500 each. She was to then await another call.

By this time, many people would be questioning the legitimacy of what was happening. The vow of secrecy, the multiple calls — these are hallmarks of the grandparent scam.

The use of Green Dot cards is a relatively new wrinkle. In the past, scammers would have you wire money using Western Union or a similar service. Green Dot cards are a more sophisticated and efficient way for them to steal your cash.

The reloadable debit cards come with their own personal identification numbers. Anyone with the PIN can access the card’s funds online and transfer the money elsewhere.

Responding to complaints from law-enforcement agencies, Green Dot has said it will phase out use of PINs. But other cards remain on the market that allow fraudsters to pull the same stunt.

When Officer Lewis called again, Crowley said, she asked for the PINs.

Crowley received another call shortly afterward, which indicates how quickly the scammers were moving. Someone identifying herself as “Mrs. Walker” said Officer Lewis must have copied down one of the PINs wrong.

She asked Crowley to repeat it and then instructed her to wait at home in Bel-Air for her grandson to get in touch. Once his bail had been processed, he would notify her where to pick him up.

About five hours passed, with Crowley honoring her pledge not to tell anyone about Will’s arrest. Finally, she decided to call her grandson’s cellphone. She reached him not in jail but on a resort island off Washington State.

Needless to say, he knew nothing of the calls his grandmother had received from the person impersonating him or the police officer handling his purported arrest.

“I felt like the dumbest person on the planet,” Crowley said.

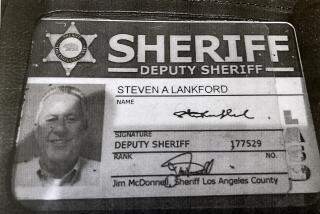

She reported the incident to the Santa Monica Police Department — the real one — and was told they’d do what they could. But she shouldn’t get her hopes up.

In hindsight, the warning signs were obvious. Here’s what the FTC advises everyone to keep in mind:

• Never act immediately, no matter how dramatic the story may be.

• Verify the caller’s identity by asking questions a stranger couldn’t answer.

• Check things out with another family member even if you’ve been sworn to secrecy.

• Never wire money or load cash onto a debit card. That’s not how legitimate law-enforcement agencies work.

“I should have questioned everything,” Crowley said. “Of course I should have.”

I pointed out that maybe this was karma for her trying to trick people with that pen name on “Please Don’t Eat the Daisies.”

“I plead guilty to that,” she replied.

David Lazarus’ column runs Tuesdays and Fridays. he also can be seen daily on KTLA-TV Channel 5 and followed on Twitter @Davidlaz. Send your tips or feedback to david.lazarus@latimes.com.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.