U.S. stocks fall; investors eye Elon Musk’s offer for Twitter

NEW YORK — Stocks closed lower Thursday on Wall Street as investors gave mixed reviews to earnings from four of the nation’s largest banks.

The Standard & Poor’s 500 index fell 1.2%, ending a shortened trading week with a 2.1% decline. The Dow Jones industrial average fell 0.3% and the Nasdaq composite lost 2.1%. Both indexes also ended in the red for the week.

U.S. markets will be closed on Good Friday.

A quartet of big banks reported noticeable declines in their first-quarter profits as the latest earnings season kicks into gear. Volatile markets and the war in Ukraine caused deal-making to dry up while a slowdown in the housing market meant fewer people sought mortgages.

Citigroup rose 1.6% while Wells Fargo fell 4.5%. Morgan Stanley rose 0.7% and Goldman Sachs slipped 0.1%.

Bond yields rose again, sending the 10-year Treasury yield to 2.83%, and the price of U.S. oil rose, finishing nearly 11% higher for the week.

“With higher oil prices, higher bond yields, [it] implies the market continues to worry about inflation, worried about Ukraine, worried about the Fed’s response to all of this,” said Sam Stovall, chief investment strategist at CFRA.

The S&P 500 fell 54 points to 4,392.59. The Dow dropped 113.36 points to 34,451.23. The Nasdaq fell 292.51 points to 13,351.08.

Technology stocks led the way lower Thursday, offsetting gains elsewhere in the market. Pricey valuations for many of the bigger technology companies give them more sway in directing the broader market higher or lower. Microsoft fell 2.7%.

Retailers and other companies that rely on consumer spending also weighed on the market. Amazon fell 2.5%. Energy stocks rose along with the price of crude oil. Exxon Mobil rose 1.2%.

Smaller-company stocks also lost ground. The Russell 2000 fell 20.12 points, or 1%, to 2,004.98.

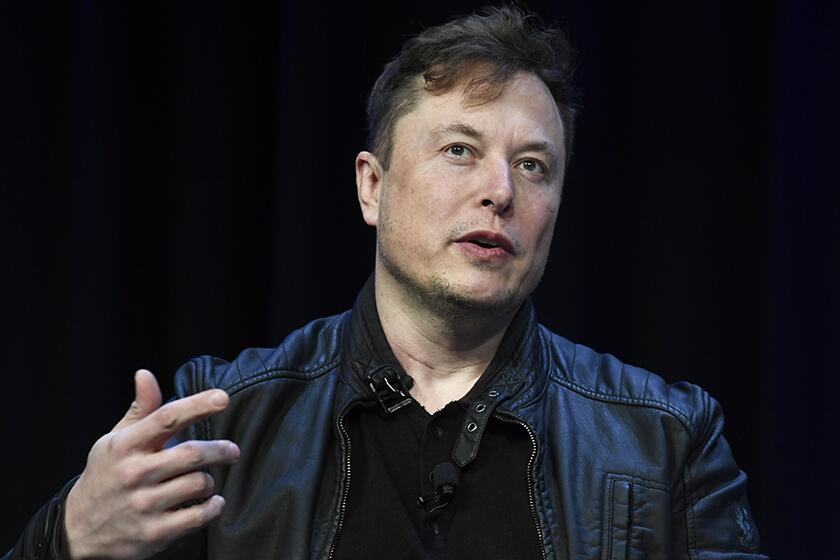

The billionaire leader of Tesla and SpaceX says Twitter must go private to fulfill its “societal imperative.” But the way he went about offering to buy it left Wall Street doubting his seriousness.

Investors again turned their attention to the drama surrounding Tesla founder and Chief Executive Elon Musk and Twitter. Musk offered to buy the social media company for $54.20 a share, two weeks after revealing he’d accumulated a 9% stake.

Musk has criticized Twitter, accusing it of failing to live up to free-speech principles and saying in a regulatory filing that it needs to be transformed as a private company. Twitter’s stock fell 1.7% to $45.08, well below Musk’s offering price.

Wall Street had mixed economic data to review after several hot inflation reports earlier in the week. The Commerce Department said retail sales rose 0.5% in March, boosted by higher prices for gasoline, as consumers continue to spend despite high inflation.

Inflation remains at its highest levels in 40 years in the U.S., and that has economists and analysts closely watching how consumers react to higher prices for such items as food, clothing and gasoline. Concerns about inflation have worsened amid Russia’s invasion of Ukraine, which has made for more volatile energy prices and contributed to rising oil and wheat prices globally.

Benchmark U.S. crude oil for May delivery rose $2.70 to $106.95 a barrel Thursday. Brent crude for June delivery rose $2.92 to $111.70 a barrel.

Tall cans of AriZona iced tea have cost 99 cents since 1992. The family behind the company says it’s committed to that price even as the prices of aluminum and corn syrup climb higher.

The head of the International Monetary Fund warned Thursday that Russia’s war against Ukraine was weakening the economic prospects for most of the world and reaffirmed the danger that high inflation presents to the global economy.

Rising prices are driving the Federal Reserve and many other central banks to tighten monetary policy by raising interest rates, among other measures, to help cool the surging demand that is contributing to the problem.

Bond yields have been mostly on the rise as Wall Street prepares for higher interest rates.

Investors received another update on the recovery in the jobs market. The number of people seeking unemployment benefits ticked up last week, according to the Labor Department, but remained at a historically low level. The data reflect a robust U.S. labor market with near-record job openings and few layoffs.

Besides the banks, insurer UnitedHealth Group was the other big name on the earnings docket. UnitedHealth rose 0.4% after reporting solid first-quarter results and raising its 2022 forecasts.

Investors are closely watching the latest round of corporate earnings to determine how companies have been dealing with rising costs and whether consumers have pulled back their spending.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.