Ex-SAG pension exec steered fund money to spouse’s firm

In another black eye for the Screen Actors Guild pension and health plans, a former executive who blew the whistle on his boss for allegedly steering business to family members was himself involved in directing fund money to his spouse’s marketing company, fund records show.

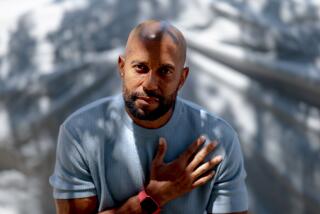

Craig Simmons, the former human resources director at SAG-Producers Pension and Health Plans who was fired in March, arranged to have the fund hire his husband’s marketing company, Fortress Communications, to help develop a campaign to mark the 50th anniversary of the plans, according to internal invoices and emails from the plans obtained by The Times.

The payments — made October 2010 and January 2011 and totaling about $25,000 — mark the latest instance in which the plans have done business with relatives of executives who work there, including family members of Chief Executive Bruce Dow.

Although trustees say the plans are financially sound, the Fortress payments raise further questions about the level of financial controls inside an organization that governs more than $2 billion in assets on behalf of Screen Actors Guild members.

The payments are likely to draw more scrutiny from federal Labor Department officials, who have been investigating claims that another former senior executive in the plans allegedly embezzled millions of dollars by receiving kickbacks from several companies that did business with the funds.

Following an audit conducted by PricewaterhouseCoopers in early 2009, SAG-PPHP sued two vendors involved in the alleged scheme. In one of the cases, the plans obtained a final judgment from an arbitrator who awarded them damages of nearly $2.5 million, which the court approved. The lawsuit against the second vendor, filed in June, is pending.

The employee who set up the contracts, Nader Karimi, left his job in early 2009 and reached a settlement with the plans for an undisclosed amount. Karimi could not be reached for comment. The plans received a $2-million payment from its insurer to recover a substantial portion of the losses, said a person close to the board who was not authorized to speak about the matter because of the pending investigation.

The alleged embezzlement scheme publicly surfaced in a complaint Simmons filed with the U.S. Department of Labor last month for wrongful termination, among other claims.

In his complaint, Simmons said he helped uncover some of the wrongdoing. He alleged that he was wrongfully terminated in March, in part for refusing to follow Dow’s orders to mislead investigators about the size of the losses from the alleged kickbacks, which he told the Labor Department were $5 million to $10 million. A representative for the plans disputed those figures but declined to provide an estimate of the total losses.

Simmons also said in his complaint to the Labor Department that he was blackballed for raising questions about Dow’s conduct, including allegations that Dow steered business to his wife’s insurance company, USI of Southern California, and arranged for a “phantom” job for his brother-in-law, Michael Bugbee. He served as the plans’ manager of communications and wrote the plans’ periodic newsletter before retiring with a SAG pension this summer. Bugbee could not be reached for comment.

Simmons maintained in his Labor Department complaint that the arrangements violated federal rules governing fiduciaries of union health and pension plans, which are regulated under the Employee Retirement Income Security Act. A Labor Department spokeswoman declined to comment on the probe.

In an interview, Simmons acknowledged that his department oversaw the hiring of Fortress, which was registered with the state in June 2010, four months before receiving payments from the plans, state records show.

He said his husband, James Buss, an American Airlines pilot listed as the registered agent of Fortess, was “uniquely qualified” for the job, citing his experience working in marketing at various companies, including Warner Bros., and his educational background, which Simmons said included a master’s degree in marketing and brand management.

Records reviewed by The Times indicate Simmons personally instructed the SAG-PPHP accounting department to set up Fortress as a vendor and said his department would receive the invoices. Simmons said in an interview that he did not personally write checks to Fortress and that Dow was aware he had hired the company and two other firms to work on a proposed marketing plan.

However, Simmons acknowledged the arrangement may have been inappropriate.

“In retrospect, maybe I should have stood up earlier and said this whole thing was wrong, but it was the culture of the organization,” Simmons said in an interview last week. “We were encouraged to hire people we knew well.”

The SAG-PPHP board of trustees, which oversees the plans and is made up of representatives from studios and SAG, declined to comment on the Fortress payments but after a meeting Friday issued this statement to The Times:

“Our independent, outside investigation is continuing and nearing completion. After receiving preliminary findings, we continue to have confidence in our CEO Bruce Dow and the 200-plus staff members who manage our plans’ operations and assets. We want to emphasize that the assets in our pension and health plans are safe and secure.”

Dow has managed the plans for 30 years and was paid $361,000 in 2009, according to an IRS filing. He declined repeated requests for an interview.

In a March 25 letter to Simmons, obtained by The Times, he cited several reasons for Simmons’ termination, including causing a “significant amount of money to be paid” by the plans into his husband’s 401(k) plan.

He added that Simmons had been verbally abusive toward his colleagues and allowed an employee to claim an educational reimbursement without approval from Dow.

In an August letter to state employment officials appealing the denial of unemployment benefits after his firing, Simmons cited his positive job performance reviews since he started working at the plans in 2008, and denied any wrongdoing, adding that he fully compensated the plans for the contribution to his husband’s 401(k). After attempts to negotiate a settlement with his former employer failed, Simmons filed his wrongful-termination complaint with the Labor Department on Sept. 14.

The Fortress payments were not cited in Simmons’ termination letter, and according to one person close to the board were not approved by senior management.

The person, who asked not to be identified because of the pending investigation, also said Sharman Dow, the wife of the chief executive, had an existing business relationship with the plans before she married Dow in 1996, as did Bugbee, who retired in July. Although her company continued to do business with the plans until 2010, she was removed from any connection with the plans at her husband’s request after they were married, the person said.

However, another former executive of the plans, who asked not to be identified because of a confidentiality agreement, said Sharman Dow’s name appeared in SAG-PPHP renewal documents from insurance carriers.

USI received $12,137 in commissions from the plans in 2009, according to a federal filing. Sharman Dow did not return calls for comment.

Simmons further alleged in his complaint to the Labor Department that several leading vendors who do business with the plans paid as much as $10,000 each to act as sponsors of a charitable golf tournament in Valencia for The King’s University, a Los Angeles bible college and seminary affiliated with the Foursquare Church.

Sharman Dow is a minister with the International Foursquare Church and serves on the board of trustees for King’s. Bruce Dow is a director of the International Church of the Foursquare Gospel.

According to the golf tournament’s website, most sponsors of the golf tournament last year were vendors of the plans, including Northern Trust, Horizon Actuarial Services and Vitech Systems Group. Five of the vendors received more than $1 million in compensation from the plans in 2009, a federal filing shows.

“It is not uncommon for vendors to espouse charitable causes by their clients,” according to a statement by the SAG-PPHP board of trustees. “Of the plans’ more than 300 vendors, eight sponsored the charity golf tournament in question.

“While the trustees do not think this is inappropriate, it is clear that this type of support can be mischaracterized. They are reviewing this matter as they are all allegations of wrongdoing.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.