China locks down Shenzhen amid COVID surge, sending supply chain ripples

- Share via

China placed the 17.5 million residents of Shenzhen into lockdown for at least a week and forbade people from leaving Jilin, the first time the government has sealed off an entire province since the area surrounding Wuhan was isolated in early 2020.

The Shenzhen lockdown, which came after new virus cases doubled nationwide to almost 3,400, will be accompanied by three rounds of city-wide mass testing. Called with little notice Sunday, the order followed earlier restrictions on Shenzhen’s central business district and will last until March 20.

All bus and subway systems in the city were shut, along with businesses providing nonessential services, spurring a key Apple Inc. supplier to halt production. Residents will be barred from leaving the city, which is home to the headquarters of tech giants Huawei Technologies Co. and Tencent Holdings Ltd. Shenzhen Yantian Port remains operational, albeit with tighter COVID-19 controls.

Apple supplier Hon Hai Precision Industry Co., known as Foxconn, said it was halting operations at its Shenzhen sites, one of which makes iPhones. The company, which has its China headquarters in the city, didn’t specify the length of the shutdown and said it would reallocate production to other plants in the country.

In Jilin, a province of 24 million that borders Russia and North Korea in China’s northeast, people have been asked not to leave or travel, particularly those in the provincial capital of Changchun and the city of Jilin, where the majority of infections have been found. Changchun was already locked down last week, forcing Toyota Motor Corp. to suspend the operation of its plant there. Volkswagen AG said Monday that one of its Chinese joint ventures had suspended operations at three plants in the city.

The growing clusters spawned by the highly infectious omicron variant in some of China’s most-developed cities and economic zones have turned into an unprecedented challenge for the country’s COVID-zero strategy. The policy, which kept China virtually virus-free for long periods, is increasingly isolating the country as others open up. Until now, officials had largely resisted more extreme measures such as lockdowns in China’s biggest cities and relied more on targeted responses. The country still hasn’t seen a virus fatality since January 2021.

The surge in infections in Shenzhen is thought to be linked to an unbridled outbreak in neighboring Hong Kong, which went from a handful of cases to more than 30,000 in about a month. A COVID-19 flare-up in Shanghai also has led to most schools returning to online learning and the restricting of travel into the city. Bus services from other provinces were halted during the weekend, and China’s aviation regulator has had discussions with airlines about diverting all international flights into the financial center, Bloomberg News reported Friday.

Unimicron Technology Corp., a printed circuit board maker with operations in Shenzhen, also suspended output. Car and battery maker BYD Co. said it’s seeing some impact to production at its Shenzhen campus.

The sealing of Jilin is the first lockdown of an entire province since China shut in more than 50 million people in Hubei in early 2020 to quash the spread of the coronavirus following its emergence in the provincial capital of Wuhan. Jilin is home to one of China’s largest mineral reserves and is a key agricultural area. Its industries are mainly concentrated around the grain, timber, car and railway sectors.

China National Petroleum Corp.’s refinery in Jilin, for example, produces petrochemicals and plastics that are sent by truck to factories making automobiles and industrial parts. Any supply snarl could mean knock-on delays along auto production lines.

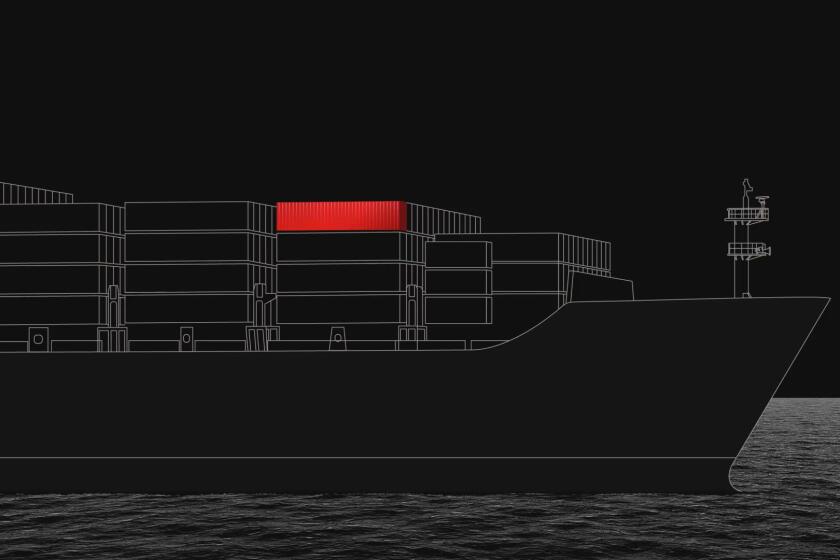

Follow a container of board games from China to St. Louis to see all the delays it encounters along the way.

