As streaming services get frugal, programming changes throw Hollywood creators for a loop

Welcome to the Wide Shot, a newsletter about the business of entertainment. Sign up here to get it in your inbox.

During the first several years of the streaming wars, media companies and studios were willing to spend whatever it took to compete in the business of making films and TV shows for digital subscribers.

But as subscription increases start to slow down, Hollywood is entering a new phase of its streaming revolution; one of relative restraint and conservatism.

Netflix is slowing down its “cost growth” as its subscriber counts plateau and revenues decelerate, holding its content spending steady at a still-huge $17 billion annually. Warner Bros. Discovery axed direct-to-streaming movies such as “Batgirl” and “Scoob! Holiday Haunt” and ditched shows like J.J. Abrams’ ambitious “Demimonde.”

After the bender comes the hangover, and it’s the talent — filmmakers, writers, showrunners, actors and below-the-line workers — who are feeling queasy. And it’s not just budgetary concerns that are throwing creators for a loop. It’s also sudden shifts in programming strategy that are turning promising shows into castoffs.

In late July, HBO Max canceled “Gordita Chronicles,” a series created by Claudia Forestieri about a young Dominican girl coming of age in Miami, a little more than a month after the show debuted. An HBO Max spokesperson said: “Live-action kids and family programming will not be part of our programming focus in the immediate future, and as a result, we’ve had to make the very difficult decision to end ‘Gordita Chronicles’ at HBO Max.”

It’s worth noting that streaming services aren’t cutting spending on content, per se. They say they’re just getting more disciplined about the kinds of shows and movies they choose to bankroll.

Abrupt shifts in “programming focus” have left showrunners and producers wondering what the future might bring for their own projects. Agents have been getting calls from anxious clients as they try to navigate the landscape. “When things shift, the reaction tends to be, ‘Oh, no!’” said one film agent who did not want to be named discussing private business. “We’ll have to see how it all unfolds.”

In this age of constant change, creators are constantly having to reevaluate their strategies for deciding which shows they’ve got in the works should be pitched to which studios.

“It’s just an avalanche of mysterious decisions,” said Mike Royce, a writer and producer known for the canceled Netflix reboot of “One Day at a Time,” in an interview. He also consulted briefly on “Gordita Chronicles.” “The mandates have changed very rapidly and seem to continually change as streaming becomes the new broadcast television.”

Warner Bros. Discovery’s highly unusual decision to shelve the movie “Batgirl” was the most dramatic example yet of how the recent company maneuvering is disrupting artists.

“Batgirl” was in postproduction and carried a $90-million budget — not at a scale grand enough for theaters, but also financially nonsensical as a streaming-only release, in the eyes of the corporate overlords. Rather than spend the money that would be needed to beef up “Batgirl” with reshoots and market it for theaters, the company scrapped it in favor of a tax write-off.

It shouldn’t come as a surprise that Warner Bros. Discovery CEO David Zaslav would look for cost savings after taking over the 99-year-old Warner Bros. studio earlier this year, and that such efforts would involve mothballing projects greenlit during the much-maligned AT&T era. Zaslav’s team is seeking $3 billion in total cost savings from the merger, and employees are bracing for hundreds of layoffs. The group overseen by HBO and HBO Max Chief Content Officer Casey Bloys is cutting 70 employees, or 14% of staff, which includes the drawdown of Max’s reality TV operations.

But killing “Batgirl” came across as ruthless, especially after reports citing sources who said that the movie was shelved in part because of its quality. That’s just not how it typically works. Rather, studios typically use test screenings as tools to figure out how to improve a movie, not to decide whether it should exist or not.

“There was a time when the… worst thing a director had to worry about was that, oh, maybe they don’t take it theatrical, maybe it goes straight to video,” said filmmaker Kevin Smith on his podcast “Hollywood Babble-On.” “Now they’ve added a new fear to the mix, which is, like, ‘We may not release it at all.’”

