Stocks surge, led by banks, as investors hope regulations will be cut

Banks and other financial companies made big gains Friday after President Trump moved to scale back regulations on the financial industry. Other stocks also rose as investors were pleased that employers hired workers at a faster pace in January.

The Labor Department said hiring sped up last month, a positive sign for the economy. Small-company stocks, which stand to benefit more than others from stronger economic growth, made sharp gains.

Financial companies are “going to benefit from not having all of this onerous red tape,” said Karyn Cavanaugh of Voya Investment Strategies. “That’s why we see the rallies every time they talk about regulation.”

Cavanaugh said a reduction in regulations also could help banks lend more and speed up economic growth, which could benefit many other industries.

Read more: Trump orders review of Dodd-Frank and suspends retirement advisor rule »

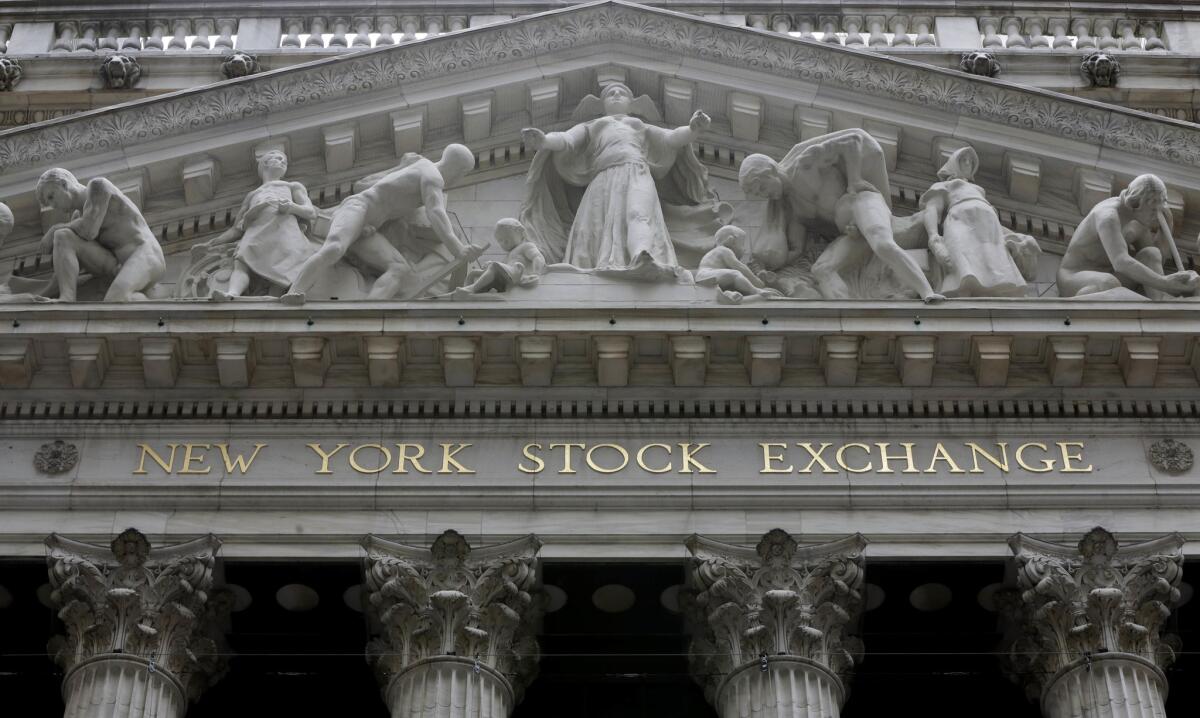

The Dow Jones industrial average jumped 186.55 points, or 0.9%, to 20,071.46. The Standard & Poor’s 500 index advanced 16.57 points, or 0.7%, to 2,297.42. The Nasdaq composite picked up 30.57 points, or 0.5%, to close at a record high of 5,666.77.

The Russell 2000 index of smaller-company stocks climbed 20.41 points, or 1.5%, to 1,377.84. Smaller, domestically focused companies may have more to gain than their larger peers from faster growth in the U.S. The Russell made big gains at the end of 2016 based on those hopes.

