‘The One’ mega-mansion is up for auction. Whoever buys it may soon have a mega-headache

The mega-mansion known as “The One” has become something of a Rorschach test for L.A.’s luxury real estate scene: Everyone’s focus is on the same massive Bel-Air structure, but they’re not seeing the same thing.

Some think it’s the ultimate trophy home, others are convinced it’s a giant white elephant clad in marble and glass that one local broker has sarcastically dubbed “100,000 square feet of drywall.”

It should be clear which vision prevails when the mansion goes up for auction this week.

The One has been among the most highly anticipated Los Angeles mansions over the last decade and was first marketed by its flamboyant developer for $500 million before it was even completed.

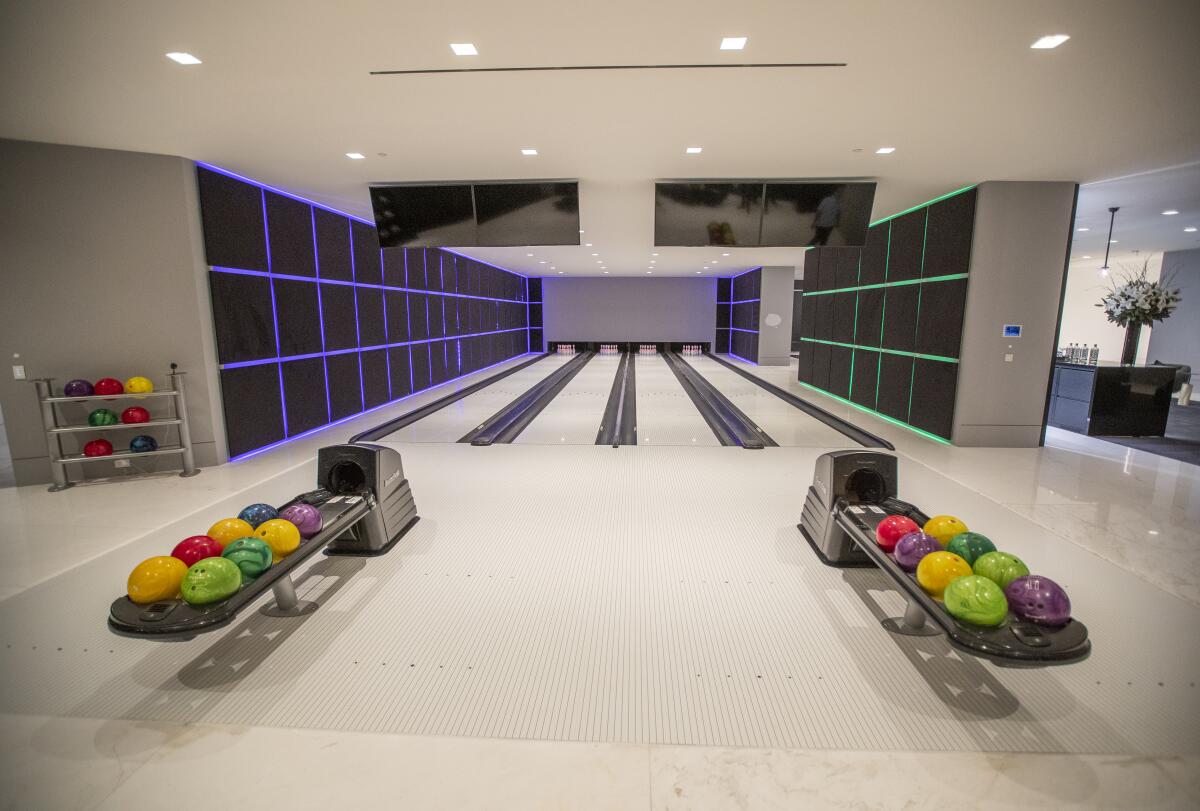

It was not only the most expensive listing in Los Angeles but also the biggest, with luxury amenities to match, including a 4,000-square-foot guesthouse, a sky deck with cabanas, a private theater, a full-service spa, a nightclub and even an outdoor running track and moat. And no shortage of places to sleep and shower, with 21 bedrooms and 42 full bathrooms.

The One’s listing agents are saying it has already drawn one offer in bankruptcy — as well as interest from ultra-wealthy buyers across the globe and L.A.’s own billionaire set, who have eagerly toured the property.

Whether that translates into anything close to its current $295-million listing price is complicated by issues surrounding the property, including lack of an occupancy permit and allegations of possible construction defects and zoning code violations, which the local homeowners association is calling a “brewing scandal” it is vowing to investigate.

The idea was simple: Nile Niami would build and sell The One, the biggest and most extravagant new home in the country. Then things went sideways.

There’s also the pall cast by the social zeitgeist, not exactly amenable to gross displays of wealth amid the uncertainty of the pandemic and gnawing economic inequality — though that hasn’t slowed luxury home sales or quelled curiosity about The One.

“You know, really this is not for me, or you. This is for the 1% of the world, and we’re not the 1% of the world,” is the frank take of co-listing agent Rayni Williams, of Williams & Williams at the Beverly Hills Estates — who dismisses the property’s skeptics as “unhappy people” who don’t want others to succeed.

