Everything to know about Silicon Valley Bank’s spectacular collapse

The government’s response to the failure of two large banks has already involved hundreds of billions of dollars.

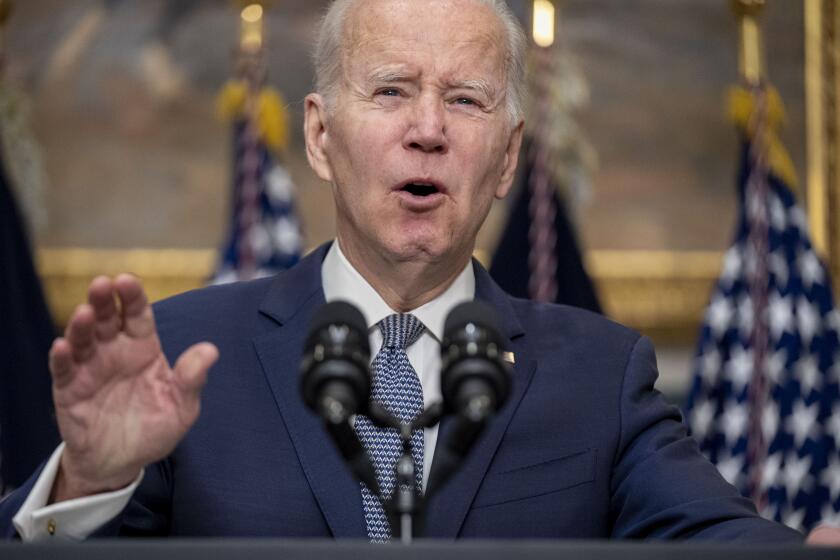

Biden called on Congress to grant the FDIC powers after the Silicon Valley Bank and Signature Bank failures sent shock waves through the banking industry.

SVB Financial Group is no longer affiliated with Silicon Valley Bank since it was seized by the Federal Deposit Insurance Corp.

To fight inflation\, the Fed has historically raised interest rates. But in times of uncertainty, rate hikes could cause an overcorrection — and a recession.

President Trump-endorsed rollback of Dodd-Frank’s tougher scrutiny of banks was a significant factor in SVB’s problems. But it wasn’t the only culprit.

The Silicon Valley Bank collapse sent some business owners and individual account holders scrambling for safe places to put their money.

Silicon Valley Bank telegraphed that its securities holdings were underwater. Why didn’t the regulators act sooner?

Assuring the public a crisis in the banking system was under control, President Biden blamed his predecessor for creating the conditions for the collapse of Silicon Valley Bank and Signature Bank.

Financial turmoil has some people wondering if a systemic problem is putting all banks in peril, as in the Great Recession. Experts say that isn’t the case.

Amid the failure of Silicon Valley Bank, the annual tech and culture summit South by Southwest in Austin has taken on a decidedly somber tone.

Bank stocks tumbled Monday on worries about what’s next to break after the second- and third-largest bank failures in U.S. history.

Governments on both sides of the Atlantic are taking extraordinary steps to stop a potential banking crisis after the failure of Silicon Valley Bank.

First Republic Bank shares plummeted on Monday despite efforts to reassure investors, amid turmoil from the collapse of Silicon Valley Bank.

Demands by the tech industry’s most vocal libertarians for a government bailout of Silicon Valley call to mind the old saw: The goal in business is to privatize profits and socialize losses.

Top officials at federal agencies assure customers of failed Silicon Valley Bank that they’ll be fully protected, and add that taxpayers will not bear the costs.

The failure of Silicon Valley Bank demonstrates the risk in showering unproven companies with cash and in handing so much power to venture capitalists to manage the process.

The Silicon Valley Bank failure is the old story of what happens when short-term depositors want their money back from a bank with only long-term assets.

The failure of one of the tech industry’s central institutions could leave countless companies unable to pay their employees in the coming weeks.