Netflix is worth more than Disney. How the Mouse can bounce back

This is the Nov. 16, 2021, edition of the Wide Shot, a weekly newsletter about everything happening in the business of entertainment. Sign up here to get it in your inbox.

Not too long ago, anyone who said Netflix would soon be worth more than Walt Disney Co. would have sounded as arrogant as John Lennon calling the Beatles “more popular than Jesus” in 1966.

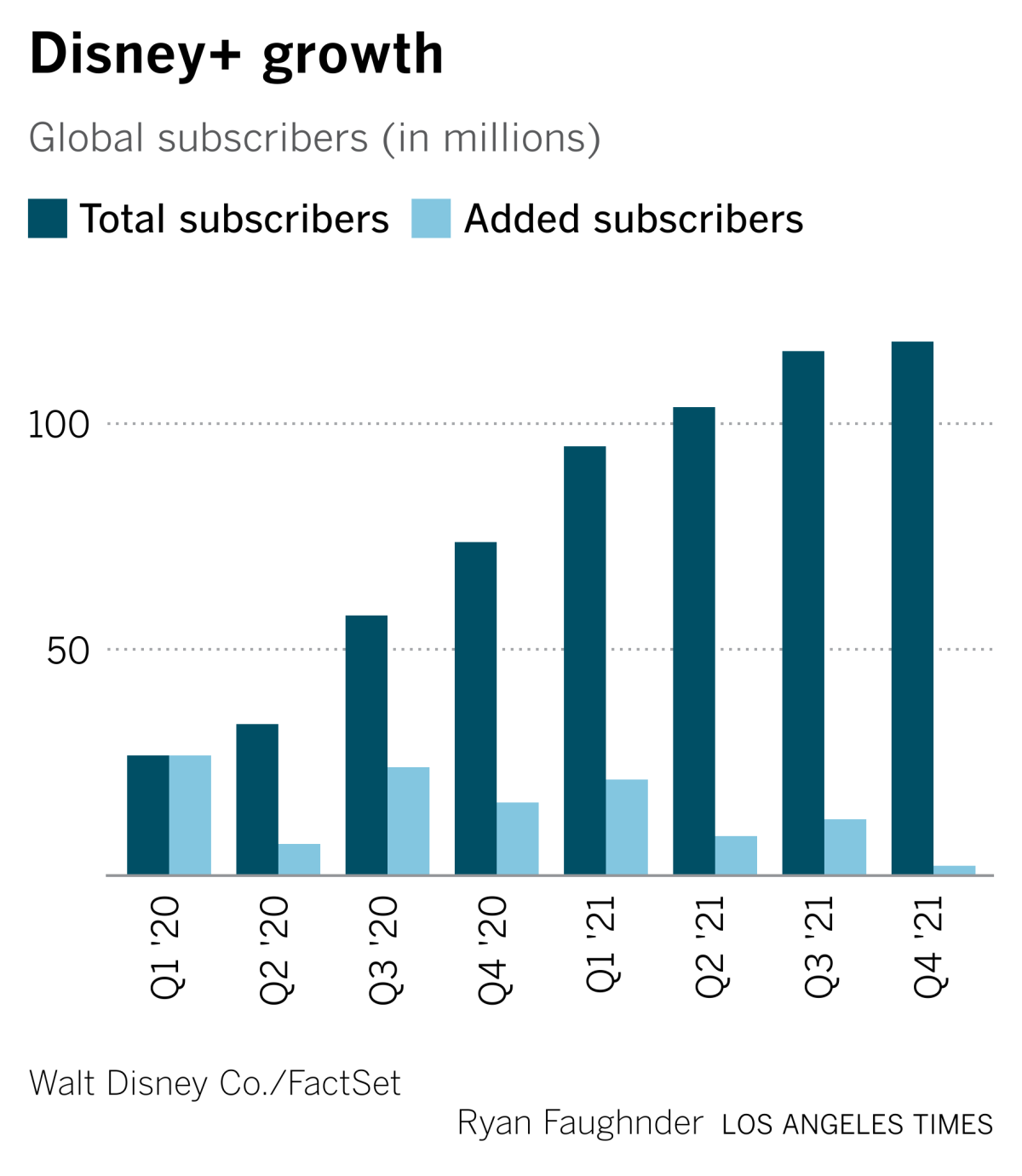

But the decline in Disney’s stock last week, following a disappointing earnings report that included tepid Disney+ subscriber growth, resulted in a notable milestone: Netflix is now more valuable than Disney to Wall Street, in terms of market capitalization.

