Jeffrey Katzenberg’s WndrCo investment firm raises more than $460 million

- Share via

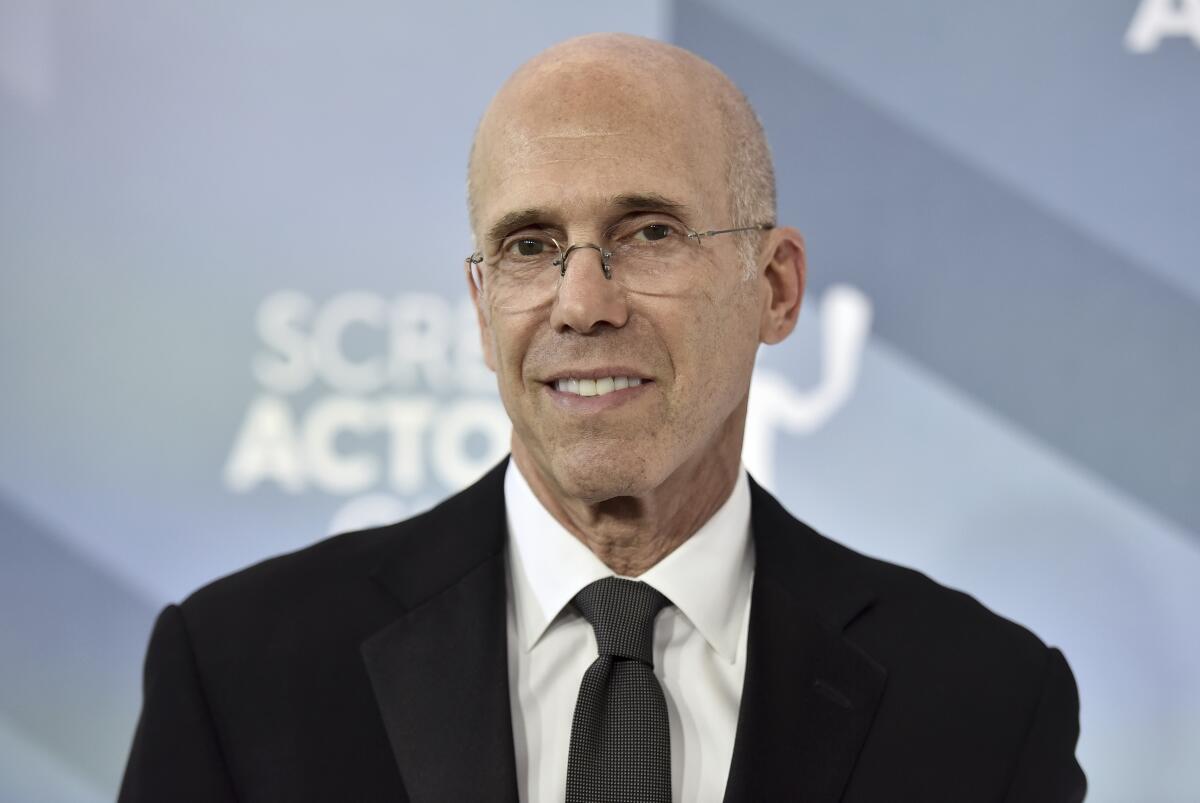

Hollywood veteran Jeffrey Katzenberg is turning more of his attention toward tech, with his WndrCo investment firm saying it raised more than $460 million for venture capital funds focused on the industry.

The funds will back companies focused on internet safety, the future of work and consumer software, according to a Tuesday statement.

“We are convinced that the coming decade, driven by the transformative power of AI, will be a remarkable period for entrepreneurship,” Katzenberg and his founding partner Sujay Jaswa, a former Dropbox executive, said in the statement. “This technology represents the most significant revolution since the mid-2000s, following the rise of cloud computing, social media, and smartphones.”

Redwood City-based WndrCo already counts password security firm 1Password, financial services company Robinhood and app-building platform Airtable among its investments. Katzenberg and Jaswa founded WndrCo in 2016.

Though Katzenberg is best known for his long tenure in the entertainment industry, including serving as chairman of Walt Disney Studios and chief executive of Dreamworks Animation, he has become increasingly involved in tech investment.

Most recently, Katzenberg and tech executive Meg Whitman launched Quibi, a failed short-form streaming video app that aimed to compete in the digital video market. Though the company raised $1.75 billion, it struggled to attract enough audiences to its shows and shut down in 2020 after less than seven months of operation.

The company, whose name was short for “quick bites,” was geared around shows and movies with episodes that lasted 10 minutes or less.

Quibi intended to distinguish itself from rivals like TikTok or Instagram with higher production values, but it launched during the pandemic, did not catch hold of audiences and missed key viewership metrics for advertisers.

The idea of deploying Hollywood-level production budgets for short videos and charging viewers for them turned out to be flawed, when viewers were flocking to other sites that offered compelling user-generated content for free.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.