How Robert Sarver brought NBA mind-set to Spanish soccer, as U.S. investments increase

- Share via

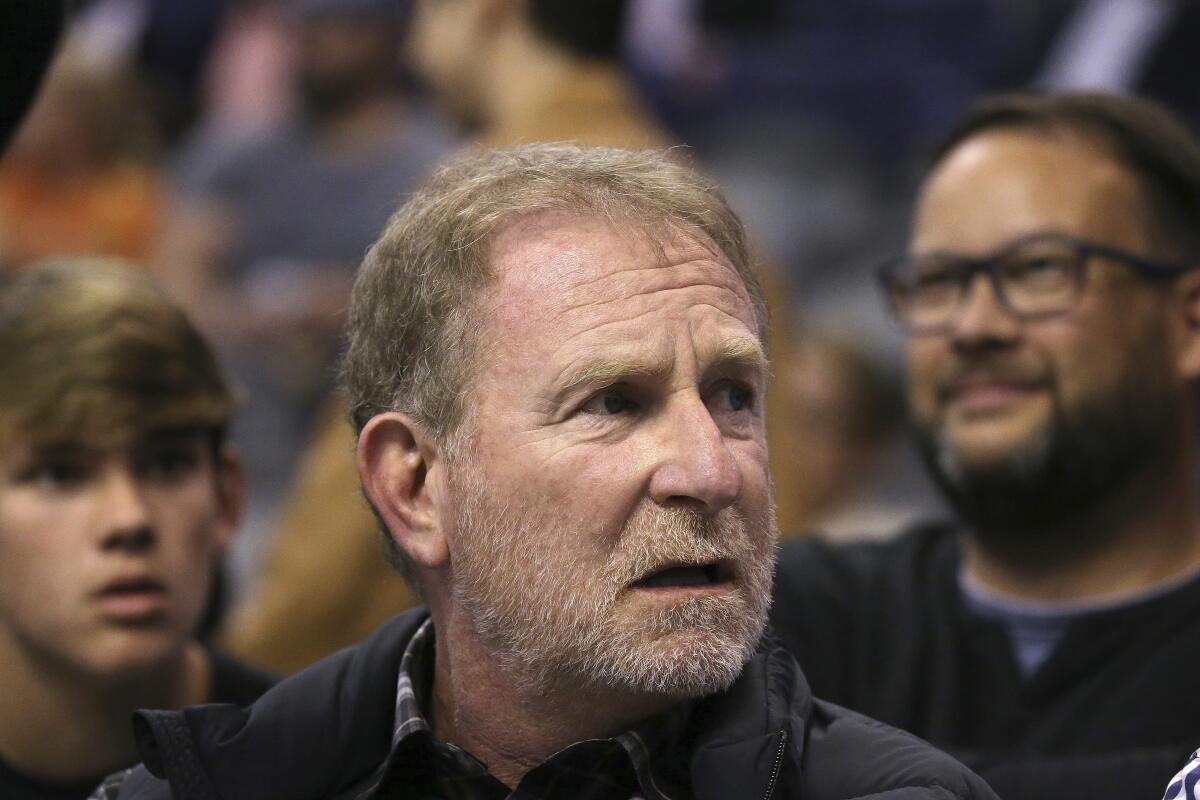

In the winter of 2016, a group of North American investors headed by Phoenix Suns owner Robert Sarver bought a financially stressed soccer team in the Spanish second division.

Sixteen months later RCD Mallorca was relegated down to the third tier for the first time in nearly four decades, which led to one very important question in the ownership group’s next conference call: What’s relegation?

“I remember a couple of our minority partners, American businessmen, hadn’t really experienced the idea or the thought of relegation,” said former World Cup player Stu Holden, who is also a minority partner. “It was kind of an education. It was, ‘OK, what do we do now?’ “

What the owners — a group that includes two-time NBA MVP Steve Nash, former national team midfielder Kyle Martino and former tennis professional Andy Kohlberg — decided to do was follow a uniquely American template by staying the course, investing in their players and leaning on marketing and promotional strategies learned in the U.S.

