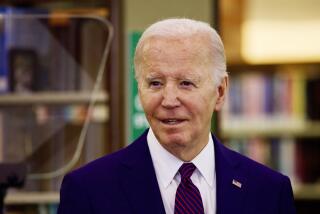

Biden says banking system is safe, promises accountability for Silicon Valley Bank failure

Biden blames Trump for scaling back regulations, which he said contributed to the collapse of Silicon Valley Bank and the closure of Signature Bank.

WASHINGTON — “This is not 2008”: That was the mantra of Biden administration officials on Monday as they sought to reassure investors and the public that a regulatory takeover of two failed banks and rescue of their depositors, along with newly implemented safeguards, would be enough to avert a broader crisis in the financial system.

As stocks opened a jittery day of trading that brought large losses for some regional banks, notably San Francisco-based First Republic, President Biden declared the underlying banking infrastructure “safe and secure” from aftershocks brought about by the fatal run on Silicon Valley Bank.

“Americans can have confidence that the banking system is safe. Your deposits will be there when you need them,” Biden said in remarks at the White House before leaving for a three-day visit to California and Nevada.

After a weekend spent warning of domino effects and mass layoffs, venture capitalists and hedge fund managers had mostly praise for the plan to guarantee deposits at Silicon Valley Bank and Signature Bank by invoking a “systemic risk exception” allowing regulators to backstop even deposits too large to qualify for federal insurance.

“The #1 thing we should be thankful for is decisive action from the US Government at every stage of this: the White House, Treasury, FDIC, the Fed, Congress, and California leaders who stepped up big,” tweeted Garry Tan, chief executive at the Silicon Valley startup accelerator Y Combinator.

The plan announced by the U.S. Treasury, the Federal Reserve Bank and the Federal Deposit Insurance Corp. also included a new instrument to prevent the spread of bank failures. Under it, banks whose balance sheets are hobbled by high interest rates will be able to access liquidity in the form of Fed loans against their affected assets.

As part of the FDIC’s takeover of Silicon Valley Bank, its top executives were fired, and a new chief executive was appointed: Tim Mayopoulos, a software executive who helped mortgage guarantee company Fannie Mae navigate the financial crisis and served as its chief executive from 2012 to 2018. Financial regulators are now reviewing whether Silicon Valley Bank, based in Santa Clara, had conducted the required planning and stress testing as the Fed raised interest rates starting last year, according to Bloomberg.

The stock market as a whole seemed unperturbed by lingering questions over the health of the banking system, ending trading Monday essentially flat.

But markets were slow to dismiss the possibility that liquidity issues could crop up at other medium-size banks, putting their depositors and especially their investors at risk, and widening the circle of economic fallout. Banks took a moderate hit, with regional bank stocks down 7.7% on Monday to their lowest level since June 2020.

Midsize institutions with customer bases similar to Silicon Valley Bank’s — rich people — got pounded. Hit hardest was First Republic Bank. Its stock dived 62% on Monday, even as First Republic Bank officials said liquidity was not an issue.

That’s yet to be fully determined. First Republic’s business model is similar to Silicon Valley Bank’s. They both serve the lucrative market of Silicon Valley entrepreneurs, executives and companies, and both are suffering asset markdowns as interest rates rise. But First Republic has a lot more of its assets in jumbo mortgages on high-priced homes, and depends less on the banking business of individual startup companies.

Regulators have been working overtime since late last week. On Friday, after a day in which customers attempted to withdraw $42 billion in funds, the FDIC seized control of Silicon Valley Bank, which held more than $200 billion in assets as of the end of 2022. Its failure was the largest since 2008. Then, over the weekend, regulators shuttered Signature Bank after they determined it also presented a systemic risk.

Despite failing to find buyers immediately prepared to take over their assets and liabilities, the Treasury Department announced Sunday that customers at both banks, including those who had funds exceeding the $250,000 federal insurance limit, would have access to their funds beginning Monday.

In his remarks Monday, Biden promised that taxpayers would not bear the costs and the money would instead come from fees that banks pay into the federal Deposit Insurance Fund.

Biden also vowed to hold accountable those responsible for the collapse and said the bank’s shareholders would not be protected.

Biden blamed the bank collapses on former President Trump’s 2018 decision to loosen banking rules enacted in the wake of the 2008 financial crisis.

Silicon Valley Bank telegraphed that its securities holdings were underwater. Why didn’t the regulators act sooner?

“Unfortunately, the last administration rolled back regulations,” Biden said.

The president said he planned to ask Congress and bank regulators to restore the Obama-era rules.

Democrats were divided about the 2018 overhaul of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, with more liberal lawmakers including Sen. Elizabeth Warren (D-Mass.) warning the changes would put “American consumers at greater risk.”

Sixteen Senate Democrats and independent Angus King of Maine, who usually votes with Democrats, joined Republicans to vote for the bill. In the House, 33 Democrats joined all but one Republican in approving the measure. Florida Gov. Ron DeSantis, a possible 2024 presidential candidate who was a member of the House at the time, was among the Republicans who voted for the bill.

Although there was broad bipartisan support for the rescue of Silicon Valley Bank and Signature Bank customers Monday, some Republicans took the opportunity to slam the Biden administration for what they called a “bailout.” They included presidential candidate Nikki Haley and Missouri Sen. Josh Hawley.

Silicon Valley Bank failed late last week, prompting fears of wider upheaval. Here’s what you should know about the collapse and what comes next.

In the span of two hours on Capitol Hill Tuesday, the sharp split between liberal and moderate Senate Democrats on a major bank deregulation bill became crystal clear.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.