Diamonds, gold, luxury homes: Inside one L.A. family’s $18-million COVID-19 fraud

The Tarzana couple were returning from a Caribbean beach vacation last October when they ran into trouble.

On a layover in Miami, a passport scan flagged Richard Ayvazyan and Marietta Terabelian for extra screening. Customs agents led them away. Their luggage and phones were searched.

Ayvazyan was carrying credit cards in the name of “Iuliia Zhadko.” Terabelian had one belonging to “Viktoria Kauichko.”

The FBI had been investigating “Zhadko” and “Kauichko” for months — tailing suspects, rummaging through trash, poring over bank records. Agents suspected the names were aliases used to secure emergency pandemic relief loans for fake small businesses in the San Fernando Valley. Ayvazyan and Terabelian looked to be part of a family fraud ring not well skilled at covering its tracks.

After hours of questioning, they were arrested at 3 a.m. and jailed for the rest of the night.

So began the unraveling of one of the more lurid scams that swindlers across the U.S. mounted last year as the government raced to send trillions of dollars in emergency funds to businesses upended by coronavirus lockdowns. Some of the players would ultimately turn on their own family members in a scramble to dodge prison time.

Just three days after Congress approved an initial $2.2-trillion relief package in March 2020, “Zhadko” signed up for a $112,000 loan for “Top Quality Contracting.” The next day, “Kauichko” requested $150,000 for “Journeyman Construction.”

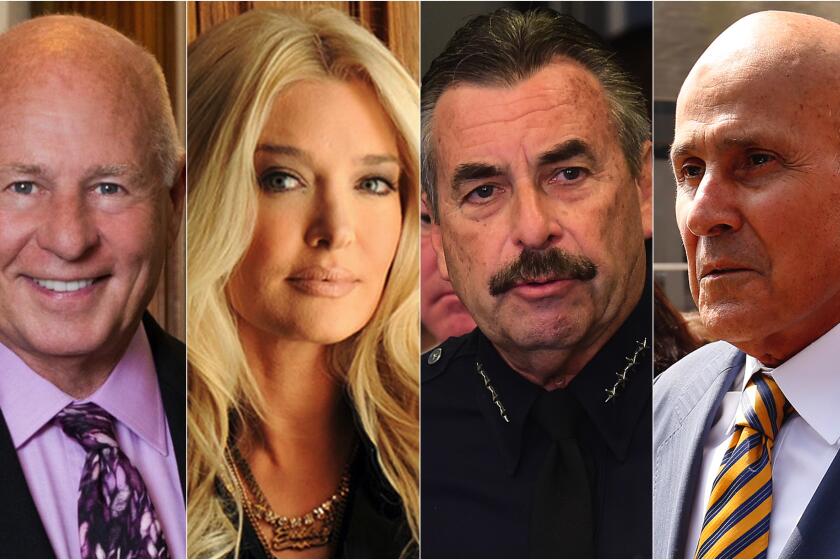

Two brothers and their wives allegedly bought houses and vacations with illegally obtained relief funds.

What followed was a torrent of loans to Los Angeles shell companies that used stolen identities, forged tax returns and fictitious payrolls to qualify for taxpayer bailout money, court records show.

By August, the group had applied for 151 loans to mainly sham businesses, some of them named after real ones. Fadehaus Barbershop collected $150,000; G&A Diamonds, $259,000; Red Line Auto Mechanics, $427,000.

On June 25, a federal jury in Los Angeles convicted Ayvazyan, Terabelian and two relatives of conspiracy to commit bank fraud, conspiracy to launder money, and related crimes. Four accomplices pleaded guilty on the eve of trial. All told, the ring of eight stole $18 million in emergency loans.

“That’s a through-line for you: They all made money,” Assistant U.S. Atty. Scott Paetty told the jury in closing arguments. “Stolen money.”

They spent it lavishly. In June 2020, Ayvazyan and Terabelian put $640,000 in pandemic disaster loans into their $3.25-million purchase of a hillside house in Tarzana — a Mediterranean-style villa with a panoramic view of the Valley.

Two weeks after the couple’s arrest, the 2.6-acre estate was the scene of an early-morning raid by FBI agents in combat gear.

As a SWAT team rolled up the long curving driveway in a convoy of trucks and Humvees, Terabelian, out on bail, dashed out the back door and hurled a grocery bag into the bushes, prosecutors say.

“Hands up!” agents brandishing rifles shouted as kids in pajamas emerged from the house with a dog and gathered on the swimming pool deck.

Agents fetched the grocery bag from the hedge and emptied it. Stacks of cash tumbled onto the lawn — about $450,000.

At the trial’s conclusion, the jury decided the government could confiscate the house, the cash, gold coins, diamond earrings, wristwatches and other property acquired with pandemic business loans that were supposed to save jobs.

One of the watches was a $35,000 Rolex that Ayvazyan bought while on holiday in the Turks and Caicos Islands.