Zaslav emphasized the importance of quality for DC films as he told analysts he had a “10-year plan” focusing on the superhero franchise, in a strategy he compared to Marvel Studios under the stewardship of Disney’s Bob Iger and Alan Horn (a tall order, you might say, even with Horn advising Zaslav in a post-Disney career act).

“We’re not going to release any film before it’s ready,” Zaslav said. “We’re not going to release a film to make a quarter.”

Streaming just had its worst week ever. But what does cinema have to gloat about?

But mainly, Zaslav focused his comments on the fiscal responsibility, or lack thereof, of making expensive movies for streaming rather than theaters.

“We cannot find an economic case for it,” he said. “We can’t find an economic value for it. And so we’re making a strategic shift.”

The streaming business’s newfound focus on sustainable business models is probably overdue. The major new streaming players are losing billions of dollars a year. Paramount Global says its direct-to-consumer efforts will lose $1.8 billion this year. Comcast has projected $2.5 billion in losses for Peacock in 2022. Disney’s direct-to-consumer segment sunk $2.5 billion during the first nine months of its fiscal year.

This comes as the media industry faces signs that the streaming market could be hitting a wall in the U.S. and Canada. Streaming services gained a combined total of 2.7 million domestic subscribers during the second quarter of the calendar year, wrote media analyst Michael Nathanson. That’s the lowest quarterly increase of the post-2020 era and, as Nathanson put it, “a clear sign that the streaming wars have given way to the reality of financial markets.”

“As a result of this slowdown in new subscriber additions, we have seen many in the industry pivot to a new wave of sobriety,” Nathanson wrote, following Disney’s latest earnings report.

Many of these companies are introducing strategies to make their streaming businesses more profitable. Netflix is adding an advertising-supported tier next year and trying to make money from password-sharers. Disney+ is hiking its monthly fee to $11 in December, for an increase of $3, and subscribers who want to keep paying the current price of $8 a month will have to watch ads.

Warner Bros. Discovery still considers streaming a priority, just not the only priority. The company’s traditional businesses of theatrical movies and linear television networks still make money. Zaslav has also indicated that the company will be more open to licensing shows it produces to other distributors. The focus on generating cash comes as the company must contend with its $53-billion debt load.

The company said its combination of HBO Max and Discovery+, launching next summer, will be profitable in the U.S. in 2024 and generate global profit of $1 billion the following year. Disney+ is also expected to become profitable in fiscal 2024, with losses peaking this year.

To thrive in streaming, companies need to get real about spending and pricing. But that could contribute to an environment of heightened tensions between talent and their employers as studios seek to please investors while also making enough stuff to satisfy streaming’s bottomless appetite for content.

No doubt, this will become a key battleground as unions representing writers, directors and actors gear up for negotiations next year. Writers are expected to be particularly emboldened in their demands, many of which will have to do with streaming, after the concessions they gained after their standoff with the agencies over packaging fees and affiliate production entities.

“As these streaming services get their feet under them, they’re looking for a way to, quote-unquote, control costs,” Royce said. “And I think everybody’s got their eye on that because there’s a lot of ways in which streaming has pushed wages down across the board.”

Stuff we wrote

— ‘Rust’ update. The FBI has finalized its forensic analysis of the deadly shooting by Alec Baldwin last year on the set of the low-budget western “Rust,” New Mexico sheriff’s officials said last week.

The long-awaited FBI report resolved some issues but left untouched key questions surrounding the death of cinematographer Halyna Hutchins. FBI did not draw any conclusions about where live ammunition came from, but it concluded that the pistol “functioned normally when tested in the laboratory.” The report also noted that, in order for the revolver to fire, the trigger needed to be pulled.

— R.E.S.P.E.C.T. Aretha Franklin documentary “Amazing Grace”” is mired in a legal fight over its release. The Amazing Grace Movie LLC (of which producer Alan Elliott is the principal) is suing Neon, accusing the indie distributor of a host of practices that hamstrung the potential success of the documentary.