Based on Monday’s closing share prices, Netflix (which closed Monday at $679.33) is now valued at $301 billion, compared with $288 billion for Disney.

Disney shares, which closed at $158.43 on Monday, have slipped nearly 10% since the company said its key streaming service gained just 2 million subscribers in its most recent quarter, its lowest number of additions to date.

If you’re reading this newsletter, you can recite by heart the brands that have made Walt Disney Co. the envy of the entertainment industry for the last few years — Disney, Marvel, Star Wars, Pixar... Disney, Marvel, Star Wars, Pixar...

Those cultural juggernauts and a low monthly price of $7 (now $8) quickly propelled Disney+ into the upper echelon of streaming services after its November 2019 launch.

Now, though, some analysts have started to worry that Disney+’s dedication to these brands and its family audience might also be a hurdle in the Burbank giant’s quest for digital domination.

Bob Chapek, Disney’s chief executive, said the company was looking at the long-term growth of Disney+, not the quarter-to-quarter upticks. He has maintained that the service is on track to hit its target of 230 million to 260 million subscribers in 2024.

Chapek assured investors and analysts that subscriber numbers would pick up once a “surge” of new programming started hitting the service, with the bulk of the big titles coming next July through September. New content is by far the best way to bring in new subscribers, he said.

But the type of content Disney offers is starting to get as much scrutiny as the amount of new programming on the service. After Disney’s earnings report, Cowen & Co.’s Doug Creutz wrote about being “somewhat skeptical that more Star Wars/Marvel/animated/family content will be sufficient” for Disney+ to catch up with Netflix, which has a library about as broad as it could be.

Analyst Michael Nathanson posed his question to Disney executives this way: “Are there any cohorts, any demographics, that you’re underpenetrated and perhaps the widening out of content is an issue vs. just more new content?”

Translation: No one’s seriously questioning whether Marvel and Star Wars are hugely popular. However, if you’re someone who really cares about Marvel, Star Wars, Pixar or the “High School Musical” franchise, you probably already have Disney+, right?

Responding to Nathanson, Chapek acknowledged that “being a four-quadrant service, we need to be broad in our approach.” He also cited preschool programming as a major opportunity. Former Disney executives Kevin Mayer and Tom Staggs clearly agree. Their Blackstone-backed firm is paying close to $3 billion for the company that makes “Cocomelon.”

Disney knows it needs more material, but it’s largely sticking with its branded IP strategy. That much was clear from the slew of trailers and footage Disney posted online Friday in celebration of the service’s second anniversary, dubbed “Disney+ Day.”

The company touted upcoming content including its reimagining of “Cheaper by the Dozen” and Marvel’s “Hawkeye” series. Critics noted that the announcements, accompanied by a promotional discount, were light on news. Much of the high-profile material unveiled was from shows that were already announced.

Disney folks have long been frustrated by the implication that their marquee streamer is mostly for kids. They argue that the appeal of its content is already extremely broad. You don’t get to $2.8 billion in box office for “Avengers: Endgame” by going narrow. More than half of Disney+ subs are adults without children, Chapek has previously said.

What would a non-Disney, Marvel, Star Wars, Pixar programming lineup look like, though? The family focus of Disney+ is partly a result of how Disney’s streaming strategy is set up, at least in the U.S., with more grownup material earmarked for Hulu.

Well, we’ve already had a couple of examples of how it can work.

“The Simpsons” isn’t an obvious fit for Disney+, but it’s there anyway for your binge-watching pleasure. Same with the National Geographic shows.

One of the biggest events in Disney+’s short history was “Hamilton,” which was originally intended for the big screen but converted into a straight-to-streaming release pegged to July 4.

