Ovitz, 6 Others Settle Conflict of Interest Suits

Creative Artists Agency Chairman Michael Ovitz and six other pension plan trustees on Friday settled three Labor Department lawsuits accusing them of conflict of interest.

The trustees were accused of investing money from three pension funds they control into Toluca Investments Inc., a limited partnership set up by Ovitz and others to buy an undeveloped piece of land in downtown Los Angeles.

The trustees gradually began putting their own money into the partnership, which was returned as interest payments to their companies’ pension funds, according to the government.

A routine Labor Department audit turned up the transaction in 1988. The government said the partnership violated prohibitions on trustees transferring plan assets for their own benefit, acting on behalf of parties whose interests are adverse to the plan and dealing with plan assets in their own behalf.

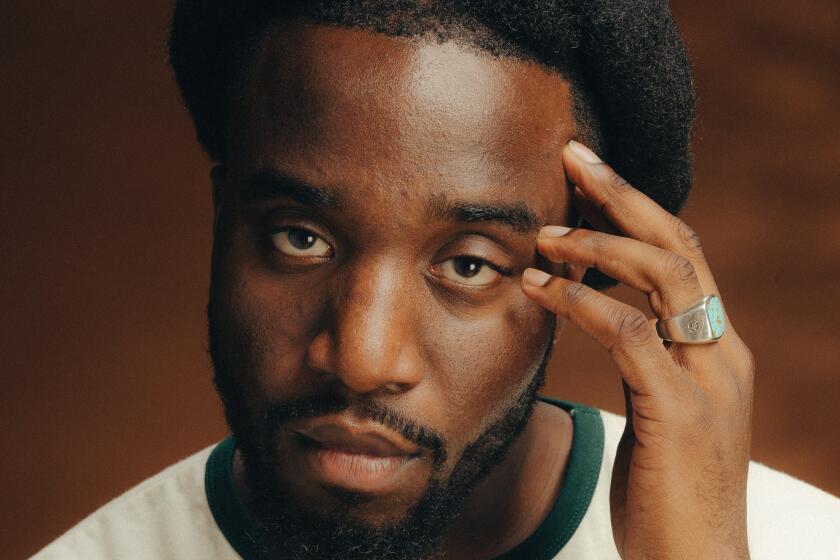

Ovitz is sometimes referred to as the most powerful man in the entertainment industry. His clients include actors Kevin Costner and Dustin Hoffman, and he counsels Hollywood’s top moguls.

In addition to Ovitz, the CAA trustees named in the case were Chief Financial Officer Robert Goldman and founding partner William Haber.

According to the consent judgment settling the Labor Department’s suits, Ovitz, Goldman, Haber and the four others received a total of $546,452 from the funds in the settlement--the amount they had invested plus interest.

The CAA officials said their outside attorney, an expert in pension law, had tailored the deal to conform to the law.

The other defendants were Leonard Marmor, a physician who was a trustee of his own medical corporation’s pension plan; and Arthur Laub, David Gordon and Deborah Laub Crink, trustees of a profit sharing plan for costume jeweler Carole Accessories Inc.

CAA’s pension fund invested $1,249,000 in the project. The Marmor plan initially put $551,000 into Toluca Investors. Carole Accessories invested $700,000 of its plan’s assets.

Ovitz and the other trustees of the plans will continue to manage the real estate partnership but no longer stand to profit personally from it.

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.