Congratulations! If you’re moving on to Step 4, that means you’re already past what might be the worst part of the home-buying process: figuring out financing.

It’s almost time for the most exciting part, where you can actually start browsing for houses, dream-scrolling through properties on Zillow or Redfin and fantasizing about how to configure the living room or where to put your plants.

But before that, one more decision awaits: hiring a real estate agent.

In the modern age, it can be tempting to skip this and navigate the market yourself. The internet has removed the Realtor as sole gatekeeper of the real estate industry, and anyone can now access property information that was once limited to certified agents. It has also opened up a new way to find agents, who advertise themselves on Instagram, TikTok and YouTube — many turning to these social media platforms during the pandemic, when in-person meetings and tours were not possible.

Despite this, there are still a plethora of reasons why it’s smarter to seek out an agent. As a buyer, you really have nothing to lose because most contracts stipulate that the seller pays the commission for the buyer’s agent.

Here’s a list of duties that agents can perform beyond simply finding you a house to tour.

Five homebuyers tell us how they chose which neighborhood to commit to in Greater Los Angeles — no small feat.

Market wisdom

Sure, the neighborhood you’re eyeing just got a new vegan bakery and a coffee shop where you can bring your dog, but does that mean home prices will appreciate? Any good agent will understand the market and, using MLS data, discern whether it’s a good idea to invest in an area.

Different agents have different tips and tricks too, and it’s worth at least knowing what they are. One, for example: “I would stay away from new listings,” said Hektor Castillo, an agent focusing on sales in the L.A. area who is active on TikTok and Instagram.

“My strategy to help first-time buyers is to show them properties that have been on the market for more than 20 days,” he said. “Properties that were just listed today will have multiple offers tomorrow. The competition will be intense.” Castillo said he recently closed two deals this way and is in escrow on a third.

If a home price seems too good to be true, it probably is, and experienced agents can help you spot and manage that, as well. Low prices meant to spur bidding wars are common. Agent Loida Velasquez said her approach is to factor that in early when considering homes, often telling her clients: “Let’s start low and have that wiggle room.”

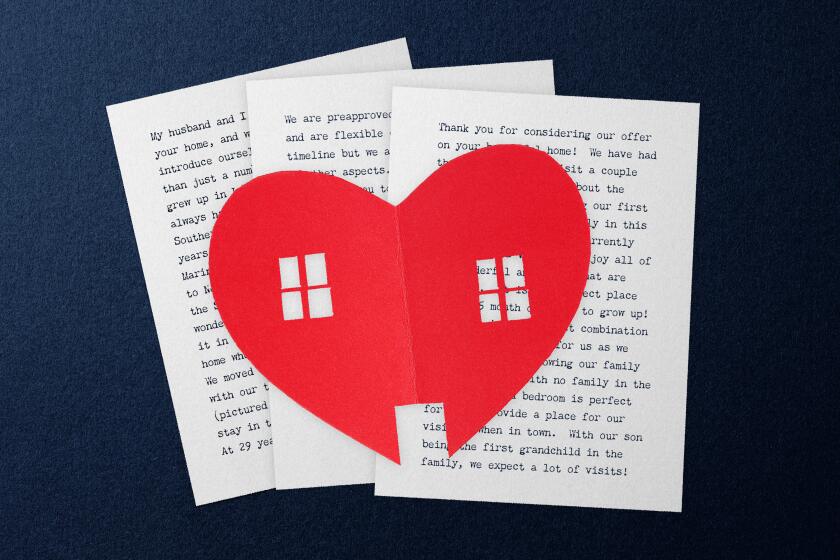

“Buyer interest” letters are common in ultra-competitive housing markets like California’s, even though they raise questions of discrimination.

“Any buyer I’m working with, let’s say they are qualified for $600,000, I say, ‘Let’s look up to $550,000 so you have a cushion to come up,’” Velasquez said. A house with a low-ball listing of $550,000, she added, “is probably going to sell at $700,000.”