— Podcast time: Sweet, scary, sad, silly Bill Hader talks “Barry” on “The Envelope.”

— Headlines on deadlines: How to get a job as a production accountant. Are the Golden Globes coming back to NBC? Eh! Shannon Bream will succeed Chris Wallace on ‘Fox News Sunday.’ Rupert Murdoch, Jerry Hall finalize divorce. Studio complex planned for downtown L.A.’s Arts District. Jeffrey Toobin exits CNN. New owner for CW Network.

Number of the week

Hedge funder Daniel Loeb is at it again.

The Third Point CEO and activist investor thinks Disney could do better in its transformation into a streaming powerhouse.

On Monday, Loeb sent a letter to Disney CEO Bob Chapek that, among other things, recommended that Disney buy out Comcast’s stake in Hulu earlier than required. That, Loeb argued, would allow Disney to integrate Hulu into Disney+ for the purpose of creating “significant cost and revenue synergies, ultimately reigniting growth in the domestic market.” He also urged Disney to consider spinning off ESPN and refreshing its board of directors.

Disney’s response to Loeb was of the “we hear you, we see you” variety.

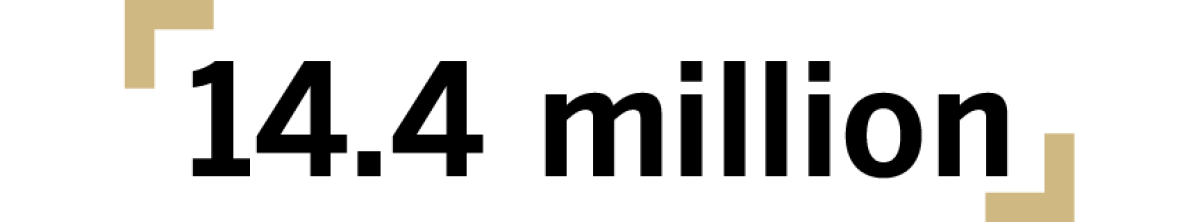

So how’s Disney doing in streaming, anyway? Disney’s name-brand streaming service added 14.4 million subscribers during its third fiscal quarter, topping the 10 million analysts expected.

As usual, the numbers are more complicated than the headline stat implies. Disney+ gained:

- 100,000 in the U.S. and Canada.

- 6 million internationally (excluding India’s Disney+ Hotstar)

- 8.3 million from Disney+ Hotstar.

That’s a lot of new subscribers from India, which are less valuable to Disney in terms of average revenue per user (ARPU):

- U.S. and Canada: $6.27

- International (excluding Disney+ Hotstar): $6.31

- Disney+ Hotstar: $1.20.

With those “ar-poo” numbers, it makes sense that Chapek didn’t want to overpay for IPL cricket rights, a big driver of subscribers in India. But that discipline has forced Disney to lower its subscriber forecast. The company said Disney+ will reach 215 million to 245 million subscribers by 2024, compared with the 230 million to 260 million it previously predicted. Only now it will consider Disney+ and Disney+ Hotstar as separate businesses and will report them as such.

Here’s the breakdown for 2024 expectations:

- “Core” Disney+: 135 million to 165 million.

- Disney+ Hotstar: Up to 80 million, depending on future cricket rights.

