All LAUSD first-graders now have a college savings account. Will families use them?

- Share via

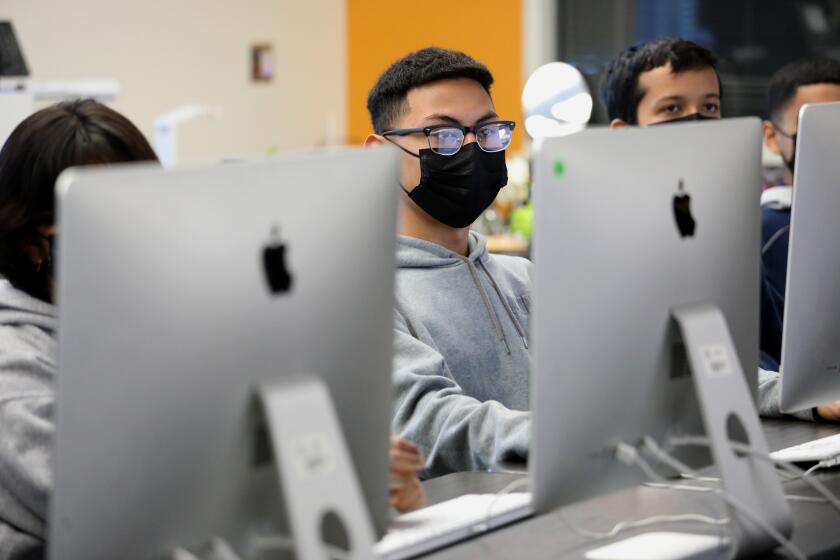

A new program is providing all first-graders enrolled in the Los Angeles Unified School District — an estimated 31,000 students — with a free college savings account.

The program, Opportunity LA, launched this week and is aimed at encouraging families to begin saving early for college or other post-high-school education such as trade schools by removing barriers like paperwork and eligibility concerns that might prevent families from starting accounts.

“This program does more than give kids and families a financial boost toward making college more affordable and accessible,” LAUSD Board Vice President Nick Melvoin said in a statement, “it also instills a college-going mindset in our students from an early age.”

The Opportunity LA accounts are similar to those of other programs, like the state-supported ScholarShare529, that offer tax-free savings accounts for college expenses.

The missing data raises questions over whether California’s community colleges have complete understanding of their enrollment.

Every first-grader in the district receives an account and a $50 seed deposit, regardless of parental income, immigration status or other factors. Families not wishing to participate must opt out of the program.

The city holds all of the accounts so as to not interfere with the public benefits a family may be receiving, officials said.

“It’s one additional tool in the toolbox,” said Abigail Marquez, general manager for the city’s Community Investment for Families Department, which helps oversee the program. “It’s a way for the city to partner with the school district to encourage and create a college-going culture in the region and to encourage more young people to pursue post-secondary education.”

Marquez said the program has been in development for a few years, with the department looking at the results of a similar program launched a decade ago in San Francisco under the guidance of Gavin Newsom, who was the city’s mayor at the time.

That program, Kindergarten to College, may offer some insights as to how Los Angeles families may use the accounts and which demographics are likely to benefit most.

According to data on the Kindergarten to College website, current as of February, 23% of the nearly 50,000 accounts in the program have received deposits outside of promotions like the initial seed money. The website states that nearly $6.8 million has been saved so far.

“The fact that we’ve been able to break 20% of our families, and that doesn’t include all of the families that are likely saving on their own, we’re really proud of that,” said Amanda Kahn Fried, chief of policy and communications for the office of the San Francisco Treasurer and Tax Collector.

Voters also expressed concern about the digital divide and want the next mayor to tackle these problems, even though the office lacks direct authority.

Fried added that around 50% of the families that have saved are eligible for the San Francisco Unified School District’s free or reduced lunch programs.

But according to a 2020 study of the program, the overall deposit rate for Black, Hispanic, Pacific Islander and Native American families was 17.8%, “a full 4.3 percentage points lower than for white families, indicating that there is more work to be done to help support [minority] families in the program.”

Only 10% of Black, Hispanic, Pacific Islander and Native American families continued to make deposits after the first year of the program. Deposit rates for Asian families neared 30%, the report said.

Fried noted that even families that experienced hardships during the COVID-19 pandemic and accessed the Kindergarten to College funds for emergency withdrawals resumed their deposits “almost immediately.”

“We’re really seeing across the board that if you meet families where they are, families desperately want to save for their children’s future and support their aspirations,” she said. “It’s our responsibility as a government to make that as easy as possible.”

Fried acknowledged that the program might not make a substantial impact on some families’ ability to pay for college. But it is beneficial in other ways, she said.

“These programs weren’t created to solve college affordability,” Fried said. “I would say that the research that sort of undergirds this work is about building aspirations.

“It’s very clear to families that the amount you’re saving isn’t what’s important,” she added. “It’s that you are taking the action; you’re talking about college with your children. You’re showing them that you believe in them and that the city believes in them.”

The model seems to be gaining steam: Last year, Gov. Newsom proposed a $2-billion program to provide nearly 4 million low-income children with savings accounts with an initial deposit of $500.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.