This is why it makes so much sense that Disney is putting Peter Jackson’s six-hour documentary, “The Beatles: Get Back,” on Disney+ in three installments starting Nov. 25.

Like “Hamilton,” the Beatles are sure to appeal to a broad swath of viewers, including those who don’t care about the Marvel heroes’ latest excursions through the multiverse. If you’re not committed to untangling the plot twists of Wanda, Loki, Captain America and She-Hulk, maybe Paul, John, George and Ringo are more your speed.

If “The Beatles: Get Back” becomes a massive holiday event over the week of Thanksgiving, it could provide a template for Disney+ to expand its reach.

Stuff we wrote

— Ron Meyer has a new job. The former NBCUniversal vice chair, who left the company after disclosing making payments to cover up an affair with actress Charlotte Kirk, will lead European film company Wild Bunch.

— The latest in our Explaining Hollywood series: How to get a job as a gaffer.

— Brian Williams is leaving NBC News. The anchor will not sign a new contract with NBC News and will leave the company after 28 years.

— Comedy podcasts are taking off at Audible, writes Wendy Lee. Meanwhile, Spotify is expanding into audiobooks. We’re all basically just sentient AirPods at this point.

Number of the week

That was a close one!

Leaders of IATSE, the union representing Hollywood’s crew workers, expressed confidence that members would ratify the union’s contract with the studios, despite grumblings among craftspeople that the deal didn’t yield enough gains for labor.

They were right but just barely, with only 50.3% of those who cast ballots approving the contracts covering West Coast-based workers and those outside New York and Los Angeles.

From Anousha Sakoui’s story: IATSE uses an electoral-college-style system through which locals are assigned delegates based on their size of memberships. Members vote within their local union, and once a local reaches a majority vote, to either ratify or reject, all delegate votes are assigned to the majority result.

The combined delegate vote held a slightly stronger margin in favor of the contract: 359 (56%) to 282 (44%), out of 641 total delegate votes from the 36 local unions.

Before this vote, it made sense to wonder if dissatisfaction with the proposed agreement among the rank and file was relegated to a vocal minority amplified by social media.

Although the deal did pass, it’s now obvious that the unimpressed reaction to the pact was not just some online phenomenon. It seems likely that union leaders will be under pressure to demand more next time around.

