Column: Herman Cain, Trump’s next pick for the Fed, embraces the stupidest idea in economic policy

Economic policy experts rolled their eyes at President Trump’s last reported nominee for the Federal Reserve Board, Stephen Moore, a right-wing ideologue with an almost unblemished record of getting his facts and economics wrong.

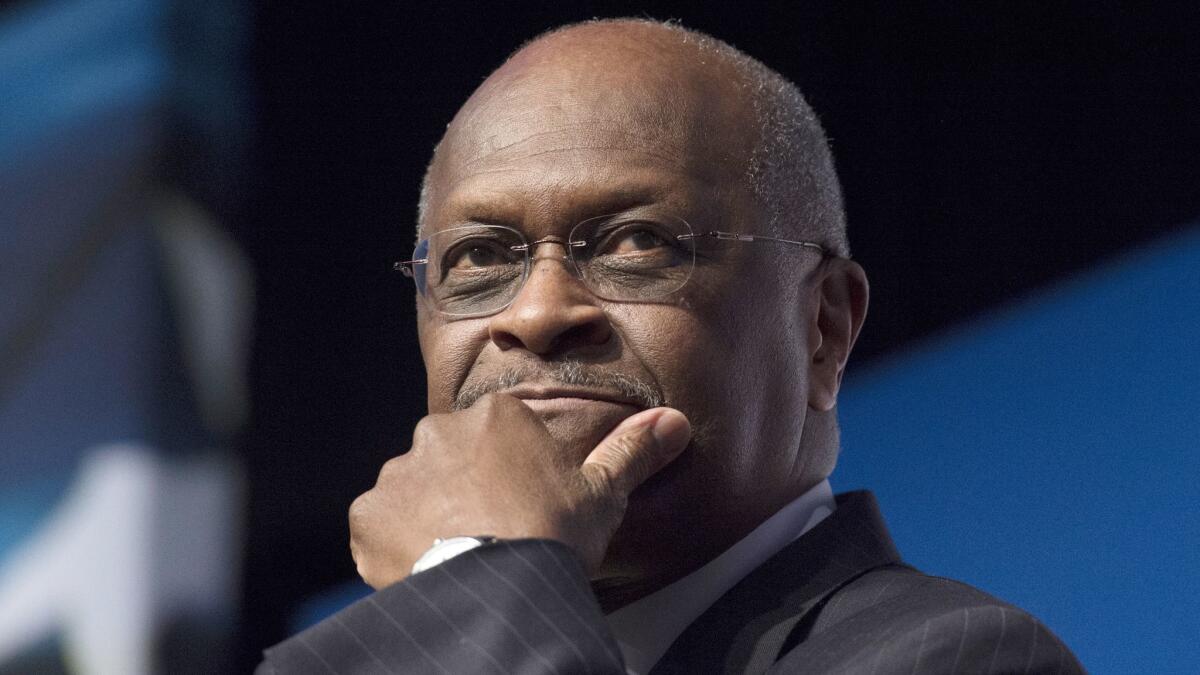

But news of Trump’s choice for a second vacancy on the seven-member board has them distinctly nervous. It’s Herman Cain, a former pizza chain executive best known for staging a clownish campaign for the 2012 Republican nomination for president (he dropped out after accusations of sexual harassment surfaced).

What makes economists so wary about Cain is his advocacy of one of the dumbest ideas on the monetary landscape — a return to the gold standard. Cain spoke up for the gold standard in a notorious May 2012 op-ed in the Wall Street Journal and in a book published around the same time. More on this in a moment.

On the surface, Cain’s qualifications to serve on the Fed board aren’t all that unorthodox. He was a business leader, after all, and his supporters note that he served on the board of the Federal Reserve Bank of Kansas City, where he was deputy chairman from 1992 through 1994 and then chairman until August 1996.

The gold standard itself was the principal threat to financial stability and economic prosperity between the wars.

— Barry Eichengreen, UC Berkeley

That sounds fancy, but economist Justin Wolfers of the University of Michigan has put paid to the notion that it was even remotely meaningful. The boards of the regional banks have almost no authority, and no role in setting economic policy. They’re essentially sops to local business types, and largely ceremonial.

“The regional Fed boards really are just there to provide the veneer of democratic legitimacy to an institution that’s not really that democratic,” Wolfers tweeted Thursday, after Cain’s name surfaced. “The board [members] enjoy a free briefing from the regional bank staff, and the staff pretend to listen to the local bigwigs about the economy.”

The one concrete job entrusted to these boards is the appointment of the regional bank’s president, who actually does set policy, but that’s subject to the approval of the Federal Reserve Board in Washington. In any event, the appointment didn’t come up during Cain’s service on the Kansas City board, so he didn’t even do that.

