Column: They each lost almost $80,000. How to avoid becoming the next scam victim

Neal checked his email one day and saw that he was being charged several hundred dollars for a software subscription he didn’t want.

The 79-year-old Brentwood retiree called the phone number in the email and allowed a stranger to take remote access of his computer to “fix” the problem. Within 24 hours in late January, two wire transfers from Neal’s Los Angeles bank account ended up in Hong Kong, with Neal having been duped into believing the payments were to correct accounting errors and make him whole.

California is about to be hit by an aging population wave, and Steve Lopez is riding it. His column focuses on the blessings and burdens of advancing age — and how some folks are challenging the stigma associated with older adults.

Just like that, he’d lost $79,500, nearly wiping out an account he and his wife had intended as a down payment in a retirement center.

“Makes me ill, just thinking about this,” said Neal, who is kicking himself because he used to work in financial services and should have known better. He later realized the email was from a personal account rather than the software company he thought he was dealing with. Neal told me he was going through a tough time and not thinking clearly when he fell for the scam.

Mrs. K., a retired educator living in the downtown L.A. area, was shopping online for a car several weeks ago when she got reeled in. The scam began with a pop-up alert about a computer virus and instructions to call a number to get the problem resolved.

Over the next three days, thinking she was following instructions from bank fraud investigators and federal agents, Mrs. K. withdrew piles of $100 bills from her bank account, put it in her purse, then stuffed tens of thousands into bitcoin machines at a Highland Park doughnut shop and two nearby locations.

“Talk about stupid,” said Mrs. K., who is 80 and chalked up her misfortune to a desire to do the right thing.

And now she’s out $75,000.

Neal and Mrs. K. asked that I not use their full names — they’re embarrassed by how easily they were duped and reluctant to share more personal information with anyone.

“I still can’t believe I did this,” Neal said.

“It’s a wonder I didn’t get killed,” said Mrs. K., who pulled wads of $100 bills from her purse at the three bitcoin deposit machines as strangers watched.

But Neal and Mrs. K. have lots of company, and the scams can be more subtle than what they experienced. Your Social Security number, credit card data or various forms of personal identification get stolen, and suddenly you’re seeing charges for goods and services you didn’t purchase.

“We’re getting 400 to 500 calls daily,” said Amy Nofziger, director of victim support at AARP’s Fraud Watch Network.

Theft targeting older adults is “big business,” Nofziger said, with sophisticated domestic and international schemes. Not that it’s any consolation to Neal or Mrs. K., but Nofziger said that in 21 years of fraud investigations, she has encountered “very intelligent and successful” victims, including doctors and lawyers. Crypto crimes like the one Mrs. K. described are common of late, Nofziger added.

The FBI’s Internet Crime Center reported in May that 88,000 victims over the age of 60 lost $3.1 billion in 2022, an 84% increase from the previous year. (Losses to victims of all ages topped $10 billion.) And authorities say much of elder abuse doesn’t get reported, so the actual total could be far greater.

“Disconnect from the internet and shut down your device if you see a pop-up or locked screen,” the FBI advised in a May 10 warning. “Pop-ups are regularly used by perpetrators to spread malicious software. … Be cautious of unsolicited phone calls, mailings and door-to-door service offers.”

“It’s definitely happening more,” said Rafael Carbajal, director of L.A. County’s Department of Consumer and Business Affairs, who saw an uptick in fraud attempts during the pandemic, when more people were learning to handle banking and other tasks online. “And these are becoming more and more sophisticated. More people live online, with more data and information available to these crooks, who are taking advantage of people.”

Another example of the perils of growing old comes to us from Bloomberg, which reports problems with an app called Papa. The app can be used for clients (“papas”) to summon workers (“pals”) for companionship or to perform chores and run errands.

What could go wrong, right?

As Bloomberg reports, pals have been accused of “stealing, harassing, getting naked.” But it goes both ways, with pals complaining that papas have “tried to kiss or fondle them, or that their residences were covered in feces or infested with roaches or, in one instance, home to an alligator.”

Bloomberg reported that Papa “disputed the suggestion that it’s lax on safeguards.”

There is no disputing that anyone with a phone or computer has to be on guard at all times. On June 15, as I was pulling up to St. Barnabas Senior Services in MacArthur Park for a seminar on elder abuse and consumer fraud, I got a phone message informing me that my past-due tax debt (I don’t actually have one) had been lifted, and I should call an 866 number immediately for guidance.

This trick is somewhat less menacing than the one in which I was warned, multiple times, that I’d be arrested if I didn’t call immediately to resolve a tax bill.

At the St. Barnabas seminar, an attendee named Martha Lopez showed me a call — labeled “spam risk” — she’d received just a few minutes earlier and said she frequently gets suspicious messages. The center’s receptionist, Linda Brown, said she had just received and deleted a phone message, purportedly from U.S. Bank, telling her that $1,900 had been withdrawn from her account and she should call immediately for help.

“And I don’t even have an account with U.S. Bank,” Brown said.