::

The family turmoil spilled into the open when Artur Ayvazyan, 41, Richard’s younger brother and codefendant, took the witness stand. He blamed much of the scam on his wife, Tamara Dadyan.

A brassy real estate broker with a fondness for calling people “idiots,” Dadyan, known as Tammy, had already named her husband and his brother as two of her co-conspirators when she pleaded guilty to three felonies in the COVID-19 loan fraud.

The core operations of what prosecutors called “an assembly line of fraud” took place in Dadyan’s home office at the couple’s gated house off White Oak Avenue in Encino.

In a search of the house, federal agents found a stash of fake driver’s licenses and Social Security cards, along with fraudulent loan applications and checks and credit cards in the names of stolen identities.

The marriage of Artur and Tammy was strained long before they called each other criminals. They slept in separate bedrooms and briefly separated, reuniting only for the sake of their two daughters, Artur told the jury.

By his account, shenanigans were happening only on Tammy’s side of the house. He said he ran his own towing and freight business out of his briefcase and trucks — an 18-wheeler and a few tow trucks — and rarely ventured into his wife’s home office.

“I go in there from time to time to make copies, faxes — that’s it,” he testified. “I’m very independent.”

Asked to explain photos of fake IDs found on his phone, he denied responsibility, saying it was “most likely my wife” who took them.

His lawyer, Thomas A. Mesereau Jr., showed him a slew of handwritten documents seized from the home, some of them listing stolen IDs used in loan applications.

“Do you recognize the handwriting on that document?” Mesereau asked over and over.

“I do, sir: my wife Tammy’s,” Artur responded.

His business was “devastated” by the pandemic, he said, so he asked his wife if he might qualify for a government loan.

“She says, ‘Yes, I’ll take care of it.’ I said ‘OK,’” he testified.

He claimed that Tammy never showed him the applications she filed on his behalf with payrolls listing fictitious employees.

Once loan deposits started landing in his bank account, he said, it was more than he expected: first $10,000, then $125,000 and, finally, $150,000. He recalled spending some of it on truck repairs, tires and permits but conceded he also bought himself a $24,000 Harley-Davidson motorcycle.

Under the Paycheck Protection and Economic Injury Disaster Loan programs, government aid could be used only to pay business expenses, such as payroll, rent and utilities. Spending for personal benefit was not allowed.

Artur also admitted to sending $93,000 of his loan money to an escrow company to help his brother and Terabelian buy their house in Tarzana. He said he was repaying some old loans from his brother, including one that he used around 2009 to start a short-lived seafood business in Louisiana.

“I was not doing anything wrong paying back my brother,” he said.

Mesereau, who once represented Michael Jackson, urged the jury not to blame his client for his wife’s wrongdoing.

“There is no guilt in America because your spouse is crooked,” he said.

The jury found Artur guilty on 21 counts of bank fraud, conspiracy and other crimes.

After their federal sentencing, now set for September, the Ayvazyan brothers and Dadyan face a state trial on mortgage fraud charges unrelated to the pandemic.

::

Rich and Art, as they are known among family, were born in Armenia, when it was part of the Soviet Union. They spent their early boyhoods there, then immigrated to the United States in 1989 with their single mother and 10 other relatives.

After settling in North Hollywood, the family moved to what Rich once described in a court filing as “a rather bad section of Van Nuys.” Their mother found work sewing in a garment factory.

The boys spoke no English and weathered a tough adjustment to L.A. public schools. It took Rich some time to catch on that “a supposed Armenian friend” was deliberately mistranslating things as a joke.

Mustafa Qadiri is suspected of misusing $5 million in pandemic relief loans to buy luxury sports cars, take lavish vacations and cover his personal expenses

After finishing high school, Rich got a job as a bank teller at a Wells Fargo branch. It did not last long. At 20 years old, he was arrested for grand theft in a scam involving fake checks. He eventually broke into the real estate business, but his criminal record made it hard to establish himself.

Ayvazyan met Terabelian at a party in 2001. They married a couple of years later and went on to have three children. For a time, Terabelian ran a kids’ hair salon in Sherman Oaks.

Legal trouble struck again in 2011: The couple were arrested for submitting fake tax returns to get a $500,000 line of credit on their house in Encino. After they pleaded guilty to mortgage fraud, their lawyers, seeking leniency at sentencing, faulted banks for their loose lending standards. Both were spared prison time.

“My purpose was not to make an illegal profit, but to provide my family and myself with a fine place to live,” Ayvazyan told U.S. District Judge Cormac J. Carney in a letter.

“My own sense of guilt and shame over what I have done,” he wrote, “is magnified a hundred times when I look into the eyes of my children.”

::

A decade later, the children, now teenagers, listened raptly from a courtroom bench as prosecutors laid out the evidence of their parents’ crimes in the COVID-19 loan scam.

Much of it was built on text messages between their father and aunt, Dadyan. The typo-ridden dialogue between “Rich” and “Tammy” laid bare how the group exploited the relief programs with ruthless efficiency to get loans before the money ran out.