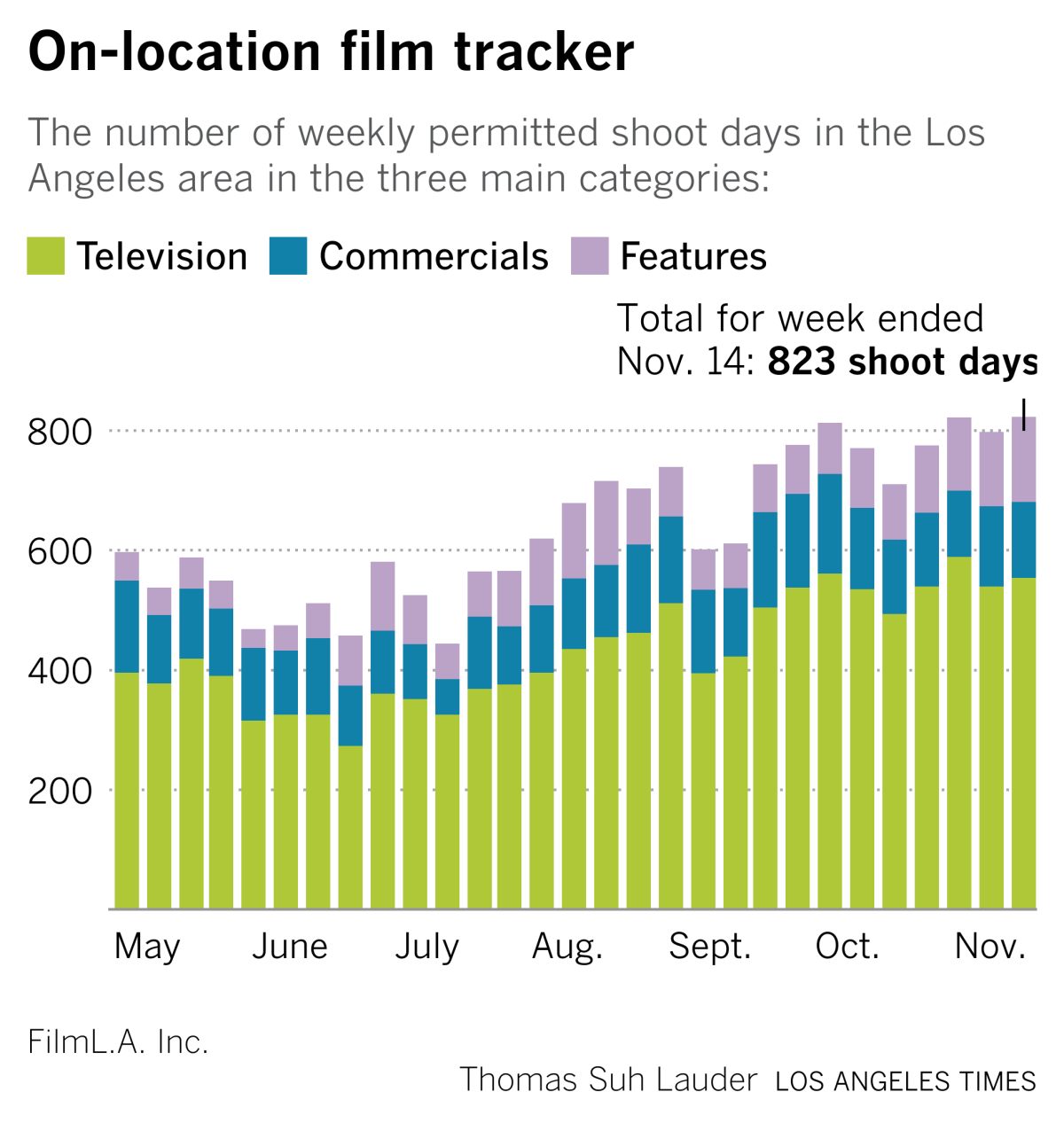

Speaking of production, Los Angeles-area shooting days reached another post-pandemic peak, with a combined 823 days for film, television and commercials. Here’s this week’s chart:

MoviePass, the return...

Ah, MoviePass. Remember the good old days of going to see “Lady Bird” for the third time because your MoviePass subscription made it basically free?

Then get ready, because the company is staging a comeback. Again. Maybe.

MoviePass co-founder Stacy Spikes, who was ousted shortly after Helios and Matheson took it over, has acquired the bankrupt company’s assets and is planning a relaunch in 2022, Insider reported.

The movie subscription service collapsed because of an unusual business model in which the company paid theaters full price for tickets when users of the app purchased them with its signature red debit card. It surged in usage after dropping its monthly subscription to $9.95. The more popular MoviePass became, the more money it lost.

Spikes’ original vision for MoviePass was smaller and probably more sustainable, charging in the ballpark of $30 to $50 a month. Any reboot will face heavy competition from companies like AMC Theatres, which launched AMC Stubs A-list in response to MoviePass’ surge.

As Bloomberg’s Matt Levine muses, a MoviePass comeback feels factory-made for the meme-stock era of business. Maybe it will become the next GameStop. Maybe they’ll partner with AMC on an NFT!

More stories from the week

— Do women still want to go to the movies? As moviegoers trickle back to theaters, one key demographic may be missing. (Wall Street Journal)

— Why there are so many black-and-white movies in 2021. From “Passing” to “Belfast,” “The French Dispatch” to “Gunda,” the monochrome movie is back in full force — and for interesting new reasons. (Vox)

— How Kristen Stewart became her generation’s most interesting star. The actor’s naturalistic style is captivating to some and inscrutable to others. (New Yorker)

Finally...

I finally went to the new Amoeba Music in Hollywood last week. If you’re ever in the area, do yourself a favor and check it out. When it comes to discovering music, no algorithm can beat flipping through physical media.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.