Column: Slowing to a 2.1% annual growth rate, Trump’s economy comes off its sugar high

- Share via

Here’s the good news about the estimate of 2.1% (annualized) growth for second-quarter gross domestic product the government released Friday: Consumer spending is remarkably strong, and the GDP grew slightly faster than economists expected.

Almost everything else in the report from the Bureau of Economic Analysis about the quarter that ended June 30 is bad or worrisome. That’s especially so if you’re Donald Trump and you based your claim to the love of the American people on your economic prowess.

The fading impact of the 2017 tax cut, a global manufacturing recession and the uncertainty tax imposed by trade policy ... will continue to damp growth in the second half of the year.

— Economist Joseph Brusuelas

Trump, it will be recalled, boasted during his presidential campaign that his policies would power economic growth to more than 3% a year — specifically, 3.5% or even 4%. Treasury Secretary Steven T. Mnuchin, playing the role of apostle one month into the Trump administration, said not only that 3%-plus growth was “achievable,” but that it would be the direct result of tax cuts and regulatory reform.

When Trump and the Republican Congress enacted a massive tax cut for corporations and the wealthy in December 2017, they asserted that the cuts would pay for themselves thanks to turbocharged economic growth.

With the political world deeply focused on the question of whether the Trump administration comprises a gang of Russian pawns, less attention has been devoted to more mundane questions, such as what ever happened to Trump’s economic policy?

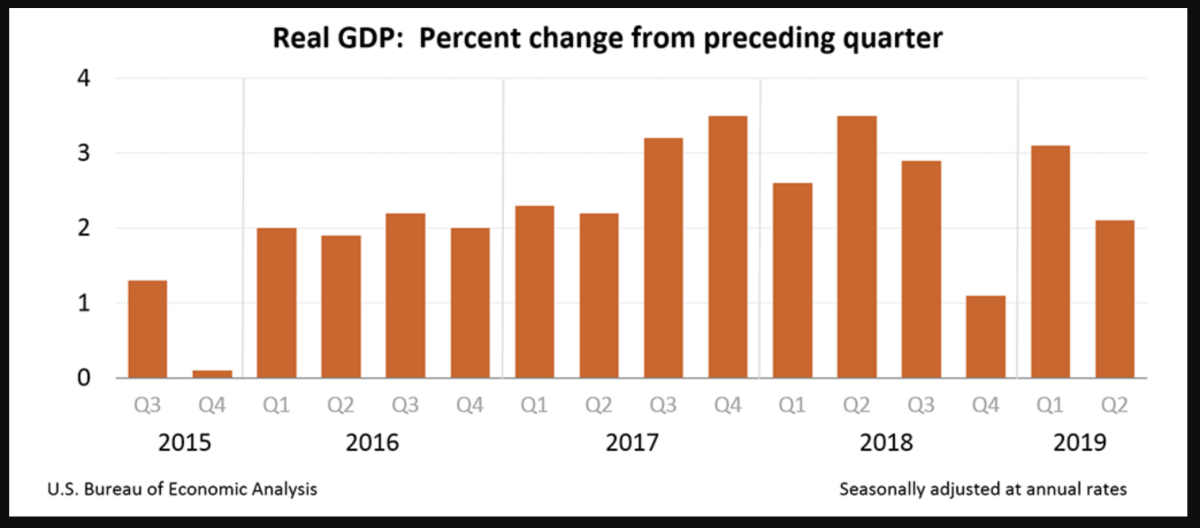

In fact, according to the Bureau of Economic Analysis, in only two quarters during the Trump administration has yearly economic growth exceeded 3%: In the second and third quarters of 2018, growth notched 3.2% and 3.1% respectively. In the second quarter of this year, the economy grew only 2.3% over the same quarter a year ago.

The latest figures indicate that the growth in business investment prompted by the tax cuts faded fast. Nonresidential business investment, which was supposed to be a chief beneficiary of the tax cuts, fell in the second quarter by 0.6%, annualized. That was the worst performance in the category since the fourth quarter of 2015, and a screeching slowdown from the surge of 8.8% and 7.9% seen in the first two quarters of 2018, right after the tax cuts were passed. Residential investment remains in a prolonged slump, with its sixth consecutive quarterly decline.

The “boost from tax cuts has now likely fully dissipated,” Gregory Daco of the analytics firm Oxford Economics tweeted.

Net exports fell at an annualized rate of 5.2%, almost certainly an artifact of President Trump’s trade wars.