In her plea agreement, Dadyan admitted what they were texting about: using fake payrolls and falsified employer identification numbers to pass their companies off as legitimate.

In one text, Rich directed Tammy to a loan website, telling her to go there “right now and apply they are approving and closing within 24 hours.” He advised her to adjust a single digit in the employer ID number for each business.

“Ya just change your EIN by one number,” he told her. “I did 7 apps last night and 4 of them got email that it’s funded.”

When Tammy asked Rich to “send me the statement from ur payroll,” he mentioned an account he’d opened under the stolen identity of “Iuliia Zhadko.”

“Use the bank statement I gave you for iuliia,” he wrote. He went on to mock Wells Fargo’s vetting of applicants: “They don’t check for s**t Tam. It’s all automated.”

Subscribers get early access to this story

We’re offering L.A. Times subscribers first access to our best journalism. Thank you for your support.

The group often used the names of Eastern Europeans whose identities had been stolen from visas while they were studying in the U.S., prosecutors told the jury. Bank accounts were opened in their names, but controlled by Rich, Tammy and their fellow grifters. The names were listed as applicants for loans to sham businesses.

Still, the inventiveness went only so far. Multiple shell companies submitted identical payrolls, claiming eight, 11 or 22 employees.

“They use the same numbers to the penny, and they do it over and over again,” Christopher Fenton, a Justice Department trial lawyer, told the jury.

Rich and Tammy sometimes sent each other photos of fake loan applicants.

“Is this a dude’s face one u used?” Tammy asked Rich. “I didn’t use this one the one I have is the same one this guy changed the numbers on I don’t want to give all same exact numbers.”

“Ya don’t use all same,” Rich answered. “I have like 3 different ones.”

They joked about using the identity of a dead man in Armenia.

“Let’s go the fool is dead on armo land,” Tammy wrote.

While working as a watchdog for the public, Tom Layton spent hours advancing the interests and political connections of one lawyer with a long record of misconduct complaints, emails obtained by The Times show.

One of Ayvazyan’s most brazen crimes was stealing the identity of his wife’s late father, Nazar Terabelian. Five days after the man’s death in July 2020, his name was listed as the applicant for more than $500,000 in emergency COVID-19 loans for Mod Interiors, a fake business named after a real one.

More than $400,000 from that loan was spent on furniture, diamonds, jewelry and gold coins for Ayvazyan and Marietta Terabelian, prosecutors said.

A pandemic loan was also used to pay a mortuary’s $8,500 bill for Nazar Terabelian’s funeral.

::

In June 2020, federal auditors detected something amiss in the loan applications filed by “Zhadko” and others in L.A.: They were using similar types of phony documentation and fake IDs. The scale — and sloppiness — of the fraud became apparent as investigators dug deeper.

Agents checked the Encino address that “Zhadko” listed in his application for a $150,000 loan to Time Line Transport. It was the home where Ayvazyan and Terabelian lived until they upgraded to the Tarzana house.

Investigators used bank records to trace the spending of the Time Line Transport loan: Ayvazyan used $110,000 for the down payment on the Tarzana house. They discovered that his wife too had diverted pandemic loan proceeds — about $250,000 — to the house purchase.

Federal agents tracking other COVID-19 relief loans discovered $239,000 had been put toward a purchase by “Zhadko” of a $1-million house in Glendale. A check of the house’s utility bills showed who was paying them: Terabelian’s mother.

Closing documents on the Glendale house sale listed a dead man, Olaf Landsgaard, as the lawyer for “Zhadko.” And agents staking out the property spotted Dadyan visiting in a black Mercedes-Benz SUV that was registered to another Terabelian relative.

Federal agents tracked yet more pandemic loan money to a third house bought in the name of “Kauichko”— this time in Palm Desert.

When Geffrey Clark, a criminal investigator at the Internal Revenue Service, drove around the San Fernando Valley checking business addresses that the group listed in their loan applications, he found no sign of Journeyman Construction or Fiber One Media. He looked for Time Line Transport in Woodland Hills.

“The business wasn’t there,” Clark testified.

By the time Ayvazyan and Terabelian left for the Turks and Caicos Islands, prosecutors decided they had enough evidence to arrest them. Unaware the scam was about to end, Ayvazyan texted Dadyan about “Zhadko” loans from the resort where he and his wife were lounging about, along with a photo of the white-sand beach and wind-swept turquoise waters.

Around the same time, Justin Palmerton, an FBI agent in L.A., asked customs agents in Miami to stop the couple for interrogation on their way home — a move that would later cause trouble for prosecutors when a judge found their phones were improperly searched at the airport.

The next morning, Terabelian made two quick calls to unnamed people from the Broward County Jail in Fort Lauderdale. Switching between Armenian and English, she asked for help hiring a lawyer, then made a clumsy attempt to cover up her family’s misdeeds.

“Try to clean the house as much as you can,” she said. “Everything.”

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.