Cases are popping up throughout China, with Omicron also in Beijing and Tianjin, a nearby coastal city. A number of cities in Jiangsu province, next to Shanghai, and in the country’s manufacturing powerhouse province of Guangdong, have also reported infections.

Jilin has the biggest outbreak, with more than 1,000 coronavirus cases in the community Sunday and 3,868 people testing preliminary positive as of 12 p.m. Monday.

In moves reminiscent of the early days of the pandemic in Wuhan, authorities are quickly building makeshift hospitals in Jilin and in the eastern port city of Qingdao. China quarantines all COVID-19 cases, regardless of severity, as a way of halting spread. A Toyota joint-venture plant that makes RAV4 SUVs in Changchun suspended operations Monday given the lockdown.

Investors reacted to the news by selling shares related to tourism and China’s reopening, while buying rapid antigen test-kit makers after China started allowing them for general use on Friday. An index of Macau casinos slumped as much as 10% to a record low, with the lockdown and outbreaks likely to limit gamblers from the mainland, especially neighboring Guangdong.

COVID-zero tactics have led to disruption, with multiple rounds of mass testing in Tianjin in January halting production at another Toyota plant there for more than a week. The approach will make it harder for Beijing to hit its economic growth target in 2022, as the costs of the measures rise, Nomura Holdings Inc. says. Still, China reiterated its commitment to COVID zero on Friday, with top health official Ma Xiaowei saying strict controls needed to be kept in place and that officials should avoid “war-weariness” in their work.

As of March 9, 14 of China’s provinces had been declared high or medium-risk for the virus, accounting for 54.4% of gross domestic product, according to Bloomberg Economics.

The COVID-19 surge in Hong Kong has provided an unprecedented challenge to Beijing, with the city’s tight border controls and weeks-long quarantines no match for Omicron once it entered the city. Thousands of people left the Asian financial hub to return to the mainland, with Shenzhen and Shanghai some of the busiest entry ports.

Hong Kong’s health system and morgues have been under pressure from the record outbreak that’s pushed its death rate to one of the highest in the world. While the virus case count in the city appears to have plateaued over the last week, fatalities have risen, especially among the elderly, which had some of the lowest vaccination rates despite their greater vulnerability.

The Hong Kong government is still formulating plans for the mandatory testing of all its residents, including timing and how they’ll ensure essential operations can continue if movement restrictions were to be imposed, Chief Executive Carrie Lam has said. For now, authorities will focus on vaccinating older people living at care facilities — which are seeing a surge in fatalities -- and increase the number of hospital beds to treat patients, she has said.

Also an adherent of COVID zero, Hong Kong has laid bare the limits of the strategy, with authorities scrambling once Omicron got through tough border defenses. There seems to have been little planning for if the virus flared meaningfully in the city, resulting in scenes similar to those seen in the early days of the pandemic. Hong Kong’s density and political climate make it difficult to lock down, and officials have so far resisted calling one despite pressure from Beijing.

Rapid Tests

While China is publicly still committed to eliminating COVID-19, there are signs the country’s health officials and experts are at least considering how they may exit the approach and live with the virus as endemic.

China last month approved the antiviral pill Paxlovid, developed by Pfizer Inc., a move seen by many as evidence of such planning. The introduction of rapid antigen tests on Friday may also be a sign, with other countries shifting toward use of at-home tests after their lab-testing systems were overwhelmed by broader circulation of the virus.

That said, any shift will be slow and unlikely to occur before 2023, given the need for stability in a politically important year for President Xi Jinping, people familiar with China’s thinking have told Bloomberg.

Zhang Wenhong, one of China’s top infectious disease experts who advises the Shanghai government, said in a social media post Monday that China needs to stick to COVID zero for now, as opening up would cause a run on hospitals and lead to excessive deaths.

He pointed out the “fairly high” number of elderly people and those with underlying diseases still not yet vaccinated because of concerns about side effects from the shots. There would be “inconceivable consequences” should infections spread widely among them, Zhang said.

China has in the past voiced concern about elderly vaccination rates in some areas. Though nearly 90% of the country’s 1.4 billion people have been fully inoculated, they’ve not provided details on the figures for specific age groups.

Bloomberg writers Jacob Gu, Davy Zhu, James Mayger, Claire Che, Ann Koh and Monica Raymunt contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.