Recession Has Some Businesses Booming : Economy: The slowdown means more customers for thrift shops, temporary agencies, employment services and auction houses.

Deep into the gloom of a 13-month-old recession, a few lights shine brightly in Ventura County.

Some area businesses are not just surviving hard times, but thriving.

For the record:

12:00 a.m. Aug. 21, 1991 For the Record

Los Angeles Times Wednesday August 21, 1991 Ventura County Edition Metro Part B Page 4 Column 3 Zones Desk 1 inches; 31 words Type of Material: Correction

Credit counseling fees--An Aug. 12 article incorrectly reported the fees charged by Consumer Credit Counseling Services for its debt-handling service. The nonprofit agency charges a maximum of $10 a month to its clients.

Amid the failing banks, listless car dealerships and struggling real estate firms, a few enterprises are flourishing, including thrift shops, temporary agencies, employment services and auction houses.

These businesses are drawing healthy profits from two sources: the thriftiness of those who have money and the needs of those who don’t.

“Recessionary times bring on different things for different people,” said Prof. Brian van der Westhuizen, a professor of marketing at Cal State Northridge. “When people have less disposable income, (they) look at maximizing the little bit of their income they can spend.”

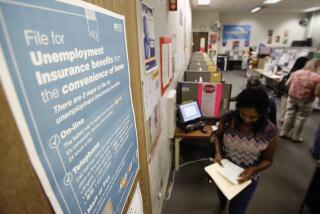

Some laid-off workers spend their savings hunting for work with businesses such as California Job Search in Thousand Oaks.

“I meet both people that are employed and unemployed,” said Peter H. Wolf, the company’s president. “The people that are unemployed are really worried. . . . They’re very scared and they just don’t know where to look.”

Wolf’s company keeps a computer bank of information on some 10,000 Southern California companies. The firm charges $20 to write a cover letter, plus $2.25 per letter to mail one to each company chosen by his customers.

The company also remakes resumes for $100. So, for $345, a job applicant can have his or her work history and goals sent out to 100 potential employers, Wolf said.

“I’ve had a significant increase” in customers during the past year, Wolf said. “The number of people I see has probably increased eightfold.”

Wolf said about 60% of his customers are unemployed. “But I would say 80% to 90% of my applicants find a job within a few days to several months,” Wolf said. “And there’s one interesting thing: Every time there seems to be some news that the recession is stopping, I get a spurt of new applicants, because I think a lot of people out there are just waiting to leave their jobs.”

Agencies that provide temporary workers suffered a deep decline in business last winter. But, their owners say, they are rebounding now that the companies that contract with them are beginning to recover from the recession’s initial blow.

“Some of our clients have gone through layoffs in the first part of the year,” said Blair Aitken, office manager of Select Temporary Services in Ventura. “When they’re gearing up again for some of these positions, they’re coming to us.”

The company is in stiff competition with other temporary services, but it is enjoying modest profits, Aitken said.

Aitken said he, too, hears hard-luck stories, particularly from people seeking temporary jobs to cover the bills until a permanent job arises.

“Maybe in the last few years they haven’t had any problems going from one job to another, and they find themselves out of work for a time, and I think it has a dramatic impact on them.”

In a lackluster economy, the demise of some businesses nourishes others.

Auction houses, for example, are busier than ever as company failures supplement their steady diet of estate sales.

“We’re busy as hell,” said Tom Needels, co-owner of J & J Auction Co. in Ventura, which bills itself as “Ventura County’s Largest Auction House.”

“It’s just been more of everything on all fronts,” Needels said. “Especially now, there’s a little rush with the end of the fiscal year, the first of July. There seemed to be a lot of people who had businesses who had problems, or they’re selling things to get funds together.”

Needels and his wife and partner, Shirley, hold auctions twice monthly at a rented hall, which must be booked months in advance. On each auction night, they sell up to 500 lots, ranging from business equipment to personal belongings.

Tom Needels said they have so many requests that they could increase their business by up to 50% if only they had the room.

Needels said he often auctions off material for people with little marketplace experience who used home equity loans to start small businesses.

