David Ellison’s Skydance explores possible merger with Paramount through National Amusements

Film producer David Ellison’s Skydance Media is exploring an all-cash deal to acquire National Amusements Inc., the company that controls Paramount Global, as part of a bid to merge the two entertainment businesses , according to people familiar with the matter who were not authorized to comment.

The discussions are in early stages and may not result in an agreement.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

Skydance would be willing to purchase a controlling stake in National Amusements from Shari Redstone only if such a deal led to Skydance merging with Paramount, one of the people said. Billionaire Larry Ellison, Skydance Chief Executive David Ellison’s father and a founder of Oracle Corp., would be involved in the funding for such a deal.

Representatives for Skydance, Redstone and Paramount declined to comment.

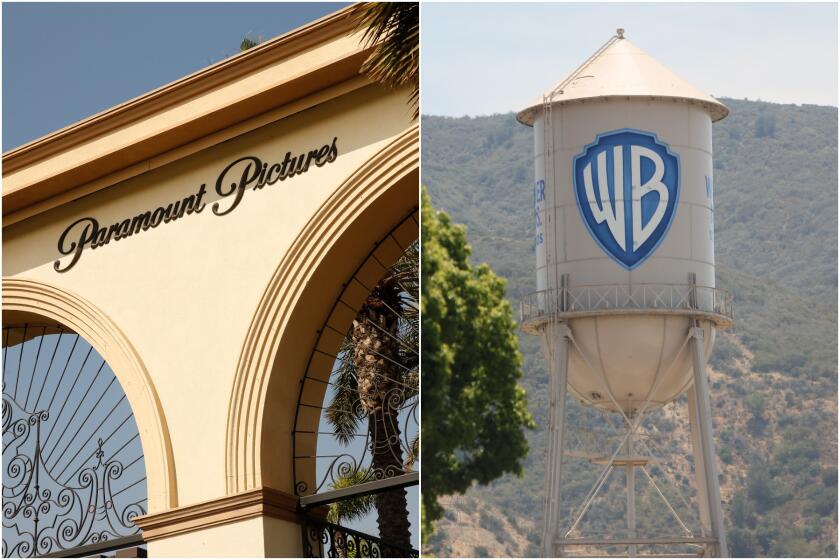

Executives at Warner Bros. Discovery and Paramount have met to discuss a potential merger. Here’s what that could mean for Hollywood.

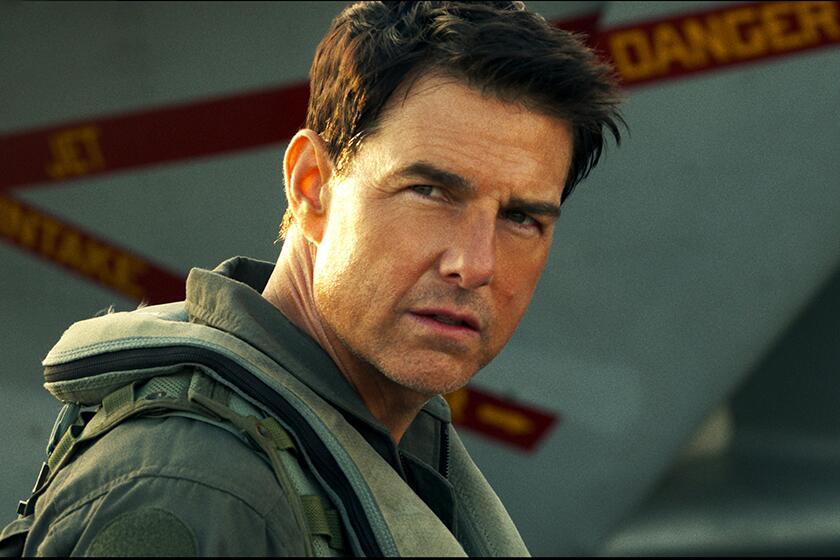

Skydance has been a longtime collaborator with Paramount Pictures, having co-produced each film in the “Mission: Impossible” franchise since 2011’s “Mission: Impossible — Ghost Protocol,” as well as the Tom Cruise–starring “Top Gun: Maverick.” Should the deal go through, Ellison and Skydance would be taking over National Amusements and Paramount Global from the Redstone family, which has held a controlling stake in various iterations of the company since 1987.

Among the key challenges is the task of structuring a deal that would be acceptable to Redstone, including contending with the tax consequences of an all-cash deal that Ellison is pursuing.

There’s also the issue of whether Redstone would be willing to break apart the media company to make a deal more digestible for Skydance. Though a deal is most contingent on including the Paramount studio operations, as one of the people said, Paramount also owns the CBS broadcast network and a large portfolio of cable TV channels, including Nickelodeon, Comedy Central, MTV, VH1 and Paramount Television.

Tom Cruise has entered a film production deal with Warner Bros., starting this year. Cruise’s production company will have offices on the Warner Bros. Discovery studio lot in Burbank.

Paramount’s premier franchises include the “Transformers” films, Comedy Central’s “South Park,” Nickelodeon’s “SpongeBob Squarepants,” the “Paw Patrol” films and Taylor Sheridan’s “Yellowstone” and its various offshoots. It also owns the Paramount+ streaming service.

Paramount’s dual class structure also complicates any deal scenario that would involve investors who own publicly traded shares. They would demand a premium for their shares, increasing the ante for Skydance.

Redstone controls her family’s Massachusetts-based holding company National Amusements Inc., which owns about 77% of the voting shares of Paramount. NAI is a private firm and also operates a movie theater chain, with locations largely based in the Northeast.

Over the years, the Redstone family has fielded interest for its media properties.

Here’s our wrap-up of the themes that defined entertainment in 2023 and how they’ll bleed into the next 52 weeks.

However, Shari Redstone was initially interested in building her late father Sumner Redstone’s company, rather than cashing out. After merging CBS with Viacom four years ago, creating what was then a $30-billion entity, Redstone became the nonexecutive chairwoman of the combined entity. The company was renamed Paramount Global in early 2022.

By then, the company’s stock had peaked in early 2021 at more than $64 a share. It has faded amid Wall Street’s gloomy view on traditional media stocks. The stock has been trading at about $15 a share since May, placing the company’s value at about $10 billion.

Billionaire heir David Ellison’s production company raises $400 million from investment giant KKR and others.

The company has lost two-thirds of its value at a time when it was spending heavily to build the Paramount+ streaming service to compete with Amazon, Apple, Netflix and Disney to be a contender in streaming.

With Paramount’s balance sheet strained and its TV assets losing audience, Shari Redstone has considered an exit from the business her father controlled for more than 30 years. In November, Paramount instituted a change of control provision to protect current high-level executives should a new owner take over, according to Securities and Exchange Commission documents, signaling the imminence of a potential takeover.

David Ellison’s interest in Paramount was previously reported in December by Puck News. The Wall Street Journal first reported details on Ellison’s potential all-cash deal for National Amusements on Wednesday.

In 2022, Skydance secured a $400-million private equity investment led by KKR, valuing the firm at $4 billion.

Skydance isn’t the only suitor. Last month, Paramount Chief Executive Bob Bakish met with Warner Bros. Discovery executive David Zaslav, who would leap at the opportunity to strengthen his company. Paramount would bring obvious synergies, such as combining CNN with CBS News.

But Warner Bros. Discovery is in a similar situation as Paramount, finding itself struggling to compete against tech companies in a difficult environment. WBD also has been struggling to rein in its more than $40 billion in debt from its deal with AT&T to take over assets including Warner Bros., HBO and the Turner networks.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.