Quattrone to Testify in Own Defense

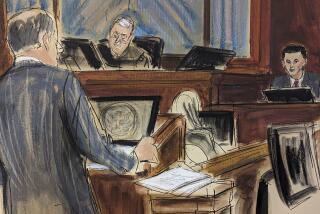

NEW YORK — Fallen Silicon Valley investment banker Frank Quattrone will testify in his own defense at his obstruction-of-justice trial, his lawyer announced Tuesday as the prosecution and defense teams laid out their strategies in opening arguments.

The decision to have Quattrone testify, and especially to announce it early in the case, surprised observers, who described it as a carefully calculated plan to show jurors that Quattrone has nothing to hide and to deliver a blunt message to prosecutors that the defense feels confident.

“You will get to know him as a man; you will get to know him as a person,” Quattrone’s attorney, John Keker, told the jury of six men and six women.

It is “extremely rare” in opening arguments for defendants to commit to testifying, said George B. Newhouse Jr., a partner at Thelen Reid & Priest in Los Angeles.

It’s risky for defendants to take the stand because they could come across badly in cross-examination by prosecutors, experts said.

Defendants don’t have to announce ahead of time whether they’ll testify. Doing so gives government lawyers time to prepare, experts say.

Nonetheless, the announcement was meant to send a clear signal.

“For Keker to say it in his opening statement is to try to knock out your opponent in the first round,” Newhouse said.

Quattrone is accused of impeding government investigations into how his former firm, Wall Street investment bank Credit Suisse First Boston, allocated shares of initial public stock offerings to clients.

The case centers on an e-mail Quattrone wrote that encouraged his staff to follow another investment banker’s suggestion to clean up their files. Prosecutors say that was a thinly veiled attempt to force underlings to destroy documents that could have hurt Quattrone.

In his opening statement, government lawyer Steven Peikin sought to portray Quattrone as a powerful and successful Wall Street executive who had a lot to lose if the government investigations turned up wrongdoing. The probes “threatened his business, threatened his reputation and threatened his livelihood,” Peikin said.

At the time he sent his e-mail, Quattrone was well aware that three separate probes were underway and that he should not order the purging of documents, Peikin emphasized, saying several times that Quattrone was notified about the probes immediately after the firm was contacted by investigators.

Keker said Quattrone, who was the head of technology-sector investment banking, was not responsible for IPO allocations and never thought his e-mail would result in the destruction of documents needed in the probes.

He said Quattrone sent his message because his unit in the past had been criticized by CSFB officials for not following the company’s document-retention policy, which calls for the destruction of certain documents.

In his comments, Peikin seemed to acknowledge that Quattrone’s investment-banking unit did not oversee the distribution of stock offerings.

That point was cemented later by the prosecution’s first witness, Jeffrey Bunzel, a managing director in CSFB’s equity capital markets group, who said that his unit normally set allocations and that “with a few exceptions” investment banking was not involved.

For the second straight day, Quattrone wore slacks and a sport coat rather than a suit, dressing Tuesday in black pants, a dark gray jacket and a tie.

Opening arguments began after the morning was spent finalizing jury selection. The jury includes a Federal Reserve official, an administrative assistant at a hedge fund, a retired architect, a retired secretary and a hotel banquet server.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.