Column: It’s not too soon to think about how to give workers permanent raises

- Share via

With the massive $2-trillion coronavirus rescue package now largely done, workers and employers can briefly breathe a sigh of relief, at least at signs that Republicans and Democrats, conservatives and progressives, can work together on Capitol Hill when catastrophe is staring them in the face.

But it’s not too soon to think about what will happen after the emergency has passed — or more precisely, what happened in the U.S. economy over the last half-century that left millions of American families without the financial resources to weather the storm.

That means examining the long, dark period of wage stagnation suffered by average households as corporate profits and the pay of top executives soar.

“The problem of wage stagnation is not just profits, and it is not just pay to the top,” says John Schwarz, professor emeritus of public policy at the University of Arizona and the author of several books about the declining opportunities for the middle and working classes in the American economy. “It’s each of them equally, so you have to put both of them together to solve the problem.”

Schwarz’s solution starts with what he calls the “compensation ratio.” It measures the relationship between a company’s profits and total compensation, top to bottom, on the one hand, and the total pay of its lowest-earning 90% of employees (typically those earning less than $100,000) on the other.

In recent days, alarm about the economic impact of the novel coronavirus have turned conservatives who weeks ago were boasting about the shrinking of the U.S. government into raving Keynesians, proclaiming the virtues of deficit-financed economic stimulus.

Using the compensation ratio to defeat wage stagnation, however, requires incentives and enforcement. Schwarz and four like-minded colleagues from the academic, business and policy worlds conceived of tying a company’s maintenance of its compensation ratio to its access to tax breaks. Companies that at least kept the ratio steady would get a break; those that allowed it to fall would be penalized.

The other members of the team are David Callahan, co-founder of the progressive think tank Demos and founder and editor of Inside Philanthropy; Harry M. Lasker, a former faculty member at Harvard’s school of education; data scientist Robbie Hiltonsmith; and businessman and investment manager William C. Coleman. They call their effort the Project to Raise America’s Pay, or Ramp.

The most recent stimulus bill actually incorporates this theory, to a limited extent and for the short term. Big businesses that accept bailouts from the measure’s $500-billion bailout fund will have to commit to maintaining until Sept. 30 the same employment levels that were in place March 24 “to the extent practicable,” but in any event maintaining at least 90% of their preexisting workforce.

Smaller businesses can receive a credit against business taxes such as the payroll tax to the extent they keep workers employed, and are eligible to have the principal of any government small-business loans forgiven for keeping their workforces in place.

Those provisions, however, last only as long as the bailout or loan funds are outstanding or the emergency continues. But the idea can be applied to the longer term.

Ramp proposes that companies that maintain their compensation ratios over time remain eligible for the corporate tax breaks in the 2017 tax cut bill and receive a tax incentive and priority for federal contracts. Those that don’t would forfeit many of their savings from the tax cut and other loopholes, and go to the back of the line on federal contracting.

With pay for the bottom 90% of employees keeping pace with corporate profits and compensation at the top, according to a Ramp working paper, “pay will have become rewired to growth.”

Even before the coronavirus crisis struck, the issue of economic inequality had moved to the front burner of American politics. Democratic presidential candidates Bernie Sanders and Elizabeth Warren proposed tax increases on the wealth of the country’s richest taxpayers.

By limiting sick leave and free healthcare, the U.S. system will promote the spread of coronavirus.

Entrepreneur Andrew Yang, another Democratic candidate, placed the principle of a universal basic income — a government payment of $1,000 a month to every U.S. adult — at the center of his campaign. An increase in the federal minimum wage to $15 an hour from the current $7.25 became Democratic orthodoxy.

