GM Sets Record With 1992 Loss of $23.5 Billion : Autos: Charges for future retiree health benefits were blamed. Overall, the No. 1 car maker showed improved operating results.

DETROIT — Despite posting a $23.5-billion loss for 1992--the largest ever by a U.S. company--General Motors said Thursday that its operating results improved greatly as its cost-reduction plan began taking hold.

The massive loss, which amounted to $38.28 a share, was largely attributable to charges of $22.2 billion for future retiree health benefits.

The report follows a week of turmoil in which the nation’s biggest auto maker was slapped with a $105.2-million court judgment for negligence in an auto-safety case, won a defamation suit against NBC News for rigging a crash test and backed away from a major dumping case against the Japanese.

None of that could minimize the size of the deficit, which compared to a loss of $4.5 billion, or $7.97 a share, in 1991. GM lost $651.8 million, or $1.25 a share, in the fourth quarter, compared to a loss of $2.5 billion, or $4.25 per share, in the same period a year earlier.

Without the charges, the company said it would have earned $92 million for all of last year and $273 million in the final three months of the year.

GM’s North American automobile operations continued to bleed red ink, but the losses narrowed to $4.5 billion in 1992 from $7.9 billion in 1991.

Company officials described GM as being in the midst of a turnaround. And like their rivals at No. 2 car maker Ford, they speculated that the firm might break even in North America this year.

“We think the trend is good,” said G. Richard Wagoner Jr., executive vice president and chief financial officer. “No miracles, but we think there is good steady tracking in the right direction.”

Huge losses in the United States, Canada and Mexico prompted the firm last year to undertake a major restructuring, laying plans to shutter 23 plants and eliminate 74,000 jobs by the mid-1990s. It also led to the resignation in October of Chairman Robert C. Stempel.

Analysts said John F. Smith Jr., GM’s chief executive and president, appears to be getting the company back on track.

“The operating results were better than my expectations--and better than the expectations of most of Wall Street,” said John Casesa, an analyst for Wertheim Schroder in New York.

Investors apparently agreed, pushing GM shares up $1.25 to close at $40.50 in New York Stock Exchange trading.

David M. Garrity, an analyst with McDonald & Co. Investments, said he was encouraged by GM’s improved operating margins. The auto maker said its gross margin--the spread between the selling price of a vehicle and the cost of producing it--was 12.9%, up 2.4 percentage points for the year.

The company said the improvement came even as vehicle sales lagged. GM revenue totaled $132.4 billion, up from $123 billion in 1991. But Wagoner attributed the gain to slightly higher prices, an easing of sales incentives and the impact of the firm’s cost-reduction program.

GM’s share of the U.S. vehicle market was 33.9%, down from 34.8% a year earlier.

The firm’s loss broke a record set just the day before by Ford, which posted a loss of $7.4 billion in 1992 as it too accounted for future retiree benefit costs. Under new federal standards, all major companies must account for those future liabilities as they are incurred--not when they are paid out to retirees.

Chrysler, which reported net earnings of $723 million last year, has not yet taken a charge for those costs.

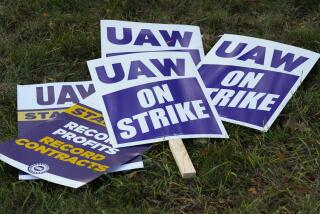

The company is working closely with the United Auto Workers on the health care issue. Smith held an unusual meeting Thursday with leaders of UAW locals, explaining in detail the company’s financial condition.

Relations between the UAW and GM have long been rancorous, and the gathering was seen as an attempt by Smith to set a moderate cooperative tone as the company approaches contract talks later this year.

Despite the upbeat tone of GM officials, there are still some trouble spots.

The company noted that its European operations are under pressure because of economic problems in Germany and Britain. It also noted that its unfunded pension obligations--future retirement benefits for which it has not set aside reserves--increased $7 billion to $12 billion in 1992.

Meanwhile, the company continued to bask in its stunning victory over NBC. A little more than a day after NBC admitted misrepresenting crash tests in a broadcast report on GM’s 1973-1987 full-size pickups, GM rescinded its decision to pull advertising from the news programs of ABC, CBS and NBC.