Making an offer

With so much money at stake, home negotiations can be a brutal process, and in a market as competitive as Southern California’s, you want an expert who has been there before and can respond credibly when offers and counteroffers go flying back and forth. If you try to negotiate with the seller’s agent yourself, they may haggle harder if they smell inexperience.

Negotiate inspections

Price negotiations are one thing, but if multiple offers come in, the seller might start asking you to waive inspection or appraisal contingencies. It’s a risky move, but doing so might put your offer above the rest, and your agent can tell you whether it’s worth doing.

The Great SoCal House Hunt

Ultimately, a real estate agent works for you. L.A. has thousands of them, and finding the right one can be overwhelming. In fact, California has the second-highest number of Realtors of any state: 212,279, according to 2021 data from the National Assn. of Realtors.

Most buyers’ first impulse is to go with someone they know, such as a friend or family member. It makes sense; if you go with someone you can trust, you can be sure they have your best interest in mind. However, in a market as competitive as this one, you need to make sure your agent is an expert in whichever neighborhood you’re eyeing.

For example, when Courtney Northrop was house hunting, she toured a home in North Hollywood. The seller’s agent was from Riverside and not familiar with the area, and he priced the home way too high. It languished on the market with little interest, and when Northrop ended up buying the home, she didn’t have to compete against any other buyers and got a great deal.

“They could’ve had a bidding war if it was priced appropriately,” Northrop said.

Beyond expertise, your agent should have connections. Compass agent Brent Chang picked up a client who said he’d written six offers, but none was accepted. With Chang, he submitted one offer, and it was accepted even though it was a bit lower than the others because Chang had worked with the seller’s agent before.

Southern California home buyers talk about how they made it through — or around — the flurry of ever-higher bids.

“Listing agents like security. If they have an offer that’s a bit lower but they’re sure the deal will make it through escrow because they’re familiar with your agent, they’ll usually go with that one,” Chang said.

Finding an agent who checks all the boxes takes research. Use Google or a real estate listing site to search for agents based in a certain neighborhood, but also ask around. Go to open houses and talk to the agents you meet. See who your friends used, and whether they had a good experience.

Another good strategy is to look at recent deals that closed in the neighborhood and find out which agents were involved. If you see names pop up more than once, those agents probably know what they’re doing. If no names are sticking out, ask friends or family for a recommendation.

“Your agent should have an ear to the ground in the specific market where you’re looking,” said Josh Altman, a Douglas Elliman agent and star of “Million Dollar Listing,” a reality show following L.A. agents. “They should know everything coming to the market, everything being built and every potential seller.”

With thousands of agents competing for business, many try to stand out on social media to get millennials’ attention — especially in a region as image conscious as Southern California. Treat those platforms the way you would if you saw an agent in an ad or heard about them through friends: Do your research.

Follow the top agents in your area on their TikTok, Instagram or YouTube accounts, and look for evidence of how active they are and their client successes. Make sure the agents are selling their work instead of themselves. If you see someone cranking out five viral posts every single day, they’re probably not spending as much time on their clients as they should be.

Uncommon ways to buy a home

Altman, already a celebrity in the industry, said that he didn’t expect to get big on TikTok, but that it brings in new business, especially from younger buyers, who spend a lot of time on the platform. “It’s not just about people dancing. It’s another avenue potential buyers use to find houses and agents,” he said.

Those savvy on social media sometimes pass on names and home leads from Instagram and TikTok to their parents, said Castillo, who lately has found YouTube to be very useful in connecting him with potential buyers.

Once you have some prospects, interview at least three. Ask them about the market. Ask them what you can expect in your price range. Ask them how many other clients they have. Ask them whether you’ll be dealing with them or one of their assistants. Ask them how they’ll make your offer stand out from other buyers’.

“It’s OK to call around for different agents. If I’m up against somebody else, that makes me work harder,” Altman said. “If I can’t find someone a house, I didn’t do my job.”

If you’re satisfied with an agent’s answers, and you connect on a personal level, then you’re good to go.

