Venture capital firms form pact to zero out greenhouse emissions

When consumer goods companies, financial institutions, cities and more rolled out bold promises to curtail carbon emissions a few years ago, one sector was conspicuously silent: venture capital firms.

Now, though, they’re showing up to the net-zero party — having spent the last two years thinking about it. A group of 23 firms announced on Tuesday the Venture Climate Alliance, an initiative to encourage early-stage investors to stop greenhouse-gas pollution and help the companies they fund do the same.

Member firms pledge to cut or net-zero out their own greenhouse gas emissions by 2030 or earlier, a time frame that is crucial to limiting global warming to 1.5 degrees Celsius. Their portfolio companies should aim to be net zero by 2050. The VCA includes general investors, such as Union Square Ventures, Tiger Global and DCVC, and firms dedicated exclusively to climate tech, including Clean Energy Ventures and Galvanize Climate Solutions.

So far, venture capital firms have taken a largely ad hoc approach to net-zero targets. Some firms are already confronting climate change head on while others are doing relatively little to track their emissions or invest heavily in climate tech.

“Venture in some ways got a pass, because either you’re already doing the work or you argue that you’re immaterial,” said Alexandra Harbour, principal at Prelude Ventures and founder and chair of the VCA. “What we saw was basically varying degrees of intensity and work, but all happening in a black box. There are some simple steps that we can take together as an industry.”

The VCA is striking a collaborative tone, eschewing requirements for either potential future members or portfolio companies themselves at this stage. “It’s really important for us that we’re not telling venture investors to change their investment thesis,” she said.

Let’s embrace the wildflower superblooms, abundant snowfall and roaring rivers while we’ve got them.

Putting together a band of interested firms is only the first step. Next, the investors plan to develop a methodology to reduce their emissions and reach net zero and best practices to encourage their portfolio companies to do the same. VCA members have been consulting with Project Frame, an initiative of the nonprofit Prime Coalition, to develop a structured way for venture capitalists to think about and quantify their emissions — and determine how to reduce them over time. That includes the role that carbon offsets — which have a spotty record — will play in ensuring their portfolios reach net zero.

The team wanted to take on a sectorwide approach to prevent a situation in which a climate framework developed for other industries creeps into their industry. Venture capital firms and their portfolio companies are small compared with the large institutions that stepped forward in the first wave of net-zero commitments beginning in 2020. They may not have the resources to factor climate change into their decision-making as easily as large financial institutions, such as those that started the closely followed Glasgow Financial Alliance for Net Zero in 2021. The VCA joins several other GFANZ subgroups as a “sector-specific alliance.”

“GFANZ spent a very long time creating a methodology to track emissions, and no such agreed upon net-zero alignment methodologies currently exist for venture capital,” said Jason Pontin, a partner at DCVC.

Harbour said she couldn’t think of an analogue to VCA, in which firms banded together to set out an industrywide methodology to take into the deep future. (A broader National Venture Capital Assn. was founded in the early 1970s.)

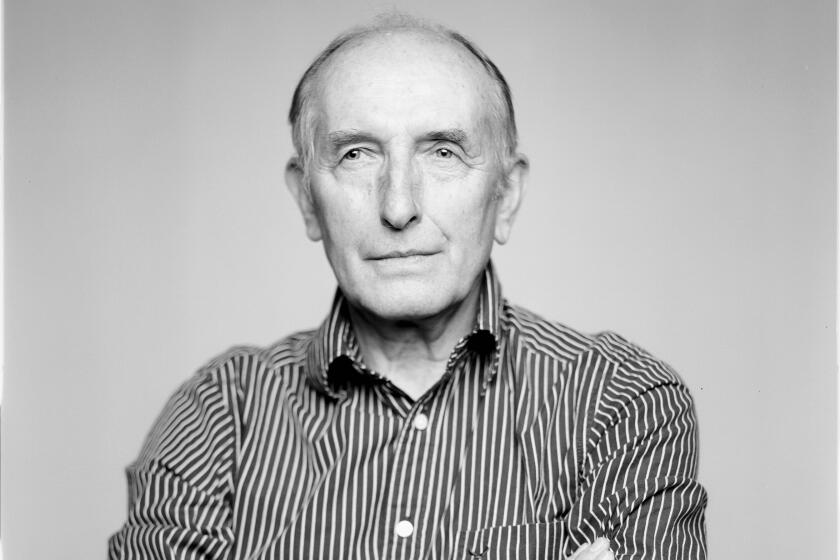

Prolific author and expert on the history of energy Vaclav Smil on why the transition from oil and gas will be tougher than most people think.

The next several years will only bring more pressure for startups to build climate considerations into their missions, even if the venture capitalists investing in them don’t expect the companies to decarbonize for some time. DCVC, a VCA founding member that counts climate tech as one of its main focus areas, will give its companies “a fairly long runway” for cutting carbon, and one that will offer hard decisions and trade-offs between growth and climate concerns along the way.

“Will there be tensions? I’m sure. That’s the challenge that every economic actor on the planet must solve,” Pontin said. “But decarbonization is happening remarkably rapidly, much faster than I would have anticipated.”

Climate tech has seen a dizzying rise in investments in recent years and has only begun to struggle against the headwinds other sectors have felt for many months.

High oil prices and rising interest rates make it an increasingly difficult environment for young companies and their backers, even in the previously red-hot climate tech space. Any economic storm will pass, though, and firms will still need to put in the work to decarbonize their operations and portfolios. Making a net-zero pledge is easy, said Daniel Firger, a co-founder, lead advisor and managing director at Great Circle Capital Advisors. “Net-zero performance is harder,” he added.