High Court Rejects Pleas in Waste Case : Bankruptcy Laws Can Be Used to Avoid Cost of Cleanup Orders

WASHINGTON — The Supreme Court, rejecting pleas from the Reagan Administration and 31 states, ruled Wednesday that, in some cases, industrial polluters can use federal bankruptcy laws to avoid the cost of hazardous-waste cleanup orders.

The justices unanimously said that firms may escape such costs when they go into bankruptcy after losing control of their business to a state-appointed receiver.

But the court, stressing the narrow scope of its ruling, left open the question of whether such firms would be liable if they went into bankruptcy before they lost control of their assets. And the justices also emphasized that states are still free to prosecute environmental law violators--and impose fines, injunctions or criminal contempt proceedings to curb industrial pollution.

Nonetheless, the decision came as a setback to attorneys for the Administration and dozens of states, including California, that had filed briefs urging the justices to overturn a lower-court ruling that allowed polluters to avoid cleanup costs by invoking the bankruptcy laws.

‘Grave Consequences’ Lawyers for the Council of State Governments and other groups, for example, called the ruling a “blueprint” for evading environmental laws.

The Justice Department, pointing to the thousands of hazardous dump sites across the nation and the limited government funds available for cleanup, warned that any ruling that excused those responsible could have “grave consequences.”

Reaction to Wednesday’s ruling was mixed. Lawrence R. Velvel, a lawyer representing the council, said the decision “cannot help but encourage” polluters to use bankruptcy laws to escape environmental laws.

“Fines and other monetary penalties are a pittance compared to the cost of cleanups, which can run into millions of dollars,” he said.

But E. Dennis Muchnicki, an Ohio assistant attorney general who argued the states’ case before the court, said the ruling “on the balance” was favorable, noting that the court reiterated the availability of other legal weapons against polluters.

“It would be nice to have 100% of our options,” he said. “But we still have 80%.”

In the case before the court (Ohio vs. Kovacs, 83-1020), Ohio authorities brought suit in 1976 against Chem-Dyne Corp. and William Lee Kovacs, its chief executive and only stockholder, charging that the company’s hazardous-waste site was causing water pollution.

An injunction was issued requiring the firm to clean up the site. Later, the state charged that Kovacs was failing to comply--and obtained the appointment of a receiver to take over the firm and clean up the site.

Before the job was completed, Kovacs filed for personal bankruptcy and, when the state sought to make him pay for the work, he successfully convinced a series of lower courts that he no longer was responsible for the costs.

The Supreme Court, in an opinion by Justice Byron R. White, upheld Kovacs, although the justices conceded that the firm originally had been obliged under the injunction to clean up the site. But when the state chose to obtain a receiver rather than to bring contempt proceedings, it effectively removed Kovacs from control over the site and took away the assets that he might have used for the cleanup, they said.

The cleanup order, White said, had been converted into an obligation to pay money--as a “debt” or “liability”--that under the language of the law was nullified when Kovacs went into bankruptcy.

In other actions Wednesday, the court:

- Held unanimously that taxpayers cannot avoid late-payment penalties by blaming their lawyers, accountants or other agents for late filings. “It requires no special training or effort to ascertain a deadline and make sure that it is met,” Chief Justice Warren E. Burger wrote for the court. “The failure to make a timely filing of a tax return is not excused by the taxpayer’s reliance on an agent, and such reliance is not a ‘reasonable cause’ for late filing.”

The court, reversing a ruling by the U.S. 7th Circuit Court of Appeals in Chicago, upheld a penalty of $18,451.01 imposed on Robert W. Boyle of Tremont, Ill., for missing the deadline for filing a federal tax return on the estate of his late mother by three months. Boyle, a businessman and executor of his mother’s will, said he had turned over all information to an attorney, who, through a clerical oversight, neglected to file the return in time.

The appellate court ruled for Boyle, saying there was no evidence that he intended to miss the deadline. The government appealed to the Supreme Court, saying that the proper course was for the Internal Revenue Service to collect the penalty from the taxpayer and let the taxpayer seek reimbursement from the attorney for negligence. The government, citing the importance of the case, noted that more than 200 similar cases, involving more than $2 million, were pending--and that upholding the appeals court could encourage the thousands of taxpayers to try to shift the blame to those they employ to do their returns (U.S. vs. Boyle, 83-1266).

- Ruled unanimously that states may impose cutbacks in Medicaid hospitalization benefits, even if the impact is more severe on the handicapped than on others. The justices said that Tennessee officials did not violate provisions of the Rehabilitation Act of 1973, which bars discrimination against the handicapped, when they reduced hospital coverage for Medicaid patients from 20 to 14 days per year in an effort to cut costs.

The state’s action was challenged on the grounds that it would have a disproportionate impact: In 1980, 27% of all handicapped patients using Medicaid required more than 14 days of hospital care, compared to only 8% of the non-handicapped.

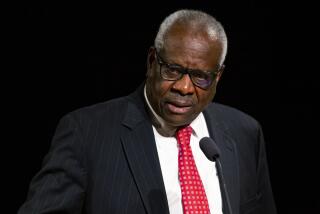

The court, in an opinion by Justice Thurgood Marshall, said that while the law requires equal access to benefits for handicapped, it did not require equal results.

“The state has made the same benefit--14 days’ coverage--equally accessible to both handicapped and non-handicapped persons,” Marshall said, “and the state is not required . . . to provide them with more coverage than the non-handicapped.” (Alexander vs. Choate, 83-727).

- Made it easier for federal investigators to check on individual taxpayers who participate in tax shelters.

The high court, in a 9-0 vote, allowed IRS agents to get information about taxpayers from companies promoting the tax shelters without first having to go to court.