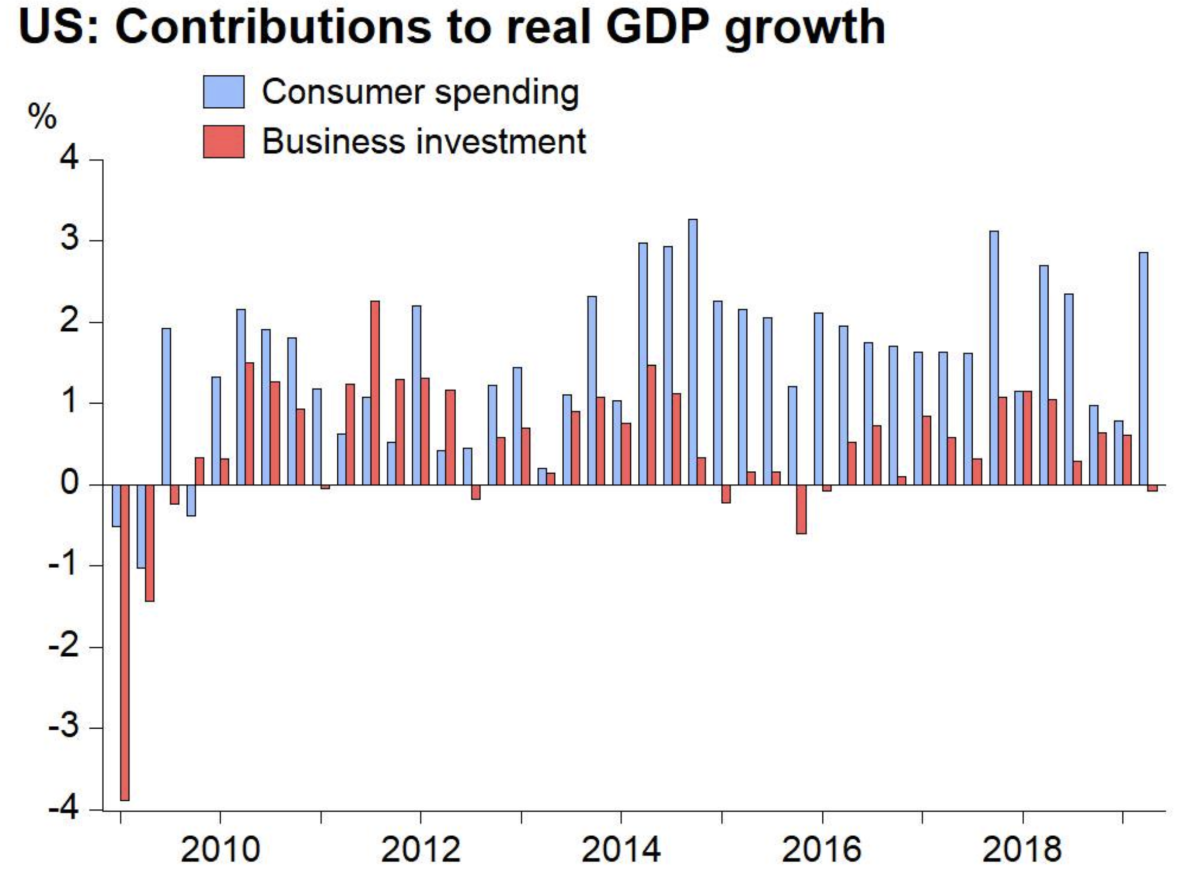

The one inescapable bright spot in the quarterly statistics was consumer spending, which rose at a healthy annual clip of 4.3%. That would have been enough to drive GDP growth for the quarter by 2.85 percentage points, but it was counterbalanced by the falloff in business investment, which pared a full percentage point off growth and exports, which in turn cut growth by 0.65 point.

Some economists doubted that consumer spending can continue to drive the economy higher at this rate. “The government shutdown, a difficult winter and the lagged impact of financial market volatility were primarily responsible for weak household output in the first quarter,” observed Joseph Brusuelas, chief economist at the consulting firm RSM. “Thus, the second quarter saw the release of pent-up demand and therefore does not imply a sustainable increase in household spending.”

Farm prices are down, bankruptcies are up, farm equipment is getting more expensive and export markets are fading away: Is there anything to like about the impact President Trump has had on the agricultural economy of the United States?

Overall, Brusuelas warns that “the fading impact of the 2017 tax cut, a global manufacturing recession and the uncertainty tax imposed by trade policy ... will continue to damp growth in the second half of the year.” To put it another way, Trump economic policies are a drag on growth, not its fuel.

Trump has tried to set the grounds to blame the Federal Reserve and its four interest rate increases in 2018 for any slowdown. The Fed is widely expected to cut its benchmark rate next week. But few economists believe a rate cut is warranted, even in the face of slowing growth.

The latest figures point to the general fecklessness of the Trump administration’s economic leadership. The tax cut of December 2017 may have pleased the Republican base of corporate leaders and wealthy individuals, but there was no evidence that it was needed to spur the economy. On the contrary, many economists warned that the additional stimulus to an economy that was already expanding would have little lasting positive effect and that the cut was poorly designed to help middle- and working-class households, for whom income was stagnant.

Trump’s trade war, meanwhile, doesn’t seem to be based on any consistent purpose except truculence. It has imposed new costs on consumers, turned America’s farm economy into mush and failed to achieve any real gains for the United States in global trade. Now even the gains he bragged about as recently as an economic scorecard in March are fading away.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.