Time Warner - Turner Talks : HOLLYWOOD’S EARTHQUAKE : Merger Frenzy: The Time Is Extra Right

These are supposed to be the somnolent dog days of summer, but tell that to the busy Hollywood and Wall Street deal makers hoping to put together yet another blockbuster union, this time between Time Warner Inc. and Turner Broadcasting System Inc.

“This is a wild-ass August,” said Bishop Cheen, a senior analyst with Paul Kagan Associates, a media research firm in Carmel. “And there’s probably some more to come.”

What’s behind this summer’s feeding frenzy, triggered by Walt Disney Co.’s $19-billion play for Capital Cities/ABC Inc.? Plenty.

The big fish devouring their smaller counterparts in true Darwinian fashion are taking advantage of an unusual convergence of forces: a friendly political and regulatory atmosphere in Washington, the growing global appetite for entertainment, the long bull market on Wall Street and the coming-of-age of sophisticated technologies that make it possible to distribute content worldwide in new, less expensive ways.

“The whole thing driving this is the worldwide demand for content, shelf space and distribution,” said Raymond T. Bennett, a Woodland Hills attorney whose clients include Turner Broadcasting. He called this summer’s hypercharged deals “the biggest change in the industry since sound movies.”

That might be hyperbole, but the shifts are indeed dramatic. The proposed mergers--including Disney and ABC, Westinghouse Electric Corp. and CBS Inc., Barry Diller’s purchase of TV station owner Silver King Communications, and now Time Warner and Turner--would pave the way for an industry of vertically integrated powerhouses with extensive control over both the content and distribution of programming.

“This is a cataclysmic summer, a watershed,” said Harold Vogel, an investment analyst with Cowen & Co. in New York.

The most important factor in precipitating this dramatic consolidation in the entertainment industry might be the laissez-faire attitude toward big business that now prevails in Washington. Changes in the regulations governing networks and telecommunications companies--some already implemented, others imminent--are making such deals ever more attractive.

In particular, the Federal Communications Commission has been persuaded by network lobbyists not to renew the so-called fin/syn rules, set to expire Nov. 1.

Under those 25-year-old regulations, networks were prohibited from having a financial interest in the programs they aired or from profiting on the rerunning of those programs in syndication--which meant, in practical terms, that movie studios could not own television networks.

Without those rules in place, networks and studios are eager to join forces, a la Disney’s proposed purchase of Cap Cities. Such integrated companies can fully control both the production and distribution of movies and TV programs.

Moreover, telecommunications reform is expected to encourage large broadcasting companies to grow even bigger.

Current rules dictate that a single company’s television stations may reach no more than 25% of the nationwide viewing audience. Proposed laws would raise that to 30% or 35%. The prospect of that change was instrumental in encouraging Westinghouse to bid for CBS. If that deal goes through, Westinghouse would own 15 stations reaching just under a third of potential viewers.

Congress is also expected to abolish limits on the prices cable companies can charge subscribers, making the economics of a deal such as Time Warner and Turner--with their hefty combined cable ventures--very appealing.

This rush to deregulate signals Washington’s acknowledgment that it simply can’t keep up with the pace of change in entertainment and telecommunications, industry observers said.

“It is a colossal shrug of the government’s shoulders,” said Peter Dekom, a prominent entertainment lawyer in Los Angeles. It’s as if, he said, regulators and lawmakers are saying: “We can’t handle this. There’s too much change. Let’s leave it alone.”

Companies might also figure that today’s favorable climate cannot last. If the pendulum can swing away from regulation, it could also swing back. Some players probably have the notion that “once you get under the tent, you’re safe,” said Everette Dennis, executive director of the Freedom Forum Media Studies Center at Columbia University.

And in the wake of the Disney-Cap Cities agreement, there is a fear among many media companies that worthwhile assets won’t stay around for long. Industry watchers are already speculating about what the next mega-deal might be, with the smart money on Rupert Murdoch’s News Corp. and Viacom Inc., owner of MTV and Paramount, as prospective buyers.

“The problem is there are only so many great properties available,” said Michael Wolf of Booz Allen & Hamilton, a consulting firm. The Disney deal set off a chain reaction among paranoid companies afraid of being devoured.

“If the competition gets bigger, you need to get bigger,” Cheen said.

And basic corporate finance has played a big role in all the tumult. The long run-up in the stock prices of many entertainment companies has made it relatively easy to fund big stock-swap transactions.

Despite the cloud of excitement that seems to hover over the entertainment business, moreover, the fact remains that these businesses face shrinking margins and ever more frenzied competition. Teaming up to gain a wider range of revenue streams can help ease that problem, Wolf said.

“The Viacom-Paramount merger,” he added, “proved that such deals could be successful.”

*

Times special correspondent Karen Kaplan contributed to this report.

*

More Media Coverage:

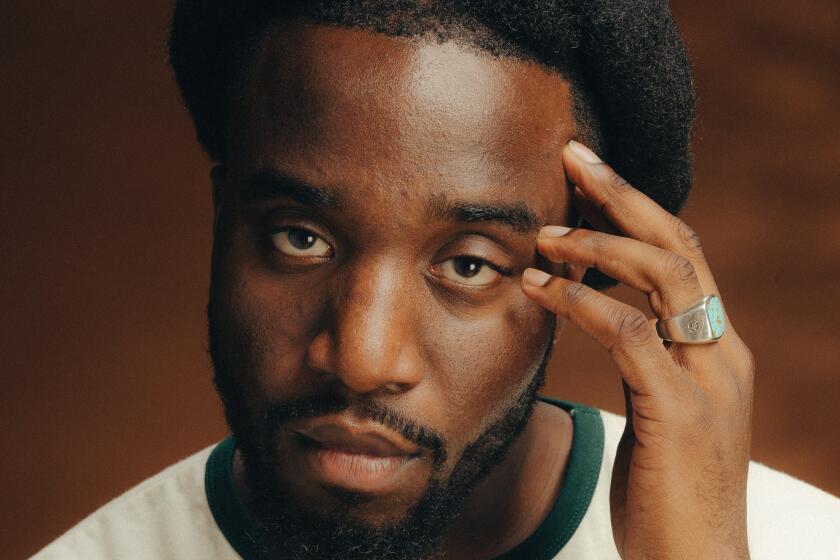

* Ted Turner: Man of surprises. A1

* Spotlight on Time Warner’s Gerald Levin and Tele-Communications Inc.’s John Malone. D4

* What the deal would mean for Time Warner shareholders. D4

* The role of Hollywood studios is lost amid deal mania. D5

* Officials say merger would raise few legal eyebrows. D5

* Each firm’s major holdings. D5

More to Read

The biggest entertainment stories

Get our big stories about Hollywood, film, television, music, arts, culture and more right in your inbox as soon as they publish.

You may occasionally receive promotional content from the Los Angeles Times.