Caroline Ellison says Sam Bankman-Fried directed her to commit crimes

Caroline Ellison, the former chief executive of Alameda Research, told a New York court that Sam Bankman-Fried told her to commit crimes that led up to the collapse of the cryptocurrency exchange FTX.

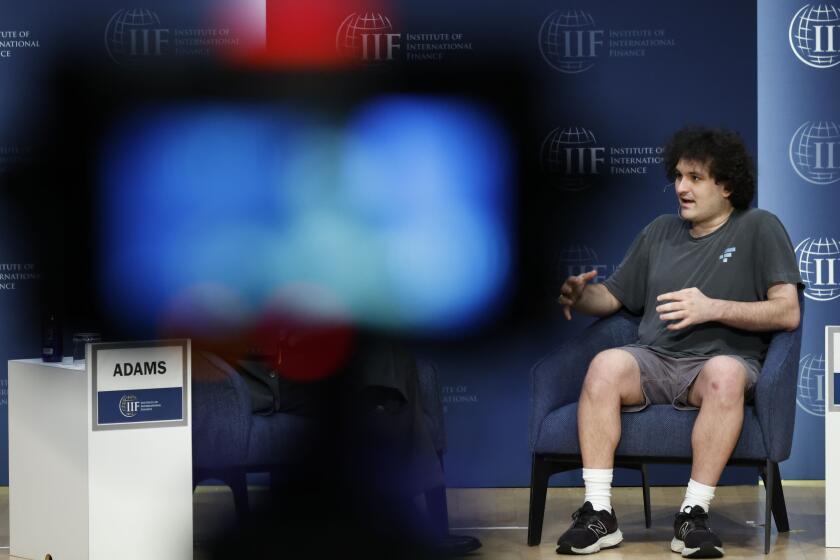

Ellison identified herself on the stand Tuesday and said that she first met Bankman-Fried when they both worked at Jane Street Group, and that the two of them later dated. When prosecutors asked her to point him out in the courtroom, she got up and said: “He’s over there wearing a suit.”

“He was originally the CEO of Alameda and the owner of Alameda and he directed me to commit these crimes,” Ellison said in her first public appearance since the companies collapsed. She added that “Alameda took several billion dollars from FTX customers and used it for its own investments” and to pay off lenders.

Ellison, 28, took the witness stand minutes after Gary Wang, the co-founder of FTX, finished his testimony. They are both among the star witnesses in the government’s case against Bankman-Fried, who is accused of orchestrating a scheme to fraudulently transfer funds to Alameda, creating a massive shortfall that led to both companies’ bankruptcies.

Prosecutors say she is one of the few people in Bankman-Fried’s inner circle who knows the truth behind the alleged siphoning of billions of dollars in FTX customer funds to the sister trading firm. She pleaded guilty and agreed to cooperate with federal prosecutors after FTX collapsed.

Prosecutors depict Sam Bankman-Fried as a calculated criminal who used investor deposits at crypto giant FTX as a personal bank account.

While being questioned by Bankman-Fried’s lawyers on the witness stand earlier Tuesday, Wang testified about more than $200 million in loans he received from Alameda that were used to fund venture investments by FTX in 2021 and 2022. He said he also received $1 million to pay the interest on the loans. He said he used about $200,000 of that to buy a house on the island of St. Kitts.

Jurors were shown a promissory note for a $35-million loan in April 2022, signed by Ellison as CEO of Alameda. Wang testified the loans were structured and presented by FTX lawyers. He signed the notes without questioning how the loans were structured, he said.

Bankman-Fried’s team claims the involvement of lawyers in the transaction undercuts government claims that he was using Alameda to conceal FTX investments and spending.

Wang was testifying for a third day at the trial of his former friend, Bankman-Fried.

Earlier Tuesday, Wang said that as late as June 2022, he was relieved that Alameda Research’s assets exceeded its liabilities and could repay lenders.

Later in the year, however, he questioned the notion that at least one calculation still showed that Alameda had a positive net asset value, shortly before both FTX and Alameda filed for bankruptcy.

Michael Lewis’ latest book, ‘Going Infinite,’ on Sam Bankman-Fried and the rise and fall of FTX, is well-timed, unsatisfying and surprisingly confusing.

“I’m not sure how accurate that was,” the 30-year-old Wang said in response to questions from Bankman-Fried’s lawyers.

Wang pointed out that some of Alameda’s assets included Serum and FTT, which were fairly illiquid if sold at large quantities. He reiterated his testimony from last week and said that in fact Alameda’s debt to FTX was at least $8 billion.

Wang testified that he began cooperating with prosecutors almost immediately after FTX’s collapse — even before he had any sort of formal agreement in place with the U.S. government.

Wang said he agreed to provide the government with information during a Nov. 17 meeting — just six days after FTX filed for bankruptcy. That was the first of five meetings over the span of about a month between Wang and prosecutors. He said FBI agents as well as staff from the Securities and Exchange Commission and the Commodity Futures Trading Commission were also present at the first meeting after FTX imploded.

Wang said he talked to the government about a variety of issues, including computer codes and the internal account that recorded the debt Alameda owed FTX from borrowing customer money. Wang received a cooperation agreement from the government in December, which included an agreement to plead guilty to four criminal charges.

The ridiculous story of Sam Bankman-Fried, FTX and cryptocurrency generally is aired in two new books, but only one is worth reading and it’s not by bestselling author Michael Lewis.

About two weeks after that first meeting between Wang and prosecutors, Bankman-Fried began an aggressive media push, denying he had knowingly committed any crimes. That included an interview with columnist Andrew Ross Sorkin at the New York Times DealBook Summit.

Wang told the court last week that Bankman-Fried sent out a tweet assuring investors that the cryptocurrency exchange and its assets were in good shape, when in fact the company was in dire straits.

On Tuesday, Wang testified that he discussed FTX’s loans to Alameda with Bankman-Fried as early as 2019. Bankman-Fried told him that the loans were fine as long as Alameda’s total value was positive, including FTX’s self-invented digital currency, known as FTT.

The managers of bankrupt crypto exchange FTX sued the parents of co-founder Sam Bankman-Fried to ‘recover millions of dollars in fraudulently transferred and misappropriated funds.’

“That made me think that it was maybe fine for Alameda to be borrowing funds,” Wang said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.