Note: Real estate agents make money only when you buy a home, and a bad agent will try to rush you through the process. If at any point you feel pressure from an agent to make an offer or accept an offer, walk away. There are plenty of fish in the sea (and plenty of agents in L.A.).

What does it really take to buy a house in Southern California? A Long Beach couple share their story, from strategic job moves to Realtor regrets.

Bad agents might also try to make you choose a certain home based on how much commission they receive. Different listings have different commissions for your agent; one home might promise 2% but another might offer 3%. If you’re choosing between a few different homes, ask your agent how much commission is at stake for each one.

Sometimes the stars align — you and the agent seem like a match — and still there are communication snags. The more you know, the better questions you can ask, the more ready you are to answer questions, and the smoother the sailing will be.

Sarah Tran and her husband came into their home-buying journey educated and prepared, and yet they hit delays near the end that she attributed to patchy information from their Realtor.

“I feel like he didn’t really do a good job of walking us through the process, the deadlines, the forms needed. I was frustrated,” Tran, 31, said. They closed on their North Long Beach home in December with a two-day delay.

Another way?

There are some other ways to go about buying a home beyond the normal real estate agent and loan. This is 2022 after all, and a handful of companies now offer ways to buy a home in a less-traditional manner.

Two major models are companies that put forth a cash offer on your behalf and companies that help with a down payment in exchange for a share of your equity.

Linda Sherry, a director with the nonprofit Consumer Action, said the new services could be “reasonable, but with anything like this the devil is in the detail.”

She noted that the long-term consequences of these products have yet to be revealed, so consumers should be extra cautious. She recommended speaking with a housing counselor or a real estate attorney to vet the products beforehand.

If you want more detail on the services, here is a sampling:

All-cash offers: Flippers and other small-time investors have long offered to pay homeowners cash for their houses. Sellers like an all-cash offer because it’s a quick sale with no need for a buyer to line up financing that may fall through.

Lately, companies called ibuyers, or instant buyers, made a splash in the real estate world with all-cash offers backed by Wall Street investors and online systems that streamline the process.

Now, some companies are offering prospective buyers a way to use cash so their bids can stand out.

One of them is Flyhomes, which gives you a short-term loan to purchase a home in cash. After the deal closes, you can then work with your lender or Flyhomes to get into a long-term loan.

Other companies — including Opendoor and Ribbon — will back your financed offer with their cash and agree to purchase the house if your mortgage doesn’t come through on time. If that happens, the companies say they will then sell the home back to you at the original price when you secure financing.

Flyhomes and Opendoor also offer some form of buyer guarantee if you use their services and move into your new home and don’t like it. If that’s the case, Opendoor will purchase some homes back, while Flyhomes will list and sell your home without charging a commission.

Equity Sharing: For those who need help with a down payment and don’t mind sacrificing some potential profit, equity-sharing companies could be an option. These companies offer loans that don’t charge interest, but instead claim some of the increase in the home’s value.

One company is Noah, which will lend you as much as 15% of your home’s purchase price to put toward a down payment. You’d have 10 years to pay it back, which you could do with savings, with proceeds from the sale of your home or with money from a cash-out refinancing.

When you decide to pay the money back — either at the 10-year mark or before — an independent appraisal is done, said Noah Chief Executive Sahil Gupta. If the home has increased in value, you owe what Noah originally gave you, plus a share of the home’s price appreciation.

Next: Make the most of open houses

Here are some open house dos, don’ts and red flags — with a handy checklist to remind you what to ask and look out for.

If the home’s value declined, you don’t owe everything Noah gave you, Gupta said. Rather, you owe the original amount minus a percentage of the decline in value.

A typical split is 65% of the home’s appreciation or depreciation goes to you, while 35% goes to Noah, Gupta said. The percentages shift in Noah’s favor if you have poor credit or Noah contributed the maximum 15% of a home’s value.

A similar equity-sharing option comes from the company Landed. However, its services are limited to “essential professionals” such as teachers, healthcare workers and government employees.

Step-by-Step Guide

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.