Hollywood production

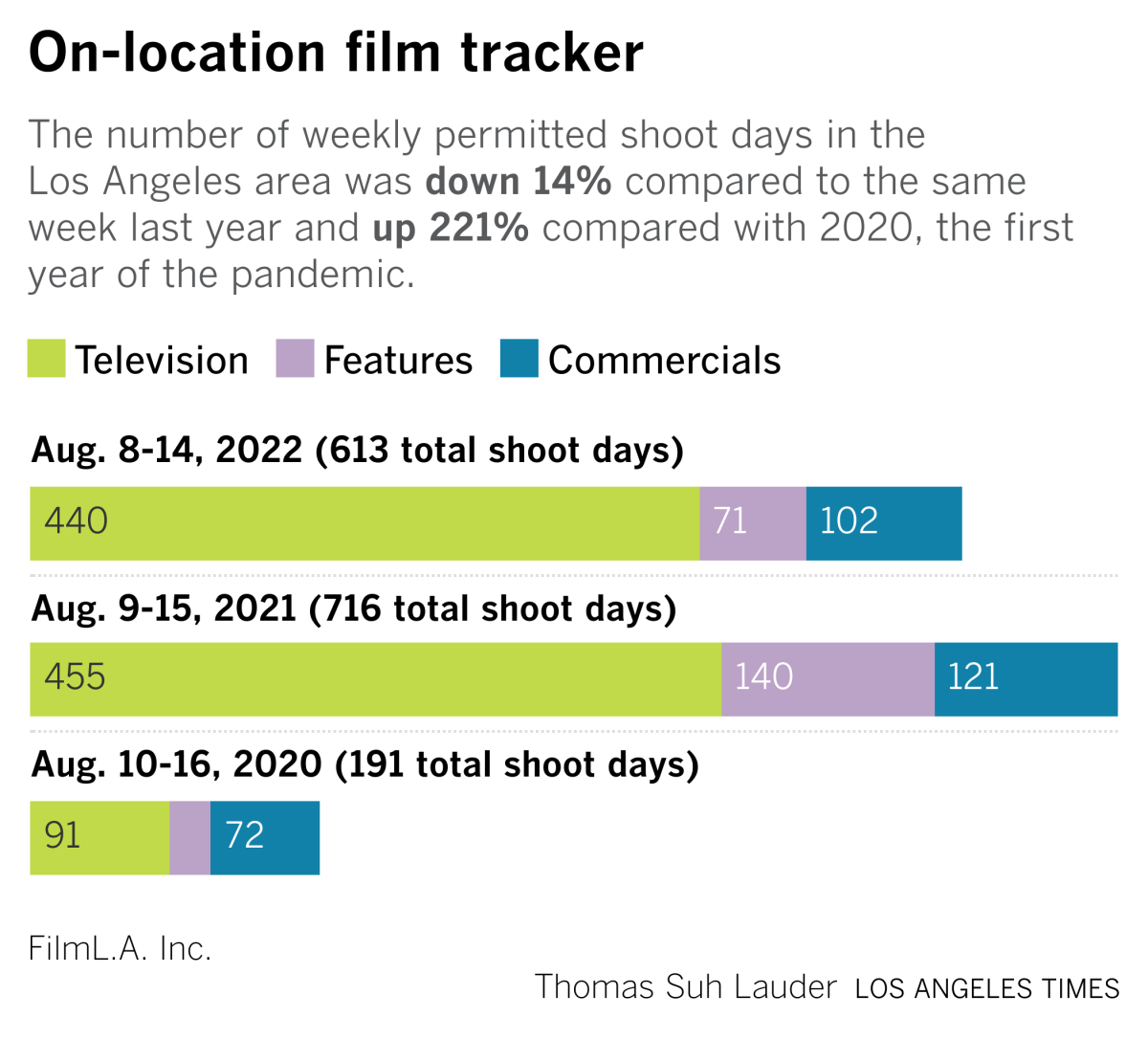

Shoot days in the Los Angeles area were down 14% last week, compared with the same period of time in 2021.

Finally ...

For a future edition of this newsletter, I’m looking for examples of the best representations of parenthood in pop culture. You know, for a friend... Movies, books, podcasts, whatever. Most of my favorite films feature examples of really, really bad parents (“There Will be Blood.” Just incredible).

Send your best examples my way.

Now for my content consumption tracker...

Watching: “Beavis and Butt-Head Do the Universe” (Paramount+). “Uncoupled” (Netflix).

Reading: “Stories of Your Life and Others,” by Ted Chiang.

Listening: A Renaissance in American Hardcore Music (Popcast/NYT). “Monkey Gone to Heaven” (cover), by Gulch.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.