Those involved in the auction want to make history for the priciest home sale in California by topping the $177 million that Silicon Valley venture capitalist Marc Andreessen spent on a Malibu estate in October. Auctioned homes, however, often go for discounts and the heyday for marble-and-glass designs so popular last decade is waning. Several of developer Nile Niami’s other homes have recently sold at discounts even without an auction.

To call the auction a total success, The One must set the state record given that it carries some $191 million in total debt, largely in loans from L.A. billionaire Don Hankey and other property lenders, according to Bankruptcy Court records.

Otherwise, in one of the world’s most expensive and hot real estate markets, where it’s been hard not to sell a home for a profit, some of the industry’s biggest names could take a bath.

To market the home, owner Crestlloyd, a limited liability company set up by Niami and his former wife, got court approval to hire two top brokerages and Concierge Auctions, which last year sold a Beverly Park home for $51 million, an auction record — but more than $100 million off its original asking price. About three dozen prospective buyers have toured the property.

“I was actually surprised by how many billionaires have shown interest in the property. We’ve had royalty from the Middle East come and show interest. We’ve had Chinese billionaires. We’ve had billionaires from East Asia and we’ve had surprisingly a number of American localized billionaires as well,” said co-listing agent Aaron Kirman, chief executive and founder of Aaron Kirman Group at Compass.

To keep out looky-loos, the home is being shown only to prospective bidders who are financially qualified, which requires them to turn over bank statements or some other proof of uber wealth unless they are prior clients of the agents or auction house — or have financial pedigrees worthy of Forbes.

“Some people just don’t feel comfortable showing us what they have in their bank account, so for the right billionaire, a private banking relationship, a good letter, as long as it can be verified, is acceptable as well,” said Kirman, who shares the listing with Williams and her husband, Branden.

Williams acknowledged there is an “extremely shallow pond” of buyers, recalling how two L.A. billionaires touring the home bumped into each other when one was late to his appointment, making for an awkward encounter. “It became a bit of a power struggle and kind of standoff” that Williams said she defused by encouraging one to say hello to the other.

The agents said that a prospective buyer, who Williams identified as international, has already made a substantial offer on the home. They decided, however, to move ahead with the auction to get the best possible price.

Williams said the hope is that the prospective overseas buyer will bid at the auction, which doesn’t have a reserve, or minimum bid price. However, Hankey, the biggest creditor with more than $130 million in debt secured by the property, might make sure there’s a floor. If it goes for anything less than his debt, he would take a loss.

“If I saw that it was obviously way under market, yes, I would bid more for the house,” said Hankey, 78, whose $6-billion fortune has its roots in subprime auto lending.

It was Hankey’s big wallet that attracted Niami in 2018. The developer needed cash to finish the 944 Airole Way house, and took out three construction loans totaling $106 million. Niami defaulted on the debt two years ago with the house still unfinished. After Hankey foreclosed on the loans, Crestlloyd put the project into bankruptcy in October, leading to this week’s online auction overseen by a U.S. Bankruptcy Court judge.

The house still isn’t completed — most conspicuously, the planned tennis court isn’t built out. It also lacks a certificate of occupancy, pending a sign-off from city inspectors on crucial permits for grading, electrical and other work.

Despite the defaulted debt, Hankey turned over $11 million more to Crestlloyd during the bankruptcy process for expenses including attorneys, insurance, spiffing up the house and grounds, and repairs.

Though that loan would be paid out first, Hankey’s move surprised onlookers considering he had been willing to auction off the home outside a Pomona courthouse in October — something akin to unloading a Bentley at a buy-here-pay-here used-car lot.

However, Hankey said he felt comfortable lending the sum after turnaround specialist Lawrence Perkins was put in charge of Crestlloyd when the home was put into bankruptcy. Perkins had worked before on real estate projects in which Hankey was involved.

“It’s in my best interest to get the house sold for as much as possible as soon as we can, and I don’t mind turning over extra money to somebody like Larry if I know that money’s gonna go into improving the house,” Hankey said.

The condition of the house was called into question last fall when a receiver appointed by a Superior Court judge to sell the property hired construction consulting firm Vertex to look it over. The receiver later filed a report saying that it would cost as much as $10 million and take as long as a year to finish construction and fix defects that had led to water leaks, possible mold growth, cracked marble and other problems.

Ted Lanes, the court-appointed receiver, who stepped down after the bankruptcy filing, declined to comment on the report. However, Vertex construction consultant Ted Bumgardner said The One was a victim of its own extravagance, including an entryway reflecting pool with skylights and a moat along the edge of the property.

“There is a tremendous amount of water features on this property over occupied space. And that’s always a concern in any home,” said Bumgardner, who was unable to complete his report on the house because the bankruptcy filing stopped work.

Perkins noted that the house is being sold to sophisticated buyers on an “as is, where is” basis, which means in whatever condition it is in with whatever faults may exist. This puts the onus on the buyer to do their own investigation.

