The $400-million-plus reason your favorite TV shows are exiting Netflix and maybe Hulu

The finale of the hit sitcom “Seinfeld” aired on May 14, 1998, and has been ubiquitous in reruns on cable and local TV stations ever since.

But more than 20 years later, its 180 episodes will soon become one of the hottest properties in television again. The streaming rights for “Seinfeld,” which has been available for streaming on Hulu since 2015, will be back on the market soon just as media conglomerates Comcast, WarnerMedia and Walt Disney Co. look to shore up content for their new direct-to-consumer streaming services aimed at taking on Netflix.

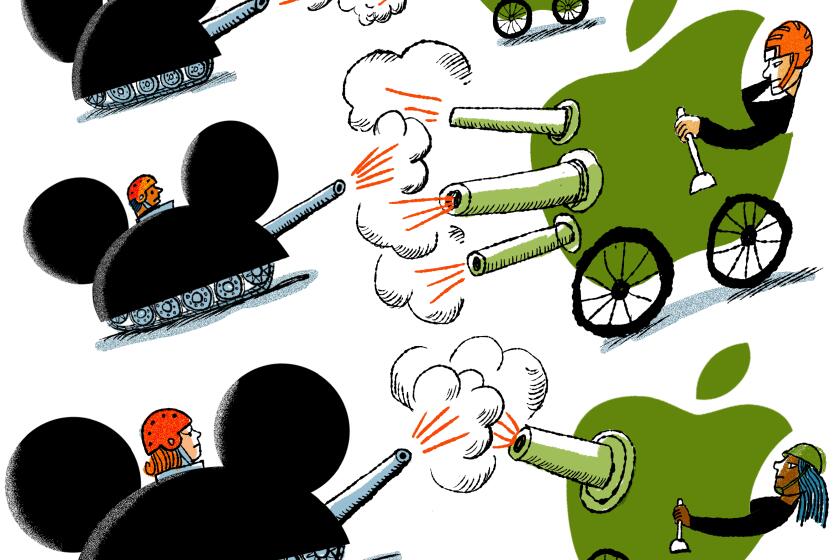

The demand for the 30-year-old series is the latest example of how streaming has altered not only viewing habits, but also unlocked the value of long-running TV shows that first became hits on the broadcast networks. With nearly 500 scripted TV shows currently in production, iconic shows from the pre-streaming era such as “Seinfeld,” “Friends” and “The Office” have become the heavy artillery used on the next front of the streaming wars.

Disney takes on Netflix, as HBO Max, Peacock, Apple TV+ and Quibi prepare to enter the streaming fray. Not all will be able to thrive in the increasingly crowded market, analysts warn.

After seeing Netflix eat away at their TV businesses, legacy media companies are targeting the streaming rights for shows that became hits at their studios and networks. And with good reason: They are proven entities that have the ability to capture a younger generation of viewers. Prying them from Netflix could force the streaming behemoth to depend more on original series, which are riskier and more costly to market at a time when the company’s subscriber growth has topped out in the U.S.

“The industry is reducing the odds that Netflix is a TV replacement as all this catalog content is removed,” said Michael Nathanson, senior research analyst at MoffettNathanson LLC. “They are now more like a premium channel on steroids. I’d expect that they would be competitive in their attempts to land ‘Seinfeld.’”

Netflix may soon get its chance. Hulu’s rights expire in 2021, but Sony Pictures Television, which handles the distribution of “Seinfeld,” is expected to start soliciting bids in the next few weeks.

“We’re getting a lot of calls about it,” Sony Pictures Television chairman Mike Hopkins told The Times in a recent interview. “We’re probably going to go out there with it sooner than we would have because there is so much heat on it right now because of the marketplace. I think it’s something a lot of other people will want.”

While Netflix is often heralded for its distinctive original programs, its two most-watched shows in 2018 were “The Office” and “Friends,” according to Nielsen. Other hits in the top 10 included ABC’s long-running medical drama “Grey’s Anatomy” and the CW’s durable sci-fi thriller “Supernatural,” both of which have been churning out episodes for the last 15 years.

The trend did not go unnoticed by media conglomerates as they planned to take on Netflix at its own game. NBCUniversal outbid Netflix to get the streaming rights to “The Office” — a show owned by its TV studio — for its new direct-to-consumer service scheduled to launch next year, paying $500 million for five years.

The years-old streaming skirmish has now become a pitched battle — for talent, for money, for your time and your eyes— as Apple, Disney, HBO and NBC to enter the fray with major subscription services.

WarnerMedia paid a reported $425 million over five years to get Warner Bros. Telvision’s “Friends” away from Netflix and now plans to offer it on its streaming service HBO Max, set to launch in spring 2020.

“Seinfeld” will likely command a price in the same range as “The Office” and “Friends,” according to several network and studio chiefs. WarnerMedia, Comcast and Netflix are all expected to compete for the sitcom along with Hulu (which paid what at the time was considered an eye-popping figure of $160 million in the five-year deal made in 2015).

“The Big Bang Theory,” the long-running hit CBS sitcom produced by Warner Bros. Television that finished its 12-year run in May, will also likely fetch a comparable sum. HBO Max is in talks to license both “Big Bang Theory” and “Two and a Half Men,” Deadline reported.

