What you need to know about the new sports streaming service

- Share via

Three major media companies rocked their industry this week when they announced they are banding together to offer a sports-driven streaming service aimed at consumers who don’t want to pay a big cable bill.

But as the dust settles, there are still a lot of questions about the unnamed venture from the Walt Disney Co., Fox Corp. and Warner Bros. Discovery, which they plan to launch ahead of the 2024-25 NFL season start in September.

The three media conglomerates will have equal ownership shares in the new service, which will carry the suite of ESPN channels, ABC, Fox and its cable sports channels, and WBD’s TNT, truTV and TBS. Whether they provide enough value for the consumer while generating sufficient revenue to cover the escalating costs of sports rights remains to be seen. Here’s what potential customers need to know:

What sports will be offered?

Everything on 14 sports-carrying channels owned by the three partners. For Disney, that means all the coverage — such as NFL “Monday Night Football,” the NBA Finals, and the Stanley Cup playoffs — and content produced on ESPN. Many major events are now carried by broadcast network ABC. WBD’s Turner Sports shares the rights to the NCAA Men’s Basketball Tournament, the NHL, the NBA and Major League Baseball. Fox has the NFL’s Sunday package, the World Series and the World Cup. Both Fox and ESPN have a heavy schedule of college football and basketball.

What’s missing?

A lot. Comcast and Paramount Global, whose NBC and CBS networks are not included, have half of the NFL schedule and several Super Bowls over the next 10 years. NBC has Triple Crown horse racing, the Olympics and PGA Golf. CBS is the longtime home of the Masters and shares the NCAA Tournament with Turner, which highlights a major shortcoming in the new streaming venture. Consumers who bid for the Final Four will only get the games carried by Turner Sports, not CBS.

Comcast and Paramount Global were excluded as a means to keep the price of the new service low. But the gaps have already drawn the attention of Wall Street analysts.

“The service would have a better chance of success with those two joining in with their rights; it would be a big consumer win to be able to have one service that includes all sports,” Doug Cruetz, an analyst for TD Cowen said in a report.

Who is the target audience for the service?

Fox Corp. Chairman Lachlan Murdoch told analysts this week that the service will be aimed at the 60 million households who are not subscribing to a pay TV service, a number that has been steadily escalating as more consumers are content with watching video through online streaming platforms. Every consumer who bypasses cable means lost revenue for the networks that have come to depend on pay TV revenue. It’s not just cord-cutters, as a generation of viewers have grown up without the linear television experience of their Gen X- and baby boomer-aged parents and grandparents. “For us, it accesses a whole new market and really drives a tremendous amount of new reach that we weren’t servicing before,” said Murdoch.

Walt Disney Chairman Bob Iger also cited the need to reach consumers who have never signed up for a pay television subscription. “This gives them a chance to do so at a price point that will be obviously more attractive than the big, fat bundle,” he said.

How much will the new service cost?

Pricing has not been announced, but Wall Street analysts are speculating the service will cost around $50 a month. Like a cable or satellite subscription, the sub fees would be paid by TV operators to owners of the networks in exchange for the rights to carry programming, with ESPN likely getting the biggest cut (pay TV operators would pay around $9 per subscriber for it).

Getting the pricing right will be critical as the service is meant to attract the cable-less consumers that Murdoch cited. If the monthly fee goes above $50, the service will be in competition with other streaming cable substitutes such as YouTube TV and Sling, both of which carry CBS and NBC stations in most markets.

Not everyone is convinced that young consumers who have discovered other means to consume sports content online or avoid live TV in general will be eager to drop $50 or more a month for another streaming service. Casey Lewis, who tracks Gen Z consumer trends in her After School newsletter, told CNBC: “I don’t not think this will be terribly impactful for young people. Many of us have streamer fatigue as it is.”