Still, Perkins characterized “the vast majority” of the issues laid out in the receiver’s report and other documents as “light to medium maintenance” that have been resolved with the financing provided by Hankey, including leaking skylights at the entryway. The house also has been staged.

“We’ve been able to invest a little bit in the house just by virtue of having the financing in place,” he said. “So the grass is nice and well mowed. You know, the inside looks great. The house is probably in as good a shape as it’s ever been.”

Crestlloyd did not attempt to complete the house, reasoning that any buyer will probably spend millions to personalize it, which is not uncommon with trophy real estate.

More problematic than any construction issues may be allegations in the receiver’s report of possible violations of the zoning code, particularly those involving the nightclub and basement, which it said may be too far above ground to qualify as one. That would mean the house violates size restrictions for its 3.8-acre lot.

The Bel-Air Assn. homeowners group cited the report in a letter sent to Crestlloyd and cc’d to city officials. The group has already appealed permits given to two other Niami homes and supported residents who sued developer Mohamed Hadid over an illegally constructed mansion now being torn down.

After years of court battles, Mohamed Hadid’s 30,000-square-foot mansion will be auctioned off to the highest bidder and then torn down.

The letter demands that any violations be rectified before The One changes hands or receives a certificate of occupancy. It called the project an “unmitigated disaster” and vowed to focus its “time and resources” on the issue.

“We want everyone to play by the same rules. If there’s a sense that it’s the Wild West we’re going to keep getting cowboys,” said Shawn Bayliss, executive director of the association, who asserted it was patently obvious that the first floor with its nightclub and other above-ground features was not a basement. “The house is not supposed to have been that big.”

A spokesman for the Los Angeles Department of Building and Safety said the department is looking into the allegations in the letter.

Perkins said that Crestlloyd’s experts have concluded that the first floor — which also contains the theater, bowling alley, spa and other amenities — qualifies as a basement.

He believes that most nearby residents are probably concerned about traffic and other potential problems that would come with a nightclub, which the homeowners association says is an illegal commercial use in a single-family neighborhood. Perkins said potential bidders have been talking about holding occasional philanthropy events there or converting it to other uses, such as more staff quarters.

“I think a party every once in a while, which people in Bel-Air do, versus a nightclub is a very different thing,” he said.

Byron Moldo, a bankruptcy attorney at Ervin, Cohen and Jessup in Beverly Hills, said the lack of a certificate of occupancy and other issues surrounding the property could depress the price.

“It’s certainly going to factor into how much somebody is going to be willing to pay,” he said.

Kirman said the agents have been as “transparent” as they can about the complications with prospective bidders. He said that any buyer will just “have to work through” the situation with the homeowners association.

Visitors have praised the property’s spectacular ocean and mountain views, the agents said. “People love the bones,” Kirman added, using a real estate code word more typically applied to fixer-uppers with potential.

The house is being described on the Concierge website as the “largest in the urban world,” a marketing term of Niami’s that is also puffery. By many accounts, a 27-story home said to be 400,000 square feet owned by a billionaire in Mumbai, India, is considered the world’s largest, outside of royal palaces. There are even contenders to the title of the largest home in America.

Though plans can change over time, the architectural plans stamped by the city in 2014 seem to indicate the home is smaller than 105,000 square feet. It might reach that figure if all developed structures on the property are included — including the roof with its cabanas and putting green.

Perkins said he hasn’t taken a tape measure to the house, while Williams said that getting accurate square footage on homes is “the No. 1 discrepancy.” In any case, she noted, it’s obvious the house is huge.

“It’s 100,000 feet, give or take five [thousand], you know. Maybe it’s 90,000 feet, give or take 10 or 12,000, something like that,” she said. “It just doesn’t matter.”

Niami, meanwhile, has been trying to hold on to the property ever since defaulting on his debt to Hankey, telling The Times in September that it would be a shame if it was owned by a private individual. He conceived a plan to turn it into an event space for blockbuster boxing matches and other events, but Hankey turned it down and moved ahead with the foreclosure.

Developer Nile Niami proposes using “The One” to back cryptocurrency as he fights to head off a February auction of his Bel-Air mega-mansion.

In a last-ditch effort, Niami in December proposed creating a cryptocurrency called The One Coin that would be backed by the mansion and pay off all the home’s debts. There’s been no word since and a spokesman for the developer said he was not giving interviews now.

The auction opens 4 p.m. Pacific Time on Monday and has a “soft” close at 4 p.m. Pacific Time on March 3, meaning Concierge will bring it to a close only after active bidding stops. Bidders will be required to hand over a refundable $250,000 deposit to participate and sign documents legally binding them to close the transaction if their bid is the winner.

Chad Roffers, president of Concierge, said he expects there will be some early opening bids, but most action typically takes place in the last 30 minutes. Although the bids will be public and can be observed in real time, the bidders will be known only by their “paddle number.”

He said it’s quite possible that the auction may end with a mystery, even though the winning bidder will be disclosed. That’s because it could be a limited liability company, a legal entity often used by the wealthy to hide their real estate purchases for a “variety of reasons.”

“Privacy may be one of them,” he said — even for The One.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.