Why economists got it wrong on U.S. inflation

- Share via

Economists are getting a dose of humility on forecasting inflation after a resurgent coronavirus, a tenuous global supply network and stimulus-fueled consumers combined to send U.S. prices well beyond the expectations of Wall Street and policymakers.

The government’s latest inflation read Wednesday showed a 6.2% annual jump in consumer prices that exceeded all projections. The October data indicated a broadening of inflationary pressures, which previously had been confined to categories mostly associated with the economy’s reopening.

Forecasting inflation “has been incredibly challenging” over the last year and will remain tough, said Matthew Luzzetti, chief U.S. economist at Deutsche Bank. “It is difficult to feel comfortable with a view that you are building in enough price pressures at the moment, and risks remain skewed to the upside for the inflation outlook.”

Since the start of the year, economists have been forced to ratchet up their projections for consumer price growth. What was once expected to be a bit of mirage, with so-called base effects distorting the figure higher, has proved to be a much more persistent problem.

The latest inflation numbers shocked even pessimistic economists, but they’re still transitory.

Federal Reserve Chair Jerome H. Powell and many of his colleagues have repeatedly said this year that inflation pressures will prove transitory. Last week Powell said he won’t entertain interest rate increases until the labor market heals further, even though inflation could run hot for months.

Some prominent economists, including former Treasury Secretary Larry Summers and former New York Fed President Bill Dudley, have been warning about higher and more persistent inflation for nearly a year.

Many expected the vaccine rollout to embolden Americans, whose savings grew from government financial support, to transition more of their disposable income to services. President Biden’s $1.9-trillion American Rescue Plan, passed in March, included an extension of enhanced unemployment benefits and $1,400 checks for millions of consumers.

The thinking was that as more people traveled, dined out and attended entertainment venues, the less they would spend on merchandise. That would, in turn, help remove some of the strains on the supply chain.

The latest numbers on rising inflation are a reminder of how President Biden’s first year has become bogged down with economic challenges.

But the Delta variant of the virus kept massive pent-up demand skewed toward merchandise and added further strain to supply chains, particularly in Asia, said Ryan Sweet, head of monetary policy research at Moody’s Analytics Inc.

Retail sales are well above pre-pandemic levels, but services spending has yet to catch up.

“A big theme that people anticipated over 2021 was this big rotation within consumer spending from goods to services, and while that has happened to an extent, goods spending has exceeded expectations,” Luzzetti said.

Continued strength in goods spending put added pressure on a fragile supply chain. Lean domestic inventories forced U.S. producers and retailers to step up import orders. At the same time, other economies around the world were stirring from their pandemic-related lockdowns.

Although Sweet expected late last year that supply chain issues would be more problematic and persistent than many thought, he’s been surprised by recent readings. “I didn’t think the CPI would get as high as it has recently,” said Sweet, who has consistently ranked high this year in Bloomberg’s quarterly lists of top forecasters.

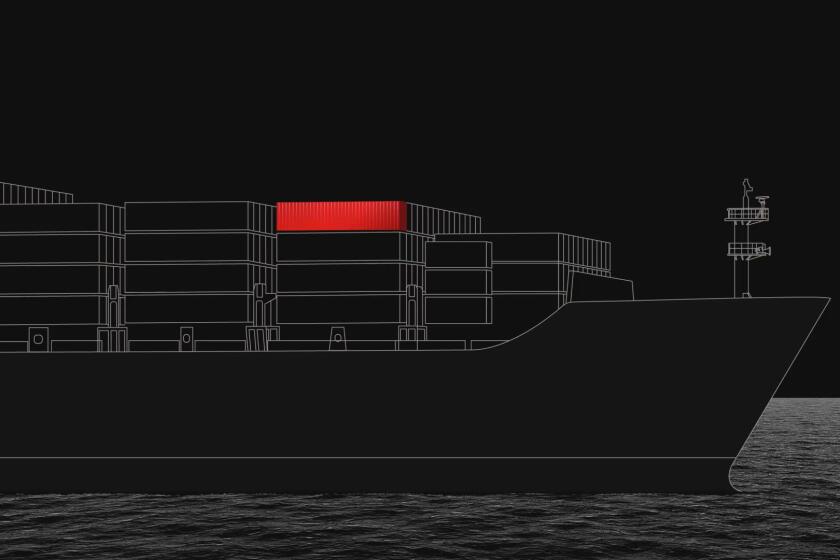

Follow a container of board games from China to St. Louis to see all the delays it encounters along the way.

Complicating matters was COVID-19’s effect on the job market. Heading into this year, many economists projected ongoing slack in the labor market would help ease inflationary concerns.

Instead, a depressed participation rate has pushed job openings to near-record levels and led to a record surge in wages. Large companies have raised prices to offset higher labor costs.

“Businesses are being squeezed on both ends,” said Simona Mocuta, chief economist at State Street Global Advisors. This is happening against a backdrop of “strong consumer liquidity, so pricing power is improving.”

As of October, the participation rate, which measures those employed or looking for work, has recovered less than half of its pandemic-related collapse. Many forecasters saw hiring constraints easing as schools reopened and supplemental unemployment benefits ended, but that hasn’t been the case.

Higher energy prices are also contributing to higher inflation.

Consumer prices for energy are up 30% from a year earlier, the largest annual advance since 2005. Gasoline is up nearly 50%. The price of electricity in October increased 6.5% from the same month last year, the most since March 2009.

U.S. prices for natural gas and oil are trading close to multiyear highs amid a global squeeze on supplies, and labor shortages at U.S. coal mines create further price pressures. The Energy Information Administration expects this winter to be the costliest since at least 2014-15.

Americans’ inflation expectations — which tend to be closely tied to prices at the pump — have also drifted higher.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.