Domino’s Pizza stock is up 5,000% since 2008. Here’s why

Innovating deliveries that include pizza by canoe, drone and robot for one. (Sign up for our free video newsletter here)

As the severe recession took hold in 2008, Domino’s Pizza Inc. was sinking as well.

The pizza delivery chain was under siege for its lousy food and mediocre service. Complaints poured in that a Domino’s pizza crust tasted like cardboard and its tomato sauce like ketchup.

Investors weren’t happy, either; in late 2008, Domino’s stock had fallen to a paltry $3.85 a share. Domino’s even aired television ads acknowledging its problems, a public mea culpa in which the chain promised to do better.

It did.

Under the guidance of Chief Executive J. Patrick Doyle, Domino’s has enjoyed a remarkable resurgence.

That’s mainly because the chain completely overhauled its pizza recipe and rooted out poor franchisees. Domino’s also aggressively embraced digital technology to make ordering more efficient, customer friendly and maybe even cool.

The Ann Arbor, Mich., company’s revenue and profit have surged. Its same-store sales — or sales from stores open at least one year, a key measure of retail performance — have risen in the U.S. market for 24 consecutive quarters, a feat that analyst Brian Bittner of Oppenheimer & Co. recently called “incredible.”

Domino’s, which is almost entirely a franchise operation, also kept expanding worldwide and it recently opened its 14,000th store, in Malaysia.

That’s a lot of pepperoni

The chain delivers more than 1 million pizzas a day and its global sales, including those of franchisees, totaled $10.9 billion last year, nearly double the $5.5 billion it posted in 2008. Its biggest foreign presence? India, with 1,106 stores.

Yet Domino’s notes that in the U.S. market — where it has 5,400 stores, including more than 500 in California — it accounts for only one of every seven or eight pizzas sold daily, and it plans to open roughly 1,000 additional domestic outlets.

Domino’s also is about three-quarters through a years-long project to remodel all of its stores, because 35% to 40% of its sales are still carry-out orders.

The stores “needed a freshening-up,” Doyle said in an interview. “They just didn’t look great,” and the remodels help sell more pies by enabling customers to better see the pizzas being hand-prepared, he said.

It’s all been reflected in Domino’s skyrocketing stock, which closed Friday at $195.28 a share — a fiftyfold increase from late 2008.

One of Domino’s biggest challenges is maintaining that growth. Its stock now trades for a rich 36 times the $5.40 a share it’s expected to earn this year, according to analysts polled by FactSet Research Systems Inc., and any slowdown could hurt the shares.

Nonetheless, “they offer an everyday value and a good quality product and a good experience in ordering and reordering,” said Alexander Slagle, an analyst with the Jefferies investment firm. “The convenience of having it ordered with just a push of a button or two and having it delivered to you is really compelling.”