But now let’s examine Cain’s advocacy of a return to the gold standard. This idea periodically percolates to the surface of Republican politics, especially in presidential election years; in the early phase of the 2016 election cycle, it was talked up by Ted Cruz, Rand Paul, Ben Carson, Mike Huckabee and Chris Christie.

Their underlying goal was to rein in the Federal Reserve by depriving it of any freedom in monetary policy — the central bank would be unable to pump money into the economy during downturns or tighten the spigots to moderate booms. That role would be ceded to the magic of the international gold market.

Economists, from one end of the economic spectrum to the other, are virtually unanimous in thinking this a flawed idea. For example, here’s Milton Friedman, the closest thing to a deity in conservative economic policymaking: In his 1962 book “Capitalism and Freedom,” he wrote that an automatic commodity standard such as the gold standard was “not feasible because the mythology and beliefs required to make it effective do not exist.”

Conservative economic commentator James Pethokoukis cited Friedman’s warning in 2015, writing of the GOP candidates’ dalliance with the idea, “I sure hope they’re not serious and this is just campaign season silliness.”

When the University of Chicago asked a panel of 39 expert economists in 2015 whether a gold standard would be “better for the average American,” they were unanimous: No. “Love of the [gold standard] implies macroeconomic illiteracy,” Chicago economist Anil Kashyap added in a side comment.

Cain’s devotion to the gold standard derives from a sheaf of misconceptions about both economic history and its applicability to the modern world. Under the gold standard, he wrote in his op-ed, “economic growth was stronger, unemployment rates lower, the price level more stable, and recessions less frequent and less severe than under the present system.” Tell that to Americans in 1929, during the gold standard era, and keep in mind that one key to the recovery in the 1930s was Franklin Roosevelt’s decision to take America off the gold standard, so it could manage its own economic policy.

Cain added, “gold is kryptonite to big-spending politicians. It is to the moochers and looters in government what sunlight and garlic are to vampires.” That should give you a clue about what’s really at work here. It’s the old story of running an economy strictly for the benefit of the wealthy, who don’t have to suffer from the waves of unemployment that were imposed on the working class in order to keep the macroeconomic world of the gold standard humming along.

The most complete demolition of gold standard mythology comes from Barry Eichengreen of UC Berkeley, whose 1996 book “Golden Fetters” is the bible of the field. Eichengreen observes that the gold standard proved utterly unable to manage international monetary crises in the aftermath of World War I and the onset of the Depression.

Before then, economic policy makers thought of the gold standard as a pillar of stability because they were paying attention only to the welfare of one economic class — creditors, who desired the returns on their assets to be protected from inflation and to take primacy over the interests of every other group.

If the economy of one country ebbed relative to another, preserving the gold standard meant that something else would have to give — laborers thrown out of work or wages brought down. If one sector lagged another — say falling crop prices endowed city dwellers with cheap food but failed to produce enough income to keep farmers solvent — there was no mechanism to bring farm prices into “parity” with industrial returns via inflation.

This was accepted because economic policy makers failed to understand unemployment as a reflection of the entire economy. In the United States, Eichengreen writes, the unemployed “were referred to as out of work, idle, or loafing but rarely as unemployed.” In other words, there was “a tendency to ascribe unemployment to individual failings.”

That viewpoint has reappeared in recent years, especially in such Republican policies as cuts to Social Security or Medicare benefits or the imposition of work requirements on recipients of food stamps or Medicaid. The notion of the “undeserving poor,” morally suspect individuals who need to be goaded to get off their lazy butts, is common in right-wing circles.

Once the notion took root that workers as well as plutocrats were part of the macroeconomy, it became clear, Eichengreen writes, that “the gold standard itself was the principal threat to financial stability and economic prosperity between the wars.”

The constraints the gold standard placed on economic planners was recognized with the advent of the New Deal. Upholding the standard in the teeth of the Depression, observed FDR’s Treasury Secretary Henry Morgenthau, would have meant “a ruinous deflation of our prices, trade, and economic activity.” The Hoover administration, he said pointedly, had stuck to the gold standard even after it was abandoned by Britain and France, “evidently under the impression that that was a proud achievement, when it was obviously economic suicide.”

Even if one could make the case for the gold standard in principle, it’s clear from Eichengreen’s analysis that now would be the worst time to implement it. That’s because its success is dependent on “credibility and cooperation.” The first he defines as “the confidence invested by the public in the government’s commitment to a policy.” The second is the commitment of all states to take whatever steps are necessary to maintain the international regime.

How would that work in the era of Trump? No one can have confidence in his commitment to policy, because he has no discernible policy — except blowing up some of the oldest and most effective arrangements for international cooperation reached in the postwar years. Trump’s nomination of Herman Cain, if it happens, would amount to its own contradiction in terms.

Keep up to date with Michael Hiltzik. Follow @hiltzikm on Twitter, see his Facebook page, or email michael.hiltzik@latimes.com.

Return to Michael Hiltzik’s blog.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.