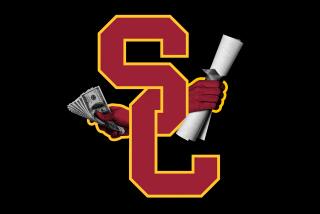

Column: Why is the UC system investing in a payday lender accused of trapping people in perpetual debt?

The University of California makes money when American workers become trapped in endless cycles of high-interest debt.

That’s because the university has invested millions of dollars in an investment fund that owns one of the country’s largest payday lenders, ACE Cash Express, which has branches throughout Southern California.

ACE isn’t an upstanding citizen even by the bottom-feeding standards of its industry.

Join the conversation on Facebook >>

In 2014, Texas-based ACE agreed to pay $10 million to settle federal allegations that the company deliberately tried to ensnare consumers in perpetual debt.

“ACE used false threats, intimidation and harassing calls to bully payday borrowers into a cycle of debt,” said Richard Cordray, director of the Consumer Financial Protection Bureau. “This culture of coercion drained millions of dollars from cash-strapped consumers who had few options to fight back.”

UC’s connection to payday lending has skated below the radar for about a decade. The university has never publicized its stake, remaining satisfied to quietly reap profits annually from what critics say is a business that preys on people’s misfortune.

Steve Montiel, a UC spokesman, said even though the university has a policy of socially responsible investment and has pulled its money from tobacco and coal businesses, there are no plans to divest from the payday-lending-related fund.

He said the university is instead encouraging the fund manager, New York’s JLL Partners, to sell off its controlling interest in ACE.

“You want to invest in things that align with your values,” Montiel acknowledged. “But it’s better to be engaged and raise issues than to not be involved.”

That, of course, is nonsense. If you’re high-minded enough to sell off holdings in tobacco and coal, it’s not much of a stretch to say you shouldn’t be in bed with a payday lender.

I’m a UC grad myself, so this isn’t just business — it’s personal. The university could be just as vocal in raising issues about a payday lender without simultaneously making money off the backs of the poor.

The Consumer Financial Protection Bureau has found that only 15% of payday loan borrowers are able to repay their loans on time. The remaining 85% either default or have to take out new loans to cover their old loans.

Because the typical two-week payday loan can cost $15 for every $100 borrowed, the bureau said; this translates to an annual percentage rate of almost 400%.

Diane Standaert, director of state policy for the Center for Responsible Lending, said most questionable fund investments persist solely because no one knows about them. Once they come to light, public-fund managers, especially those espousing socially responsible values, are forced to take action.

“In UC’s case, this is definitely troubling,” Standaert said. “Payday loans harm some of the very same people that the University of California is trying to serve.”

As of the end of September, UC had $98 billion in total assets under management, including its pension fund and endowment. UC’s cash is spread among a diverse portfolio of stocks, bonds, real estate and other investments. About $4.3 billion is in the hands of private equity firms.

In 2005, UC invested $50 million in JLL Partners Fund V, which owns ACE Cash Express. The fund also has stakes in dozens of other businesses.

JLL Partners declined to identify its investors but says it works with “public and corporate pension funds, academic endowments and charitable foundations, sovereign wealth funds and other investors In North America, Asia and Europe.”

Montiel said UC has made money from its Fund V investment, “but we’d lose money if we suddenly pulled out of it.”

Thomas Van Dyck, managing director of SRI Wealth Management Group in San Francisco and an expert on socially responsible investments, said UC needs to weigh potential losses against the repercussions of being linked to a “highly exploitative industry.” The public relations hit could be more costly than divesting, he said.

The university has been down this road before. Most prominently, it bowed to pressure from students and others in the 1980s and pulled more than $3 billion from companies doing business in South Africa, which was still under the apartheid system.

After Jagdeep Singh Bachher was appointed in 2014 as UC’s chief investment officer, he implemented a policy of pursuing “environmental sustainability, social responsibility and prudent governance.”

Rep. Maxine Waters (D-Los Angeles) convened a meeting on Capitol Hill last July to assess the impact of payday lending on low-income communities. Afterward, she wrote to UC, Harvard, Cornell and public pension systems in several states to ask why, through their Fund V investments, they’re stakeholders in the payday-loan business.

“This is unacceptable,” she said in her letter. These institutions should not support “investments in companies that violate federal law and whose business model depends on extending credit to our nation’s most vulnerable borrowers often on predatory terms.”

She urged UC and the other entities to divest their holdings in Fund V.

Montiel said UC contacted JLL Partners after receiving Waters’ letter and asked the firm to clarify its position in ACE Cash Express. The firm replied, he said, with a letter defending ACE and the role that payday lenders play in lower-income communities.

Since then, Montiel said, there’s been no change in UC’s Fund V investment. “It isn’t something we’re ignoring,” he said. “Things don’t happen overnight with this sort of investment.”

Officials at Harvard and Cornell didn’t return emails seeking comment.

Bill Miles, JLL’s managing director of investor relations, told me that ACE and other leading payday lenders have gotten a bad rap.

“These are emergency loans to people who have no other way of borrowing money,” he said, specifying that his remarks reflected his personal thinking and not that of his company. “It’s really the only source of funding to that community, short of a loan shark.”

In 2014, 1.8 million Californians took out 12.4 million payday loans, clearly showing that many if not most borrowers took out multiple loans, according to the state attorney general’s office.

Loan sharks like to be repaid. Payday lenders don’t seem satisfied until people are constantly borrowing more.

Obviously a $50-million investment in a fund with a payday-loan connection is pocket change for UC. But that doesn’t make the investment any less meaningful, nor does it excuse the university from profiting from people’s hard luck.

There’s a reason the university no longer invests in tobacco or coal. As UC says, they don’t “align” with the 10-campus institution’s values.

Payday lending does?

Absolutely not.

David Lazarus’ column runs Tuesdays and Fridays. He also can be seen daily on KTLA-TV Channel 5 and followed on Twitter @Davidlaz. Send your tips or feedback to david.lazarus@latimes.com.

MORE FROM DAVID LAZARUS

Don’t expect this ‘award’ to help you enter college

When collectors call, demand proof of your debt

Wireless-only phone users have become a one-stop shop for scam callers

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.