How will the Baltimore bridge collapse affect prices and the West Coast?

The collapse of the Francis Scott Key Bridge and the closure of the Port of Baltimore this week could have far-reaching implications all the way across the country for the ports of Los Angeles and Long Beach, according to several experts.

The bridge collapsed Tuesday about 1:30 a.m. when the Dali, a 985-foot-long cargo ship en route to Sri Lanka, crashed into one of the bridge’s support pillars shortly after losing power. It sent a majority of the bridge plummeting into the 50-foot-deep Patapsco River below, claiming the lives of at least two construction crew workers on the bridge; four others are missing and presumed dead.

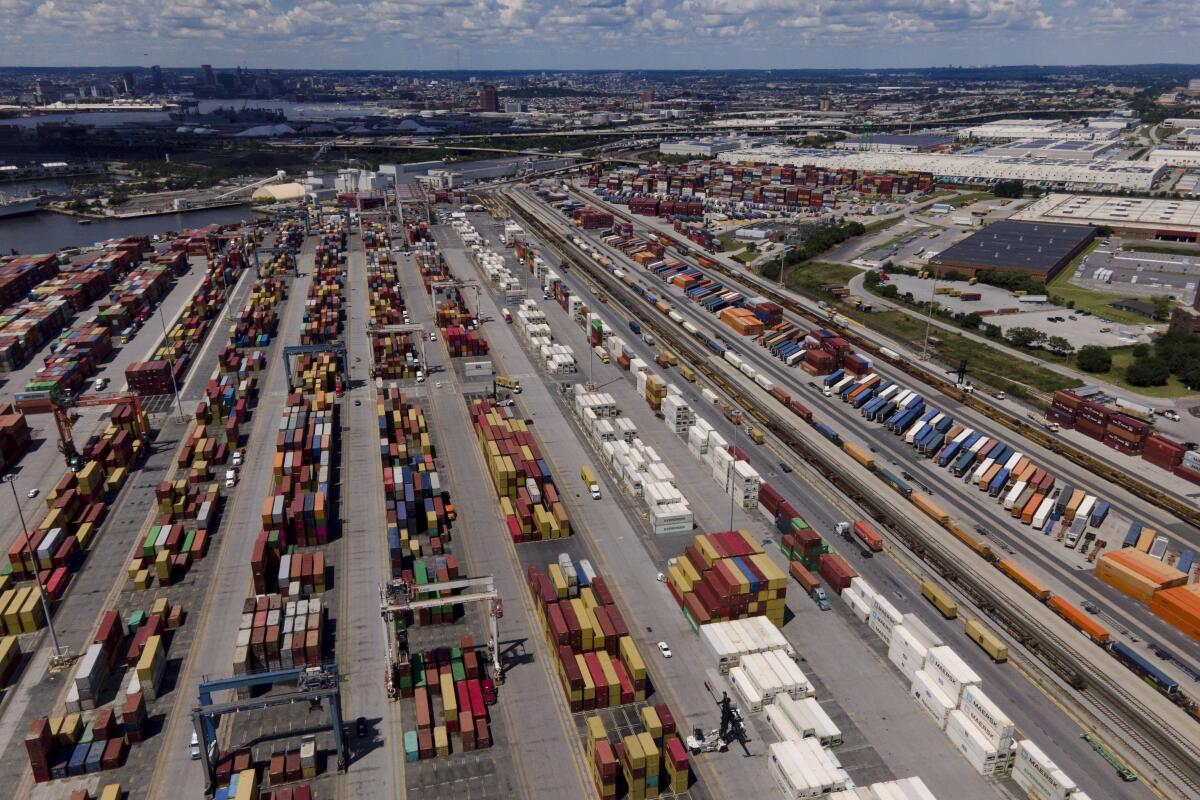

In the short term, the closure of the Baltimore port will increase costs for businesses and consumers on the East Coast, said Lisa Anderson, founder of LMA Consulting Group, which specializes in supply chains and manufacturing. That’s because the container ships on their way to Baltimore will be diverted to nearby New Jersey, Pennsylvania and Virginia ports, and the products they’re carrying will have to change the arrangements previously made to be transported to wherever they need to go, Anderson said.