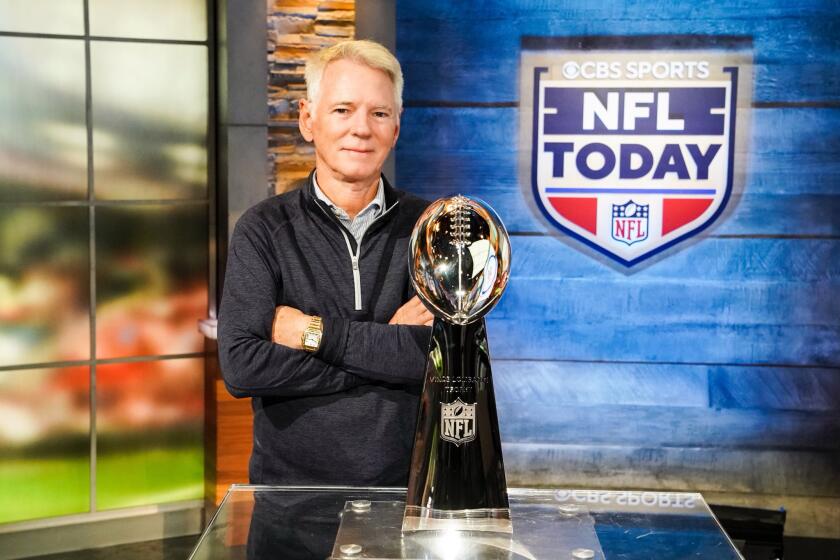

The CBS Sports chairman, who joined the network in 1996, spent a lifetime in control rooms that brought the biggest events to the nation’s living rooms.

Will I be able to get my favorite local teams’ games on the service?

Only if they are playing in a national or regional telecast offered by one of the partners. Consumers who want access to every game in their markets will need a pay TV service or a subscription streaming service if their team offers one.

What’s the business rationale for three competitors banding together?

The companies are in the grip of paying escalating costs for sports rights while their revenue sources are under threat from cord-cutting and shrinking ratings that are driving down ad revenues. Fox, Disney and Warner Bros. Discovery know that sports TV is the most reliable attraction for audiences and live in fear that major properties will eventually be poached by deep-pocketed tech companies such as Apple and Amazon. Apple has the exclusive rights to Major League Soccer while Amazon holds the rights to the NFL’s Thursday night package and is considered a major contender for at least a piece of the next media deal for the NBA currently held by Disney and Warner Bros. Discovery. The venture is aimed at bringing in a new source of revenue that can help the partners remain competitive for media rights going forward.

Will consumers still be able to stream live sports on existing platforms such as ESPN+ and Max?

Yes. Even with the new venture, Disney is going ahead with a plan to provide the ESPN channels in a streaming offering that does not require a pay TV subscription. The new direct-to-consumer product will be available by August 2025.

What will the new service mean to the future of the cable bundle?

Nothing good. The venture is clearly an acknowledgment that the cable bundle, which provided a steady stream of revenue to media companies for years, is on borrowed time.

“This is a realization that they have to somehow develop a new revenue stream apart from traditional pay TV,” said Lee Berke, president of LHB Sports, Entertainment & Media.

Sports, followed by news, has long been the top reason for holding on to to a pay TV subscription in the new media landscape that has moved toward streaming video. The success of a lower-priced streaming option for sports fans could accelerate cord-cutting among the 70 million homes still left in the U.S. — a number that 10 years ago was well over 100 million.

Are there any regulatory issues that could keep this venture from happening?

“We tend to doubt it,” Cruetz said. The streaming venture would feature content that would still be available through pay TV operators, streaming platforms and in many cases over-the-air television received free with an antenna.

But Fubo, a New York-based streaming TV service designed to provide live sports-carrying channels at a lower cost than cable, is saying the service could ultimately force people to pay more to watch sports.

“Every consumer in America should be concerned about the intent behind this joint venture and its impact on fair market competition,” the company said in a statement. “This joint venture spotlights a concerning trend where an alliance with significant market share, reportedly controlling 60-85% of all sports content, could dictate market terms in a manner that may not serve the broader interests of consumers.”

Fubo’s stock dropped 26% after the new venture was announced on Wednesday.

Times staff writer Meg James contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.