Fox’s earnings rise despite fallout from sexual harassment scandal

The mounting sexual harassment claims at Fox News that led to the dismissal of Bill O’Reilly and an exodus of advertisers has dominated headlines and cast a shadow over parent company 21st Century Fox.

But the widening controversy, which erupted last summer, so far has done little to dampen the media giant’s earnings growth.

That was apparent Wednesday when 21st Century Fox handily beat earnings expectations for its fiscal third quarter, which ended March 31, though shares of the media conglomerate fell in extended trading Wednesday after the company reported weaker-than-expected revenue.

Fox, based in New York, reported adjusted earnings of 54 cents a share, up 15% from 47 cents in the year-earlier quarter. Revenue was $7.56 billion, up 5%. Analysts polled by FactSet had expected earnings of 48 cents a share on revenue of $7.63 billion.

Fox attributed the profit growth to strength in its cable and TV businesses, both of which saw revenue grow quarter-over-quarter. The company cited particularly strong growth in domestic cable affiliate fees — the portion of subscriber revenue that cable operators pay to content owners. Popular channels include FX, Fox Sports Networks and Fox News.

The latter remains a key profit center for the company, though it has been roiled in recent weeks as leaders faced calls for the dismissal of O’Reilly, the cable channel’s highest-rated anchor. O’Reilly, who was accused of sexual harassment by several former employees and on-air personalities, was fired from Fox News in April.

His firing was followed by the departure of Fox News co-President Bill Shine, who resigned this month over public criticism of how he handled sexual harassment claims against O’Reilly and former Chief Executive Roger Ailes, who left the channel last year.

The cable channel has been shaken by sexual harassment complaints since former anchor Gretchen Carlson filed a lawsuit against Ailes in July. The suit, which was settled for $20 million, led to Ailes’ ouster.

Facing pressure from activists, several advertisers pulled commercials from Fox News’ “The O’Reilly Factor.” Ratings for the time slot have dropped since O’Reilly was replaced by Tucker Carlson, but have remained steady among the 25-to-54 age group coveted by advertisers. Advertisers have also returned.

Fox disclosed in a regulatory filing Wednesday that it has incurred $45 million to settle potential or pending lawsuits since Ailes resigned. Federal investigators also are conducting a probe into whether investors were properly notified about payments made to settle cases against multiple women who’ve accused Fox executives of sexual harassment. Ailes and O’Reilly have denied any wrong doing.

Executives said little about the scandal during a call with analysts Wednesday but expressed continued confidence in the conservative news channel.

“As we’ve said, the channel continues its ratings dominance,” John Nallen, Fox’s chief financial officer, said during the call. “So we’re very confident in the future of that business.”

Analysts weren’t expecting much of an earnings impact from the O’Reilly departure.

“Fox News’s dominance stems from the consistency of its messaging and the loyalty of its broader audience more than from the success of star anchors,” Vijay Jayant, an analyst at Evercore ISI, wrote in a recent research report.

Still, the business impacts could be felt elsewhere. Fallout from the scandal could put Fox’s plan to acquire the European satellite TV service Sky in jeopardy. An attorney representing plaintiffs in sexual harassment and racial discrimination cases has been invited to appear before the Office of Communications, the British regulatory body reviewing the potential deal.

Wendy Walsh, the Los Angeles radio host who was a regular guest on “The O’Reilly Factor” and who has accused O’Reilly of sexual harassment, recently met with British regulators about the Sky deal.

On Wednesday, Fox dismissed speculation that the deal was in trouble.

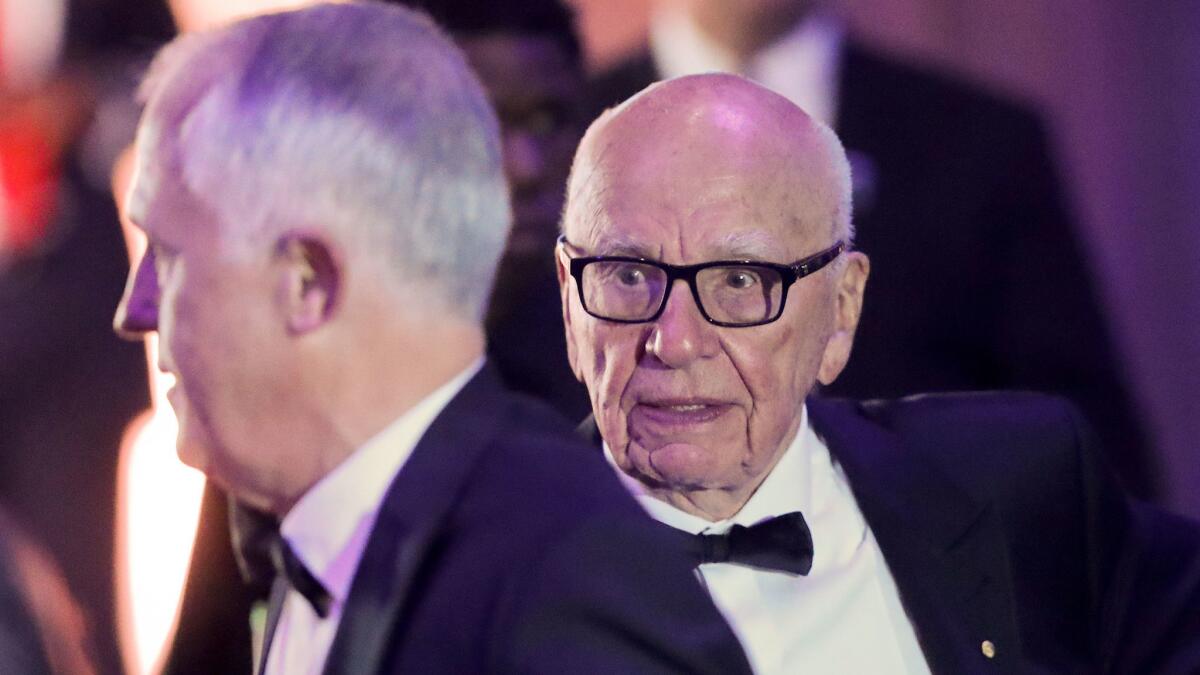

“We remain confident the proposed transaction will be approved by the end of the calendar year following a thorough review process,” Executive Chairmen Rupert and Lachlan Murdoch said in a statement Wednesday.

The acquisition of Sky would help Fox diversify its revenue and mitigate the financial impact of cord cutting, as more cable subscribers ditch their services in favor of streaming options.

Revenue for the quarter was weaker than expected due largely to Fox’s movie division. Although L.A.-based 20th Century Fox had hits with the superhero-themed “Logan” and the drama “Hidden Figures,” it faced tough comparisons to the year-earlier quarter because of the success of the hit movie “Deadpool.”

The division also had a box-office bomb with “A Cure for Wellness,” a psychological horror movie that opened in February and grossed slightly more than $8 million domestically.

Upcoming theatrical releases include “Alien: Covenant” and “War for the Planet of the Apes.”

UPDATES:

4:20 p.m.: This article was updated with additional comments from an investor call.

This article was originally published at 2:20 p.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.