Are you the victim of identity theft? Here’s what to do

- Share via

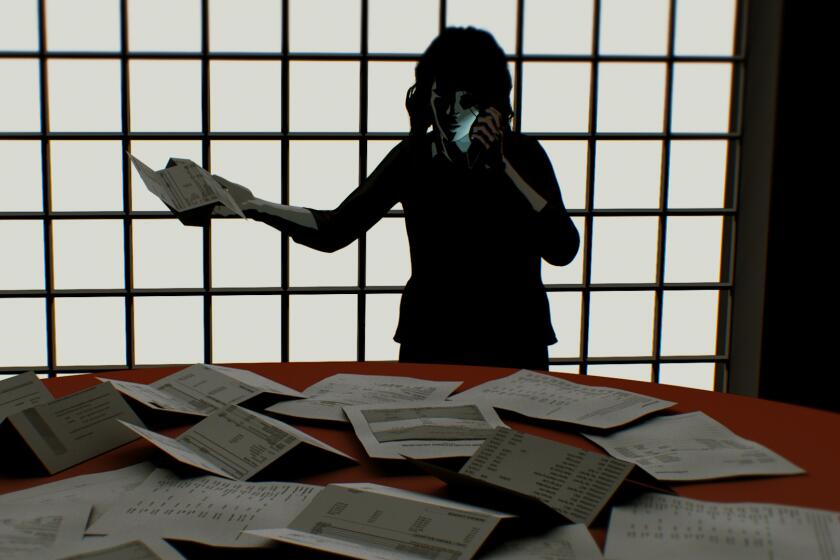

My identity was stolen. It was a nightmare. And it could happen to you.

There are a few different ways you can become a victim of identity theft. In my case, someone stole my wallet out of my purse and was able to obtain the rest of my information online. It can also happen if your mail is stolen, or if you’re a victim of a data hack.

If you think your personal information is being used fraudulently, here’s what you need to do.

Start taking notes

You need to be organized to fight this. Write down dates, any information you received in email or postal mail, what number you tried calling, the name of the customer service representative you spoke to, and the case or incident number they assign you at the end of your call.

Freeze your credit

Freeze and add fraud alerts to your files with the main credit bureaus (Equifax, Experian and TransUnion) and Chex Systems. This should prevent someone from being able to use your information to open new lines of credit or bank accounts.

Is identity theft insurance worth the expense? What do identity theft protection companies such as LifeLock and Aura do? Here’s what to consider.

Report it

File reports with the FBI’s Internet Complaint Center and with the Federal Trade Commission. These reports will serve as evidence to help defend yourself if fraudulent charges are made in your name. Visit complaint.c3.gov to file one. And the Federal Trade Commission runs IdentityTheft.gov, where you can also file a report and get started with a recovery plan. You can also contact the FTC about identity theft by calling (877) 438-4338.

Put banks in your speed dial

Contact the banks’ fraud lines. Reach out to any financial institution where you think a new account has been opened and let them know it’s fraudulent. One mistake I made was calling the general 800 number for the banks to do that. I ended up on hold for what seemed like a thousand years because I didn’t have “my” account number handy to punch in. Banks have fraud departments. Look up those numbers and call them instead.

A stolen wallet precipitates a reporter’s years-long fight against identity thieves — and a system that doesn’t care and won’t help.

For complicated cases

Some identity theft cases are more complex than others. If you need extra assistance:

Contact the Identity Theft Resource Center. The nonprofit advocacy group exists to help victims. Visit idtheftcenter.org or call (888) 400-5530 to get started.

File a police report. You are likely to get some resistance, like I did, from officers who are unwilling to take your report and unlikely to follow up. But having that report is another key piece of evidence so you won’t be on the hook for any of the thief’s activity. You are entitled to a copy of your report once it’s done, though you may have to jump through some hoops like going to the station again or sending a written request.

About The Times Utility Journalism Team

This article is from The Times’ Utility Journalism Team. Our mission is to be essential to the lives of Southern Californians by publishing information that solves problems, answers questions and helps with decision making. We serve audiences in and around Los Angeles — including current Times subscribers and diverse communities that haven’t historically had their needs met by our coverage.

How can we be useful to you and your community? Email utility (at) latimes.com or one of our journalists: Jon Healey, Ada Tseng, Jessica Roy and Karen Garcia.

More to Read

Totally Worth It

Be your money's boss! Learn how to make a budget and take control of your finances with this eight-week newsletter course.

You may occasionally receive promotional content from the Los Angeles Times.