“There they are with a business that’s failing, and they want out,” he said. “That happens more and more frequently. With others, the businesses fail and, rather than face the landlord, they play games and before you know it they’re locked out and we’re called in to sell everything.”

Business in home equity loans has been brisk during the recession, said Bill McAleer, chairman of the Ventura County National Bank in Oxnard.

“People are basically using their house as collateral to get a relatively low rate, compared to credit cards,” McAleer said. “We had such a rush of that two years ago that any volume after that pales by comparison.”

Those who go too far into debt often need help to get out--providing a boon to credit counselors.

“We always have people coming in the door,” said Diane Gentile, education director for Consumer Credit Counseling Service of Ventura County Inc. The nonprofit service has 1,100 customers in Ventura County this month and charges the badly indebted a fee equal to 6.5% of their debt, Gentile said.

For that, the service intervenes with creditors to set up manageable payment plans and helps debtors rein in their spending on credit.

“We freeze their credit, totally freeze it while they’re on the program,” Gentile said. “They have to promise they’re not going to charge anymore. I have them cut up their credit cards, then we send those credit cards to the creditor with a proposal letter asking them to accept” the payment plan.

Gentile said many of her clients got into debt by spending their overtime pay instead of saving it. “They should have been saving it, but they were using it to up their standard of living. When the overtime stops, they can’t make their payments,” she said.

The recession has forced people to spend less, said Cal State Northridge’s Van der Westhuizen.

“People tend to spend on the necessities first,” he said. “As the level of income declines, a greater portion will go to staples--groceries, foodstuff, housing and, to some extent, clothing.”

Business at Ventura County supermarkets has been steady throughout the recession, and even increased in some cases.

“People need to eat, even in a recession,” said Vicky Sanders, a spokeswoman for the Vons supermarkets chain.

Second-quarter earnings for the chain were up 2.4% over last year, Sanders said.

Families who cannot afford vacations because of the recession are turning to barbecues and picnics for relaxation, she said.

“You may be able to go without a blouse or a TV or a new pair of shoes, but you still need groceries. I think that accounts for a lot of . . . why we’re busy,” she said.

Some area residents who cannot go without a new blouse or a new pair of shoes are turning up at thrift shops instead of the usual boutiques and department stores.

Thrift shops in Ventura County report a dramatic surge in business over the past year.

“Ours has increased, probably in the last six months, about 20%,” said Shirley Jones of the Association for Retarded Citizens--Ventura County Inc., which runs thrift stores in Ventura and Oxnard.

“I think we see a few more people that we didn’t before, people that are upper-middle class,” Jones said. “They’re just trying to make their money go further. They’re afraid to spend, trying to curtail their spending just in case it (the recession) gets worse.”

Valerie Bowman, manager of the American Cancer Society Discovery Shop in Ventura, said she has seen an increase in customers searching for good, inexpensive work clothes.

“I think they are looking at ways not to spend so much money,” she said. “The way we price things on clothing, it’s one-quarter of the price of new clothes, with 70% of the wear still in it. We attract even career people who need to wear nice things to work, but they don’t want to spend $100 on an outfit when they can get it here for $25.”

Ventura County residents who do buy new clothes off the rack may be choosing less expensive racks, said A. J. Sobczak, a lecturer in economics at Cal State Northridge.

Jeff Bick, manager of the K mart store in Camarillo, agreed that the recession has changed the county’s shopping habits.

“Some of the people shopping at your higher-priced stores . . . find they can buy the same name-brand items carried here at much cheaper prices,” he said.

Bick noted that while business at his store is steady, he is losing some of his poorer customers while gaining richer ones.

The economists, Van der Westhuizen and Sobczak, agreed that there is one type of business that definitely thrives during a recession.

“What some people rather cynically refer to as . . . the beneficiaries of the recession--people who do better due to the misfortune of others: the legal profession,” said Van der Westhuizen.

“Any time you get into economic stress, you’re going to have more people declaring bankruptcy,” said attorney Bartley S. Bleuel, president of the Ventura County Bar Assn. “And that means there’s going to be more business for bankruptcy attorneys.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.