A big slice of technology

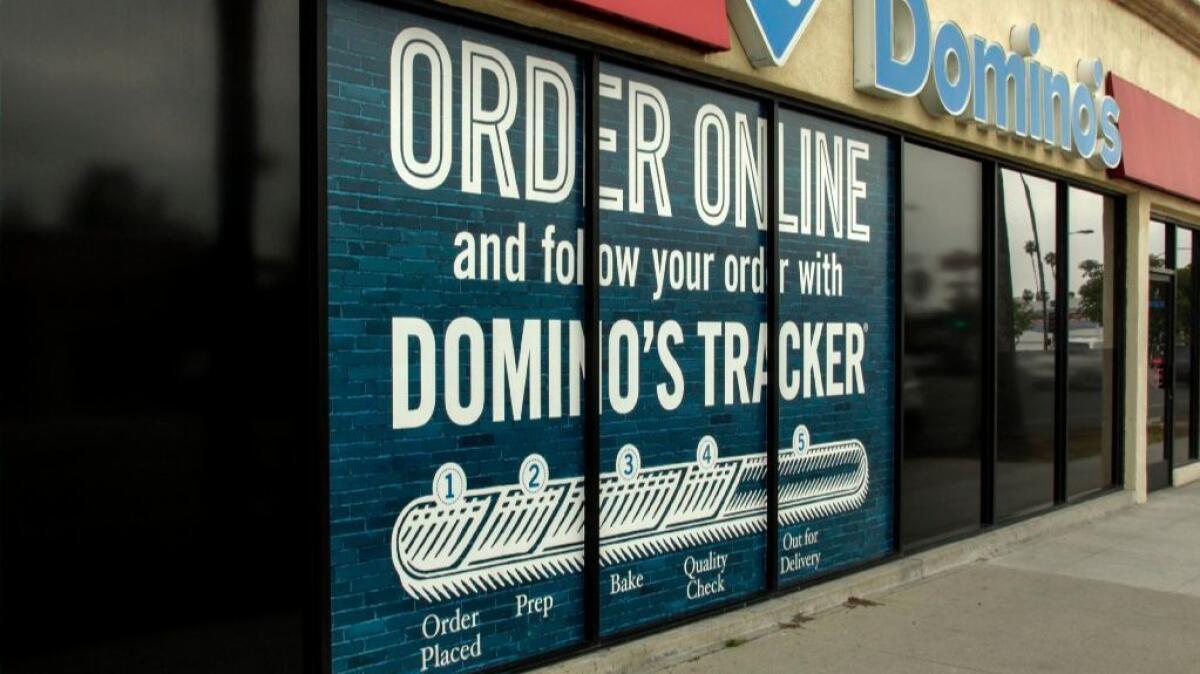

More than 60% of Domino’s orders are now executed on digital platforms, rather than by phone, and Domino’s often refers to itself as a “technology company.”

Customers can order on Domino’s own smartphone app, Amazon.com Inc.’s Echo speaker or online via Facebook, Twitter and other platforms as well as at the Domino’s website. Discounts often are included when ordering online, and there’s a loyalty rewards program.

In the cool technology department, the Domino’s app includes an order tracker that lets customers follow the preparation and delivery of their food. It also has a voice feature allowing customers to order by simply speaking into their phones.

“We fundamentally believe that voice is a far more effective and efficient way for people to interact with technology,” Doyle said. “What we do with it is going to be refined over time, but we need to get into this and start learning.”

At the end of the day, if we don’t deliver a great pizza to people, then none of the rest of this matters.

— J. Patrick Doyle, Domino’s CEO

Domino’s is hardly alone in the pizza business in exploiting the digital trend.

Pizza Hut Inc., a unit of Yum Brands Inc. that has an industry-leading 16,000 stores in 100 countries, also lets customers order via its phone app, its website, Facebook, Twitter and Echo.

Pizza Hut last week rolled out its own delivery tracker that gives customers the option of receiving text alerts for updates on their deliveries rather than reopening the Pizza Hut app.

Papa John’s International Inc., with about 5,080 stores in 45 countries, said this month that 60% of its orders come from its phone app and other digital platforms.

Papa John’s also has enjoyed steady gains in sales and earnings in recent years, and its stock price has jumped tenfold since late 2008, closing Friday at $82.06 a share.

But Domino’s Doyle said that for all the benefits technology provides, “we’re still a pizza company. At the end of the day, if we don’t deliver a great pizza to people, then none of the rest of this matters.”

That’s especially true on New Year’s Eve, Domino’s busiest delivery day. It’s followed by New Year’s Day and Super Bowl Sunday. The most popular American topping? Pepperoni, then mushrooms and sausage.

The $900 loan and VW Bug that made pizza history

Domino’s was started in 1960 when brothers Tom and James Monaghan borrowed $900 to buy a pizza store named DomiNick’s in Ypsilanti, Mich.

The next year James traded his half of the business to Tom for a Volkswagen Beetle. Tom later renamed the business Domino’s Pizza. (Tom also met his future wife making a pizza delivery to a college dorm.)

Tom Monaghan quickly went the franchise route and Domino’s grew rapidly. It had 1,000 stores by 1983 and 6,000 by 1998, when Monahan sold the company to Bain Capital Inc. for a reported $1 billion. Six years later, Domino’s went public.

After the taste of Domino’s pizza was heavily criticized in 2008-09, Doyle led the effort to revamp the recipe from scratch. The new pizzas had a richer, spicier sauce, tastier cheese combinations and a buttery crust with garlic and herbs.

“It was huge difference — huge,” said Jeanette Morales, who supervises seven stores for a Domino’s franchisee in Los Angeles. “You could see the impact right away.”

Domino’s also sells chicken wings, sandwiches, salads, breads and desserts but shies away from rolling out too many new menu items.

“The standard playbook in the restaurant industry has been this constant flow of new products, most of which do not change your typical customers’ experience at all,” Doyle said. (Doyle himself eats Domino’s pizza about twice a week, preferring the Pacific Veggie pizza on a thin crust or a deep-pan pizza with pepperoni.)

But on the technology front, Doyle said, Domino’s “is going to take risks” such as when it introduced voice ordering on its app three years ago.

“That’s the sort of thing that’s not going to generate a fast return, but that’s part of how you stay ahead of the market,” he said.

On a call with analysts last month, Doyle noted that many customers repeatedly order the same items and that, for example, “if somebody is a pepperoni pizza customer, how are we going to make that experience better for them next year than it is this year?”

“That’s what’s ultimately going to drive growth in the business,” he said.

Twitter: @PeltzLATimes

MORE BUSINESS NEWS

Waymo and Lyft team up on technology for driverless cars

Marriott turns to prefabricated rooms for quicker hotel construction

Despite those viral videos, airlines are turning passenger bumping into a data-driven art

How the big TV networks are adapting to ad-skipping viewers ... and Google, Snapchat and Facebook

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.