Why are companies willing to break the bank for streaming rights to shows that have been readily available to viewers for years? They may be repeats to fans who first experienced them during their network and syndication runs, but viewers under age 35, whose viewing of broadcast and cable TV has dropped dramatically over the last five years, are discovering them on Netflix as if they were new.

“The Office” is a prime example. The series, which finished its network run on NBC in 2013, was not a big success when its repeats were syndicated on local TV stations, where sitcoms shot with a single camera and without a studio audience have rarely performed well.

But millennial-aged Netflix viewers connected with the show’s depiction of workplace life — and also likely recognized its stars Steve Carell and John Krasinski through their feature film work. They gravitated to “The Office” and stuck with it. The program’s popularity is driven by a relatively narrow slice of devoted subscribers who watch most of its 201 episodes, people involved in the program said.

Using library content to build a new TV platform isn’t new. When cable channels proliferated in the 1980s and ’90s, old broadcast network series were their lifeblood. “The Andy Griffith Show,” the biggest hit sitcom of the 1960s, was among the most popular shows on TBS. Repeats of NBC’s addictive procedural crime drama “Law & Order” turned A&E into a viewer destination.

Streaming was an immediate boon to serialized dramas that had little value in syndication after their initial network runs. But for sitcoms, it adds to an already massive pot of money generated by sales to cable networks and TV stations. “Friends” generates a reported $1 billion a year in syndication revenue. “Seinfeld” had taken in $3.1 billion in syndication revenue from 1995 through 2014 and is still a strong TV ratings performer for TBS and local stations.

“The Office” demonstrated Netflix’s ability to introduce viewers to shows they missed on traditional TV. AMC’s “Breaking Bad” had low ratings and was nearly dropped by its network before a legion of fans found it on Netflix. More recently, a second-season renewal for the current CW series “All American” was uncertain until the network’s executives saw how well episodes performed on the service.

But the power of “The Office” or “Friends” to be a draw for an entirely new streaming service is untested. While WarnerMedia and NBCUniversal will have a substantial array of programs to launch their services, Netflix is still synonymous with the streaming experience. Disney — which will pull back all of its movies from Netflix by the end of the year for its own streaming service — is considered better positioned as its brand name is so recognizable to consumers.

“People found ‘The Office’ on Netflix — they didn’t buy Netflix for ‘The Office,’” said one veteran TV producer who does business with the streaming company and did not want to speak on the record. “[Netflix Chief Content Officer] Ted Sarandos believes the platform was just as valuable as the product,” the producer said.

Netflix declined to comment for this story.

The Los Gatos-based company, which is building a large presence in Hollywood, is a one-stop-shopping streaming experience for many viewers. The concept of getting consumers to pay monthly fees for multiple services as their favorite shows spread out among them is one of the challenges new entrants face.

Still, the emerging competition is not something Netflix can ignore.

Sarandos has said publicly that Netflix fully anticipated other entertainment companies getting into the streaming business and that it would have to eventually wean itself from outside program suppliers — a major reason why the company invested $12 billion on content in 2018 and is investing $15 billion this year.

During the company’s second-quarter earnings call, Sarandos noted that its subscriber base continued to grow after losing all of its programming from Fox and Nickelodeon in recent years.

The company reported a loss of 130,000 subscribers in the U.S. last quarter — the first downturn since 2011 — attributed to a price increase and a lack of new original shows. While Netflix has touted its growth opportunities globally, a recent report from consulting firm PwC said the company’s U.S. subscriber level may have reached its peak at 60.2 million.

Nathanson does not see the loss of library content having a major effect on Netflix’s ability to add subscribers. But he believes Netflix will need to step up the marketing for its original series, many of which don’t generate the kind of attention as its biggest hits “Stranger Things” and “Orange Is the New Black.”

The company that defined the concept of binge watching has continued to reinvent itself. But as Disney, Apple and others enter the streaming business, Netflix faces the biggest challenge in its history.

TV industry executives also believe Netflix may have to order more episodes of its original series to keep subscribers hooked longer.

It will take time to determine the effect that losing classic hit shows will have on Netflix, as the exodus will not happen overnight. Netflix has “The Office” until the middle of 2020. Many of the deals it has to carry series such as Disney’s “Grey’s Anatomy” and CBS’ “NCIS,” both huge streaming favorites, run for several years after those shows finish production.

The new Warner Bros.-produced series on the CW — the broadcast network 50% owned by WarnerMedia — will no longer go to Netflix after they air on TV as they have in recent years. They will be on the CW’s own streaming platform, then eventually land on HBO Max. But “Supernatural,” along with other established CW shows such as “The Flash,” “Arrow” and “Riverdale,” are under contract to remain on the service for several years after their runs on TV are completed.

The pressure on media conglomerates to use their most potent properties to build competitors to Netflix presents an opportunity for Culver City-based Sony Pictures Entertainment as an independent studio that can make deals with all of them. The company has a vast library of well-known TV series, including the 1970s classics from producer Norman Lear, who has experienced a renaissance of late with ABC’s recent live stagings of “All In the Family” and “The Jeffersons” episodes.

“With so many of these services and lots of resources going after them, our best positioning is to be the one selling picks and shovels during the gold rush,” Hopkins said. “That’s our business right now.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.