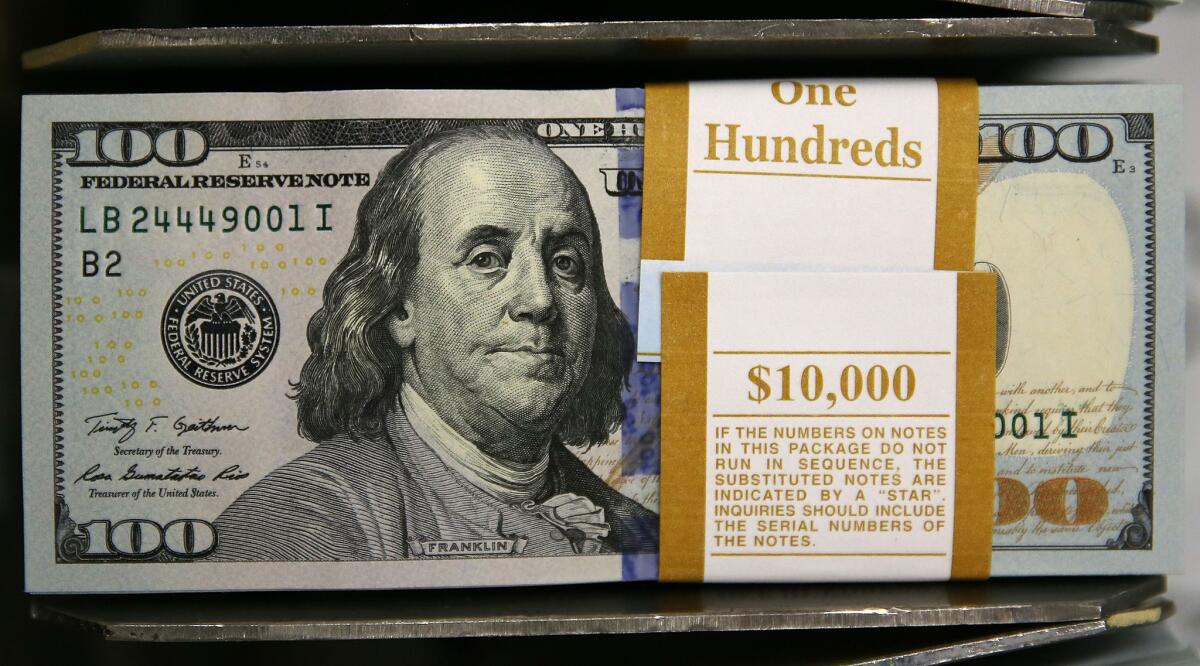

Redlands broker accused of stealing $4.2 million from two clients

A Redlands broker allegedly stole $4.2 million from two client accounts, including one set up for an Alzheimer’s patient, and gave the money to two friends who spent lavishly on a vacation home and casino gambling, according to a complaint by the Financial Industry Regulatory Authority.

John Thomas Thornes, 46, and his firm, Thornes & Associates Inc. Investment Securities, are accused of dipping into two customer trust accounts over more than two years through illicit transactions masquerading as loans, according to the complaint filed Tuesday.

One account, set up to care for a 77-year-old woman suffering from Alzheimer’s, was drained of about $1.5 million over a two-year period, the complaint said. The second, which provided college scholarships to high school graduates, plunged to about $140,000 in assets from around $3 million over roughly the same period.

Quiz: How much do you know about California’s economy?

Thornes allegedly transferred the money to two friends who are identified only as “CB” and “KL” through “fictitous loans.”

The loans, along with interest of 15% to 20%, were supposed to be repaid by CB within a year, the complaint said, but Thornes did not receive any documentation or signed promissory notes to reflect the loans.

“As Thornes was aware, his friends CB and KL used the funds for extravagant purposes including chartering a jet, gambling at a local casino, purchasing a vacation home and purchasing a luxury automobile,” the complaint said.

William “Skee” Saacke, an attorney for Thornes, disputed FINRA’s accounting of the events and said the agency should be going after CB, who took out the short-term loans and never paid them back.

“There is a bad guy and it isn’t my guy,” Saacke said. He later wrote in an email that CB “failed to pay back the money despite repeated promises to do so.” Saacke added that Thornes had filed civil lawsuits against CB to recover the money.

Michelle Ong, a FINRA spokeswoman, declined to comment further on the case, citing agency rules against talking about a specific complaint.

According to the complaint, even after the loans became overdue, Thornes continued to transfer funds to CB. Thornes exchanged more than $1 million into cash and cashier’s checks so CB could “evade an asset freeze and use some of the funds at a casino,” the complaint said.

The case will be heard before a hearing panel that includes a FINRA officer and two securities industry representatives. Possible sanctions include fines and restitution. Thornes and his firm could also be barred from the securities industry.

Saacke said he’s preparing evidence to present in the hearing.

“Rather than assist in seeking recovery from the third party wrongdoer, FINRA has chosen to pursue an enforcement action, without compromise,” he wrote.

ALSO:

Utah, Virginia governors visit California to woo businesses

Los Angeles, San Francisco top cities for draft dodgers, study says

College graduates see pay drop 7.6% in the last six years, report says

Follow Shan Li on Twitter @ShanLi

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.