On Friday, Trump directed the Treasury secretary to look for potential changes to the Dodd-Frank law, which reshaped financial regulations after the 2008-09 financial crisis. The order does not have any immediate impact, but investors applauded its intent.

Read more: Here’s what’s at stake as Trump moves to unravel Dodd-Frank »

Trump also signed a memorandum to delay an Obama-era rule that requires financial professionals who charge commissions to put their clients’ interests first when giving advice on retirement investments.

JPMorgan Chase rose 3.1% to $87.18, and Goldman Sachs climbed 4.6% to $240.95. Morgan Stanley jumped 5.5% to $44.43. Smaller banks, which could find it easier to lend money if regulations are cut, also traded higher. Texas Capital Bancshares went up 3.4%, to $86.10, and East West Bancorp advanced 4.5% to $52.72.

U.S. employers added 227,000 jobs in January, according to the Labor Department. That’s more than last year’s average monthly gain of 187,000. The unemployment rate ticked up to a low 4.8% from 4.7% in December as more people started looking for work. That helped smaller companies and industrial stocks, both of which would benefit from faster economic growth.

Read more: Five things we learned from the January jobs report about the economy Trump inherits »

Visa said shoppers stepped up their use of debit and credit cards in the latest quarter, and the payment processing company also benefited from its acquisition of Visa Europe. Its profit and revenue were stronger than analysts expected, and Visa’s stock jumped 4.6% to $86.08.

Online retail giant Amazon fell 3.5% to $810.20 as investors grew concerned about its sales. The company’s fourth-quarter sales fell short of analyst estimates, and so did its forecast for revenue in the current quarter.

Macy’s stock soared 6.4% to $32.69 after the Wall Street Journal reported that Hudson’s Bay Co., the owner of Saks Fifth Avenue, could buy the department store chain. Macy’s has been trading around five-year lows. Hudson’s Bay stock rose almost 4% in Toronto.

Macy’s is rumored to be in takeover talks with the owner of Saks »

Biotech drugmaker Amgen climbed 5% to $167.53 after it disclosed a bigger profit and better sales than analysts expected. It also reported results from a study that showed its new cholesterol drug, Repatha, reduced the risk of death, heart attack and stroke in patients with advanced atherosclerotic cardiovascular disease. That could help boost prescriptions for the drug.

GoPro dropped 12.7% to $9.58 after the maker of action video cameras reported weak fourth-quarter sales and issued a disappointing forecast.

Hanesbrands slumped 16.4% to $18.98, its lowest price in almost three years, after the maker of underwear, T-shirts and socks announced surprisingly weak holiday sales and gave disappointing projections for the year.

Bond prices wobbled, then turned higher. The yield on the 10-year Treasury note fell to 2.47% from 2.48%.

Benchmark U.S. crude rose 29 cents to $53.83 a barrel. Brent crude, used to price international oils, rose 25 cents to $56.81 a barrel. Wholesale gasoline rose 2 cents to $1.55 a gallon. Heating oil rose 1 cent to $1.67 a gallon. Natural gas fell 12 cents, or 3.9%, to $3.06 per 1,000 cubic feet.

Gold rose $1.40 to $1,220.80 an ounce. Silver rose 5 cents to $17.48 an ounce. Copper fell 7 cents, or 2.6%, to $2.62 a pound.

The dollar rose to 112.96 yen from 112.70 yen. The euro inched up to $1.0765 from $1.0764.

France’s CAC 40 jumped 0.6%. The British FTSE 100 rose 0.7%, while Germany’s DAX advanced 0.2%. The Nikkei 225 in Tokyo finished almost unchanged, and Seoul’s Kospi rose 0.1%. The Hang Seng in Hong Kong shed 0.2%.

UPDATES:

2:55 p.m.: This article was updated with closing prices, context and analyst comment.

9:05 a.m.: This article was updated with market prices and context.

This article was originally published at 6:55 a.m.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.