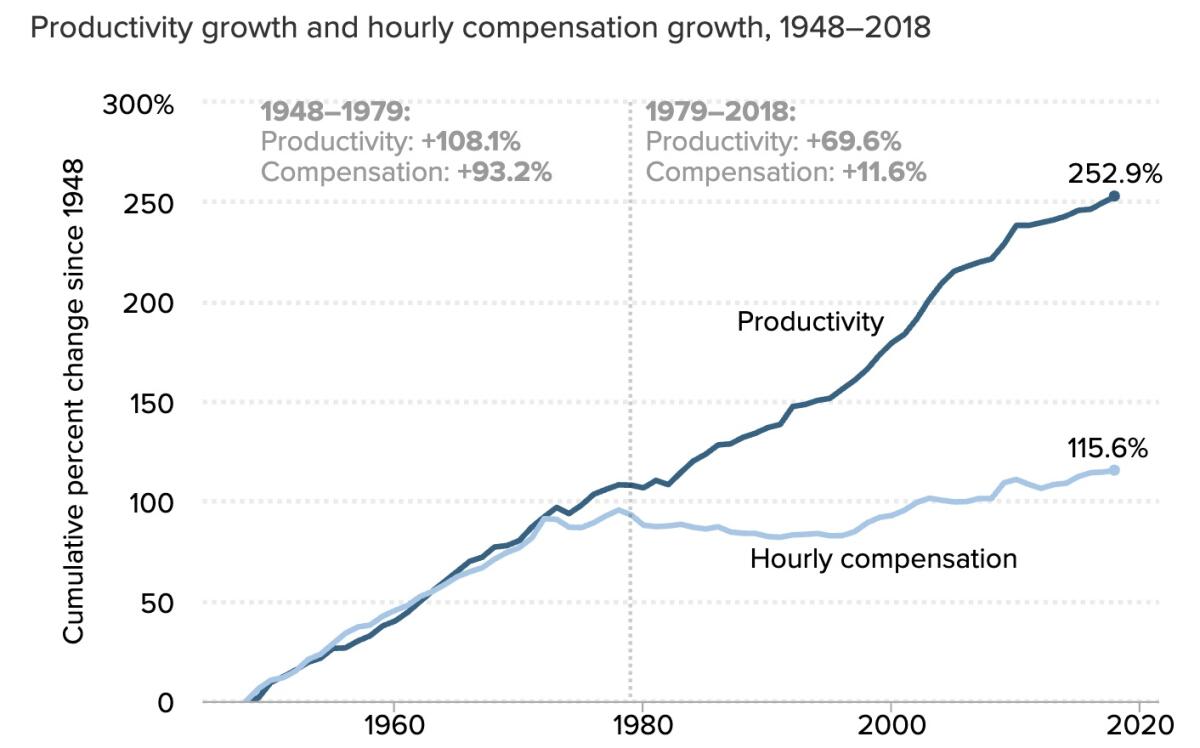

The contributing factors to wage stagnation are also fairly well understood. Chiefly, they involve the disconnection of wage growth from economic growth based on worker productivity and as measured by corporate profits. As the labor-oriented Economic Policy Institute has documented, productivity and hourly earnings marched in step from 1948 to 1979. In that period, productivity grew by 108% and hourly compensation by about 93%.

After that, however, the two metrics became unlinked. From 1979 through 2018, productivity grew by about 70% and compensation by only 11.6%.

Where the gains went is no mystery: to corporate profits. According to the Bureau of Economic Analysis and the Bureau of Labor Statistics, from 1994 through last year, after-tax corporate profits nearly quintupled, but labor’s share of the nonfarm economy fell by 10%.

A fairer distribution of the fruits of economic growth over the last few decades might not have saved millions of Americans from unemployment during the current crisis, but it might have enabled them to face the toll with lower household debt and a thicker financial cushion. That underscores the urgency of redressing the imbalance for the future.

Schwarz came to the topic of wage stagnation not as much through economics as through political science. “The idea of freedom has changed in this country without us realizing it,” he told me.

“The Founders, Lincoln, Roosevelt all had an idea of economic freedom that centered on the notion of economic independence — people having the wherewithal through means under their own control to provide a decent living and get ahead,” he says.

“The idea of freedom has changed since then to an idea of individual choice within a free market. That idea of freedom is neutral to wage stagnation — it happens under certain circumstances in the market and not under others. But under the Founders’ and Lincoln’s and Roosevelt’s idea of freedom, wage stagnation is a violation of freedom; it means not being able to make a decent living or having the opportunity to get ahead.”

In his 2013 book “Common Credo: The Path Back to American Success,” Schwarz observed that individual workers were left on their own starting in the 1970s “partly because of a steady decline in union membership and the eroding power of collective bargaining.” Executives and upper management kept their bargaining power and therefore “were able to push their interests to considerably greater effect than were individual workers.”

Union membership has been declining for decades. Can labor unions be revived? The answer is yes... if.

Meanwhile, government abandoned its position as a countervailing force in the economy. The minimum wage dwindled because of inflation, full employment disappeared as a political goal, and tax cuts for the wealthy increased the burden on average workers.

The consequences of this trend have been dire. The malaise that has infected the U.S. since the early 1970s, Schwarz wrote, “has produced a dysfunctional government that most Americans don’t trust and an economy that has left a solid majority of working Americans out of prosperity for two generations.”

That prompted him to look for solutions. He and Lasker developed the idea of tying corporate taxes and other government benefits to their success at stabilizing their compensation ratios. “If you stabilized the CR, you would defeat wage stagnation,” he says.

The Ramp team believes its approach would have a more powerful and longer-term effect than other approaches to wage stagnation. The conservative nostrum of cutting corporate taxes and reducing regulation has led merely to more money funneled to shareholders and top executives. Raising the minimum wage to $15 an hour would mean a sizable increase for many workers but a marginal benefit at best for 80 million rank-and-file employees, according to Ramp calculations.

A federal infrastructure construction drive could create jobs for millions of workers, but they would fade away once the construction was completed. Removing obstacles to collective bargaining would give workers more leverage, but it would take years for unions to raise their footprint in the private sector from its current level of 7%. In any event, strong unions in Germany, Canada and other countries that favor organized labor haven’t made them immune from wage stagnation.

Aligning worker pay with expected corporate earnings growth would outperform all those options for the long term, the Ramp team calculates. But the proposal’s most important feature may not be its specific return, but more general: It’s that after decades of being left by the wayside, American workers would again have a full share in the fruits of their own labor.

The current crisis has shown how close to the edge millions of American families live; they need to be pulled back from the brink and settled on solid ground, permanently.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.