The closure will also affect warehouses and other logistics services, which will have to decide whether they want to switch to other facilities while officials work on reconstructing the bridge and reopening the port, Anderson said. Trucks will also have to be diverted from the Key bridge, meaning they’ll either have to go around the city or pass through tunnels, which have height, width and hazardous materials restrictions.

Experts say the Baltimore collapse does not expose significant vulnerabilities in the major bridges near ports across California. The ports of Los Angeles and Long Beach handle about 40% of U.S. container imports from Asia.

Longer term, ports in Los Angeles and Long Beach could see more activity, especially with drought conditions reducing the capacity of the Panama Canal, Anderson said. The shipping route from northeast Asia through the Suez Canal and to the East Coast of the U.S. has also become perilous because of the war in Gaza. The Iran-backed Houthis in Yemen have been attacking commercial ships going through the Suez Canal, resulting in shipping lines having to divert their vessels around the southern tip of Africa.

What that means is that the ports of Los Angeles and Long Beach will see an increase of volume, translating to more activity for trucking companies as well as for warehousing and rail systems, Anderson said.

“That’s a positive, but we also need to make sure it’s not gonna become a new bottleneck,” she said. “These folks are adding time to their orders so they have to find new routes and we wanna make sure we’re prepared to service this additional volume.”

The closure of the Baltimore port could also lead to a “nominal” uptick in costs for the products that typically arrive there, such as cars and light trucks, Anderson said. The costs of diverted transportation will eventually be passed on to customers, but it’s not expected to be significant across the U.S., she said.

Prices could also go up because it’s currently the contract negotiation season for big retailers and logistics companies, and contracts for the whole year will be finalized in the next two to three weeks, said Robert Khachatryan, chief executive of Freight Right in La Crescenta.

Southern California’s twin ports could see more freight business as shippers seek new routes away from problems at the Suez Canal and the Panama Canal.

Disruption gives pricing power to the shipping companies, which could lead to higher rates in the contracts, Khachatryan said. Because the port closure also resulted in vessels being stuck and diverted, there is also a scarcity of vessel space.

“The carriers had a stronger hand negotiating in the last few weeks. Walmart, Target, they were pushing back on not signing higher rates, but the Baltimore disruption will force their hand to agree,” he added. “It’s not gonna be anything like COVID but it might be a few hundred dollars more per container, which is about a 10% to 15% increased cost in freight.”

The disruption could also mean that shippers might rethink their import strategies for the next six months to a year, especially because it could take several months to more than a year to get the Port of Baltimore back into commission, according to Alex Cherin, former Port of Long Beach managing director for trade.

“Depending on fuel prices, if it’s coming from Europe through the Suez Canal, they might save more if other East Coast ports can accommodate cargo, or the rail rates from the West Coast could be a better bargain,” he said. “It’s a pretty fluid situation. In the next three to six months, you’ll see some trickle-down into the Gulf Coast and West Coast ports.”

It’ll also depend on the type of cargo that’s being shipped, Cherin said. Because Baltimore handled a lot of automobiles, some East Coast ports might not have the infrastructure or capacity to handle those products. Baltimore has been the top U.S. port for passenger vehicles, handling 11% of those imports in 2023, Forbes reported.

Follow a container of board games from China to St. Louis to see all the delays it encounters along the way.

Gulf Coast and western ports, such as those in Los Angeles and Long Beach, have more capacity for specialty containers and bulk goods, Cherin said. Shippers might opt to go with them because they can handle roll-on/roll-off ships — as Baltimore could — which are designed to carry cars, trucks, buses, trailers and other vehicles.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.