It worked, with Mallorca winning promotion in each of the next two seasons to rejoin La Liga this year for the first time since 2013.

“We’re an ownership group that comes from the NBA that has a lot of experience in America in marketing and business. And then we have a club that’s over 100 years old, that has a deep culture and history and fan base,” Nash said of the soccer franchise. “So how do you marry the two?

LAFC gave president Tom Penn, general manager John Thorrington and chief business officer Larry Freedman multiyear contract extensions Friday.

“Part of our success has been best practices from both sides of the ocean.”

That started when Sarver sent consultants from his NBA team to Spain, where they created new fan experiences borrowed from the basketball league, such as a pitch-side VIP area and the Tunnel Club Experience, which allows fans exclusive views of players as they leave the dressing room and head to the pitch.

Ownership also decided to overpay their players, giving them second-tier salaries to play in the third tier. As a result, five players who appeared in Mallorca’s final game in the third tier were in uniform last August for the team’s return to the first division.

“That’s been a really big positive for us: the continuity and the chemistry and the culture,” Nash said of Mallorca, which has a league-low salary limit of $33 million, less than one-twentieth of what La Liga rivals Barcelona and Real Madrid will spend.

Perfecting that mix of smart spending with savvy marketing is necessary for survival in a North American sports landscape crowded with five major professional leagues, college athletics and NASCAR, among other things — competition that European club owners have never faced.

“Over there it’s like you’re so far and away the dominant player that you don’t have to be brilliant in marketing because your fans are coming. It’s passed down for centuries,” Nash said.

But with teams increasingly competing for hearts and mind in a global marketplace, it’s now just as important to sell your team to supporters in Manila and Minneapolis as it is to keep your fans in Mallorca. And that new reality has made American owners highly sought in European soccer.

France’s Ligue 1 has been the most ambitious suitor, designing a 32-page presentation that it pushed on prospective investors during more than a half-dozen recruiting trips to the U.S. in the past two years. As a result, two of the league’s 20 teams belong to Americans, among them former Dodgers owner Frank McCourt.

Italy’s Serie A has one Canadian and three U.S. ownership groups, and there are 12 teams in the top two division of English soccer with American owners. Only the German Bundesliga lacks a U.S. owner, and that’s because it’s forbidden under a rule that requires teams to be majority-owned by German club members.

“American owners bring sports marketing knowledge, business knowledge,” said Olivier Jaubert, Ligue 1’s chief sales and marketing director. “They bring their revenues and they bring their expertise. We need to have investors and we need to have experts who can make sure that our stadiums are full, that we generate new sponsorship revenues, we increase merchandising.

“People who are owning franchises in the U.S., normally they are masters of this kind of industry and business.”

The investors, meanwhile, are drawn by the chance to make a quick buck. When a group that included Boston Celtics co-owner James Pallotta bought a 67% share of Roma in 2011, it cost them $100 million. Last spring Forbes said the club was worth $622 million.

Major League Soccer released its 2020 schedule Thursday. LAFC and the Galaxy will meet May 16 at Banc of California Stadium and Aug. 23 at Dignity Health Sports Park.

Sarver’s group bought Mallorca for $24 million. The team will make more than double that in prize money alone this season even if it finishes last in La Liga. (With a 2-0 loss Saturday to Sevilla, Mallorca enters Sunday — the final match day before La Liga’s holiday break — 17th in the 20-team league — just a point out of the relegation zone.)

“We found a niche in the market: a lot of upside that wasn’t too expensive,” Nash said. “American owners are like, ‘Wow, there’s this place over there where we can make a ton of money using practices we’re learned here.’ ”

Added: Holden: “There’s no secret. We invested in Spanish soccer because you see an opportunity to increase the value of your investment. But also to do it in the right way … with a sustainable long-term plan, and that’s what’s been the most effective thing for our group.

“And having a North American ownership group is part of it.”