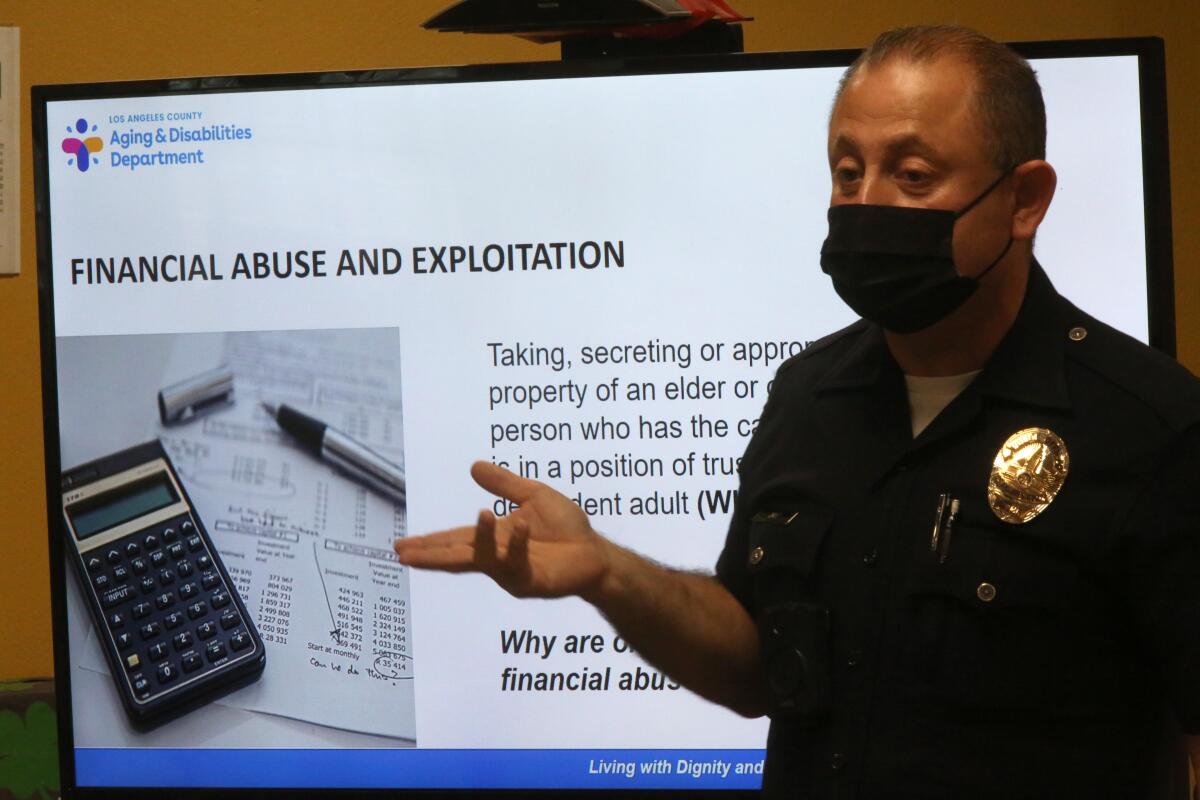

At the seminar, LAPD Senior Lead Officer Carlos Diaz and Det. Albert Smith, along with Evelia Gonzalez, a manager in L.A. County’s Aging & Disabilities Department, covered the basics of physical and emotional elder abuse as well as financial scams, all of which can be orchestrated by acquaintances or even family members, in addition to strangers.

As for the latter, “Don’t give anyone any information,” said Gonzalez, and don’t answer phone calls from unfamiliar numbers. She warned the St. Barnabas gathering of lottery scams, in which people are told they need to pay the taxes upfront to claim jackpots or new cars, and of romance scams, in which suitors are after something other than a relationship.

At the seminar, “fraud alert” literature from the L.A. County district attorney’s office warned of door-to-door home-improvement scams, charity scams, gift card scams, auto collision scams and prescription drug scams.

And then there’s the scurrilously under-handed ripoff in which a grandparent gets a call saying a grandchild has been involved in an accident or some other emergency, and money must be wired immediately. To make such pleas more convincing, the swindlers might dig up information about the “grandchild” on social media, or artificially replicate the voice of the grandchild.

As Neal and Mrs. K. have discovered, once you’ve been ripped off, it can be difficult, if not impossible, to get your money back. They each have accounts at Chase and wonder why their bank representatives didn’t suspect something was amiss when they made such large withdrawals — especially all cash, in the case of Mrs. K.

A Chase spokesman said the bank can’t discuss individual clients. Neal and Mrs. K’s losses are “heartbreaking,” he said.

If a customer is coached on withdrawals and how to explain them, that’s a red flag, and Chase says it provides a document warning customers to be aware of wire scams because “once the wire is sent, you may not be able to recover your money.”

“We urge all consumers to ignore phone, text or internet requests for money or access to their computer or bank accounts,” Chase said. “Legitimate companies won’t make these requests, but scammers will.”

When Neal realized he’d been had, Chase attempted to recall funds wired to Hong Kong but was unsuccessful. In Mrs. K.’s case, when she withdrew the first $25,000, she told a bank rep she needed the money for home improvement projects. She used a deposit code provided by her scammers and was directed to the nearest bitcoin machines, where her money went into digital “wallets” to which the bank does not have access.

Neal has reported his theft to the FBI. Mrs. K. went to local police, at her bank’s suggestion, and a relative reported the crime to federal authorities.

One problem with these ripoffs is determining which agency to notify, but here are some options: Try your local police department; the L.A. County Department of Consumer and Business Affairs, at 800-593-8222; the Federal Trade Commission, at 877-382-4357; the FBI’s Internet Crime Complaint Center, at www.ic3.gov; and the AARP Fraud Watch Network, at 877-908-3360.

You can also tell it to Golden State by dropping me a line at steve.lopez@latimes.com

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.