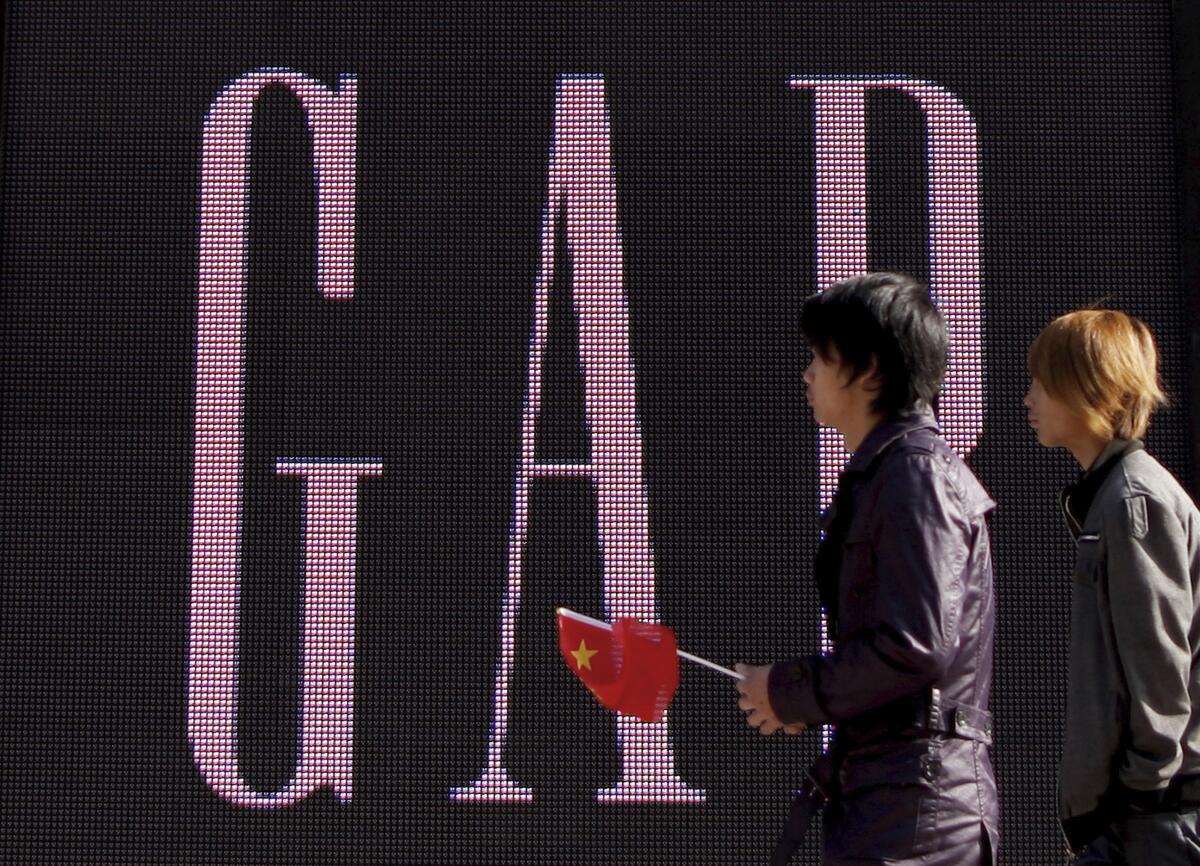

Gap CEO fired after failing to rescue struggling retailer

Gap Inc. shares fell Tuesday as rising costs and discounts thwarted Sonia Syngal’s turnaround after 2 1/2 years as chief executive of the clothing retailer.

Chairman Bob Martin is taking over immediately as interim CEO, according to a statement late Monday, and the apparel retailer lowered its expectation for second-quarter operating margin percentage to a range of zero to slightly negative. The shares, which fell as much as 8.7% in New York trading, have lost more than half their value this year.

Syngal was hired right before the pandemic, which roiled demand and intensified focus on online shopping amid mandatory store shutdowns. Missteps such as a clumsy implementation of expanded women’s sizes at the company’s Old Navy chain, whose top executive left earlier this year, caused inventory levels to swell just as demand may have crested.

“Several disappointing catalysts have now hit, the bull case has been eliminated in the near-to-medium term,” Wells Fargo analysts led by Ike Boruchow said in a note.

In early 2020, it was Syngal who stepped in to replace a CEO who abruptly departed amid operational problems. Predecessor Art Peck left after a scrapped plan to spin off Old Navy and failure to reignite sales growth. Syngal had been the head of Old Navy, which generates more than half of the company’s revenue.

Syngal’s departure further reduces women’s representation at the top of U.S. public companies. There are currently 33 women leading companies in the Standard & Poor’s 500 index, according to data compiled by Bloomberg. Gap was removed from the index at the start of the year.

28-year-old Dominic Green signed out of his shift on a Wednesday afternoon. Five days passed before his body was discovered.

After taking over in March 2020, Syngal immediately had to navigate COVID-19. She oversaw the expedited implementation of curbside pickup and the expansion of e-commerce — moves that investors applauded.

She was unable to keep up the momentum, however. The company as a whole appears to be struggling to capitalize on rapid changes in apparel trends as offices reopen and consumers move away from comfortable clothes, such as sportswear, in favor of work attire. Gap’s upscale Banana Republic chain was a standout last quarter, but that wasn’t enough to counter weakness at the other divisions.

Additionally, a deal to produce apparel with Kanye West’s Yeezy brand has failed to generate meaningful results. After announcing the project with fanfare, Gap executives have been mostly quiet on the issue.

The company’s missteps are ill-timed as the retail industry gears up for back-to-school season, one of the biggest shopping times of the year. “As a family brand, this has a compound halo effect. When we aren’t delivering for moms, she’s less likely to come to Old Navy for her kids,” Syngal said during the company’s latest earnings call.

Gap, which also operates Athleta in addition to its namesake brand, expects $50 million of air-freight charges and other costs that will offset operating profit in the fiscal second quarter.

The company sees Old Navy reaching $10 billion in sales by 2023. Old Navy added more plus-size women’s apparel to expand appeal, but the move backfired when its size assortment was imbalanced, with too many of some sizes in stock and not enough of others. That led to cuts in orders for the third quarter.

The announcement followed a previous reduction in its earnings outlook. The retailer expects to get through its glut of inventory with steep discounts, which will weigh on its results.

“Old Navy was going in the wrong direction and that can’t happen because it’s so critical to the overall business,” Morningstar analyst David Swartz said. “It’s clear that some of the strategies that Syngal herself was a proponent of had failed, like the extended sizes.”

The apparel retailer also hired Horacio “Haio” Barbeito as the new CEO of Old Navy. Barbeito will join Gap after a 26-year career at Walmart Inc., where he most recently served as CEO of the retail giant’s operations in Canada, its largest foreign market except for Mexico. Before that, he led Walmart’s business in Argentina and Chile.

— Bloomberg writers Brendan Case and Jeff Green contributed to this report.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.