Union Pacific CEO Takes Leave for Alcohol Rehab : Railroads: Drew Lewis’ startling departure comes as company boosts bid for rival Santa Fe to nearly $3.8 billion.

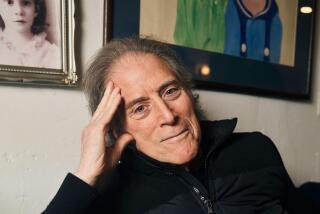

Union Pacific Corp. said Sunday that Chairman and Chief Executive Drew Lewis, a former Secretary of Transportation and architect of the company’s recent bid for rival Santa Fe Pacific Corp., is taking a leave of absence to enter an alcohol-treatment program.

The startling disclosure came as Union Pacific increased its bid for Santa Fe to nearly $3.8 billion, topping a $3.2-billion offer from Burlington Northern. A Santa Fe Pacific spokesman said the board of the Schaumburg, Ill.-based railroad , which originally agreed to a friendly, $2.5-billion merger with Burlington Northern in July, would “consider” the revised Union Pacific proposal.

Union Pacific said Lewis, who will turn 63 on Thursday, is expected to return to the helm of the nation’s largest railroad in four to six weeks.

“That’s what we hope,” Union Pacific spokesman Tim Hartman said. “We certainly hope that the treatment is successful.”

Lewis entered “a highly respected facility” last Monday, Hartman said, adding that Lewis and his family have requested that no additional information be released.

Union Pacific’s revelation, which came in the middle of a detailed news release on the new offer for Santa Fe, highlights a murky area in corporate communications: No government regulations specifically address the issue of CEO illness. Securities and Exchange Commission and New York Stock Exchange rules vaguely direct public companies to reveal any information deemed “material.”

Many chief executives consider their health to be nobody’s business.

MCI Communications, for example, took two weeks to disclose the 1987 heart transplant of then Chief Executive William G. McGowan. That was the first public inkling that McGowan was not well, even though he had suffered a heart attack in December, 1986. McGowan’s illness forced him to give up the daily stewardship of MCI in late 1991, and he died the following year.

Washington-based transportation consultant Robert L. Banks, who has been following the railroad takeover battle, called Union Pacific’s exposure of its top executive’s drinking problem “unusual. There’s no doubt about it.”

But the public auction that Union Pacific forced is unlikely to cool in Lewis’ absence, Banks said. “Union Pacific would like to keep the status quo because it is the top dog. I think their motives are fairly transparent,” Banks said.

Both sides have predicted troubles for their opponents with the Interstate Commerce Commission, which must approve all rail mergers.

Union Pacific’s latest offer is to exchange 0.407 share of its stock for each share of Santa Fe Pacific stock. The offer is worth about $20 per share based on the New York Stock Exchange Friday closing price of $49.125 per share for Union Pacific. Under Burlington Northern’s last offer, Santa Fe shareholders would get about $17.21 per share based on Friday’s closing price of Burlington Northern. Union Pacific said it would consider including cash in the deal, but offered no details.

Lewis, who joined Union Pacific in 1986 and became chairman and chief executive in 1987, had built a reputation as a millionaire corporate turnaround specialist. He served as secretary of transportation under Ronald Reagan from 1981 to 1983, and his tasks included breaking the notorious air traffic controllers strike with the firing, in 1981, of thousands of controllers who refused to return to work.

Lewis returned to the private sector as chairman and chief executive of Warner Amex Cable Communications, then the nation’s sixth-largest cable systems operator. He was credited with helping to restore the New York company to financial health during his three years there.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.