Weight-loss app Noom was all about mindfulness. Now it wants to sell you costly diet drugs

Noom Inc., a startup that for years has touted a psychological path to weight loss, is now ready to add drugs to the equation.

After a pilot last year, the company is launching its Noom Med option that will include prescriptions for obesity drugs such as Novo Nordisk’s Wegovy for about $120 a month. It’s the latest weight-loss company to join the lifestyle-focused industry’s push into using highly effective, costly GLP-1 obesity drugs to help customers slim down.

Noom is among a field of companies aiming to capitalize on the drugs that help people feel fuller and eat less with relatively few side effects.

Patients who took the highest dose of Mounjaro, a diabetes drug from Eli Lilly & Co. that’s in testing as an obesity treatment, lost an average of 50 pounds. Many onetime dieters see those results as far more reliable and easily obtained than from traditional habit-changing programs.

With the new category of drugs, “the weight-loss outcomes are so much better, and we listen to our users, our patients,” said Linda Anegawa, Noom’s chief of medicine. “Patients are asking, ‘How can Noom support us more?’”

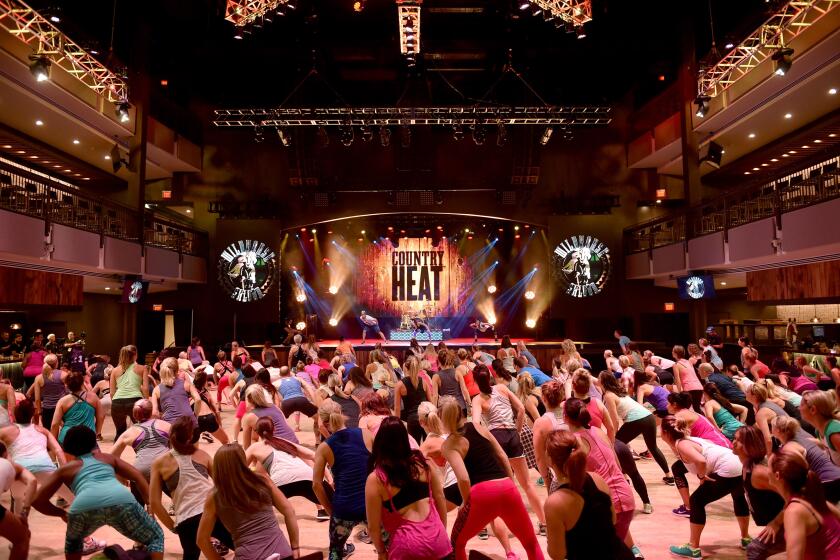

In a class-action lawsuit, exercise coaches for Beachbody allege they’re key to the company’s success but they’re not paid accordingly.

Traditionally, the weight-loss industry has favored behavioral interventions such as reduced-calorie diets and exercise programs over earlier medications that were often burdened with safety concerns or modest effectiveness. Now, players such as Noom see an opening to offer prescriptions alongside guidance on diet, behavior change and exercise.

Anti-obesity medicines “without a doubt have revolutionized this landscape for sustainable weight loss,” Anegawa said in an interview with Bloomberg Radio. “But for the millions of Americans taking these medications, lasting success is really not often achievable without having that anchor in behavioral change.”

Noom Med will be available initially in California and 31 other states, including New York and Texas, with plans to expand further. Along with GLP-1s — Novo’s Wegovy, Saxenda and Ozempic and Lilly’s Mounjaro — the program will offer cheaper, less-effective medications such as Currax Pharmaceuticals’ Contrave, which reduces food cravings, and metformin, a generic diabetes drug that’s also used for weight loss.

Since 2016, Noom has offered an app “powered by psychology” to help customers shed weight. The move into telemedicine pits it against a slew of other services, including a familiar rival: WW International Inc. — also known as WeightWatchers — whose shares soared in mid-April after it acquired telehealth obesity-drug provider Sequence. Other competitors include startups Calibrate, an early leader in the space, and Ro. Shares of WW International fell as much as 3.9% on Wednesday.

The proliferation of companies raises concerns about prescription oversight that earlier arose with some services providing medications for attention deficit hyperactivity disorder and erectile dysfunction. Medical supervision is crucial as side effects such as nausea and diarrhea are common with GLP-1 use, and the drugs are linked to rare risks such as pancreatitis. Patients with obesity commonly need care for other medical conditions that the telehealth firms aren’t set up to provide.

A pharma giant rebrands its diabetes drug for weight loss. But health plans’ coverage of Wegovy, at more than $1,300 a month, is not a sure thing.

Although dozens of companies are writing weight-loss drug prescriptions, obtaining GLP-1 drugs remains a challenge for patients.

Telemedicine platforms can cost about $100 to $140 a month, and often don’t include the cost of drugs. Insurance coverage is limited, a legacy of obesity being treated as an aesthetic issue, and without it, patients’ out-of-pocket costs can rise above $1,000 monthly.

Weight-loss medication customers will meet Noom’s providers in an initial video visit, with subsequent communication through text-based chats and the option of additional follow-up video visits. Noom said it will continue to pair medical interventions with its behavioral program, Noom Weight, and believes the approach is essential to lasting, healthful change.

“I can throw all the Wegovy at you in the world, but if you don’t have a comprehensive lifestyle program in place,” people can still gain weight, Anegawa said. “Nobody believes me, but they absolutely can.”

GLP-1 drugs are seen as the next top-selling chronic disease treatment, with the potential to transform care the same way cholesterol-lowering statins did for patients at high risk of heart disease more than 30 years ago.

You’ve read the stories about miracle weight loss drugs? The real miracle would be to stop blaming fat people for being fat.

The commercial potential is propelling drugmakers such as Novo and Lilly to the top of the U.S. and European markets. Investors are also eyeing Pfizer Inc.’s experimental danuglipron after a midstage study yielded positive results.

About 130 million American adults are eligible for treatment with the drugs under guidelines largely based on a person’s weight. For example, a 5-foot, 9-inch man who weighs 210 pounds would be eligible based on body mass index alone, a measure based on height and weight that’s used as a proxy for body fat.

Users who sign up for Noom and qualify for medication will now be offered the option of joining the new program. Noom clinicians will follow those criteria and consider other factors, including underlying medical conditions and lab testing results, Anegawa said. They can also work with patients to manage common drug side effects such as nausea and bloating, she said.

The company will aim to rely more on GLP-1 drugs that have been specifically approved for obesity such as Wegovy, she said; insurers are reluctant to cover diabetes drugs such as Ozempic that haven’t been cleared for weight loss.

“The cat is out of the bag on that,” she said. “Payers are really not allowing it anymore.”

The shift toward drug treatment for obesity could lead the way to more expansion at Noom, she said.

“We’re not specifically marketing ourselves at this time as a diabetes treatment or hypertension treatment yet,” Anegawa said. “But is that something we’re looking to for future iterations of this program? Quite possibly.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.