Carter Hawley’s Rescuer Likes Fixer-Uppers

Sam Zell has spent the past year with $1 billion in his pocket, searching for troubled companies that need cash. But it took Carter Hawley to finally lure Zell into spending some of that cash.

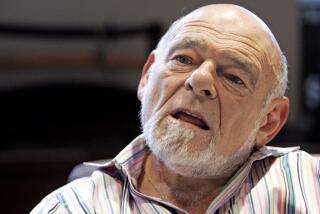

Zell, 49, is legendary for buying low and selling high, especially real estate. The Chicago-based investor, known for an unconventional approach that extends to business clothing (he favors sweat shirts instead of suits), roamed all over the Sun Belt in the ‘70s snapping up distressed real estate from desperate sellers.

After creating a huge real estate empire of offices, apartments and stores, Zell began buying operating companies in 1982. He has built Itel, a major lessor of rail cars, into a $2-billion business today, from $100 million in sales in 1985. Itel itself has become a big investor in such firms as railroad Santa Fe Pacific and its real estate spinoff, Catellus Development.

Last year, Zell canvassed big investors to join a new fund that would pump cash into troubled companies with a good chance of recovering. Zell attracted $1 billion from eager investors but hadn’t put a dime of the money to work until he found Carter Hawley.

In a May interview with The Times, Zell’s partner David Schulte said he and Zell had identified “a ton of (distressed) situations.” But once negotiations began, Schulte complained, the troubled companies were unwilling to cede to him and Zell the level of control that the partners felt was necessary.

It’s assumed on Wall Street that Zell’s investment savvy has kept him patient--that he wouldn’t do a mediocre deal for its own sake. But other factors also sidelined him.

In June, 1990, his longtime partner, Robert Lurie, died of cancer. Lurie and Zell had been college frat brothers and had jointly built their empire, which Forbes magazine values at $900 million.

He also has had to contend with losses at Itel and with the 1990 launch of Catellus, which owns 1.5 million undeveloped acres of land mostly in California, including the huge Mission Bay development planned for San Francisco.

It’s Zell’s real estate expertise--and the chance for melding Carter Hawley’s retailing franchise with new California developments--that is believed to have attracted Zell to the bankrupt store chain.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.