How fast do you cancel streaming services? It’s a problem for Hollywood

Say you sign up for HBO Max to watch “The Flight Attendant.”

The eight-episode season concludes, and you browse for your next binge-viewing fix. Maybe you turn on “Wonder Woman 1984” or rewatch “The Sopranos.” How long before you go to your Apple device’s subscriptions tab and drop the $15-a-month app?

A month? A week? A day?

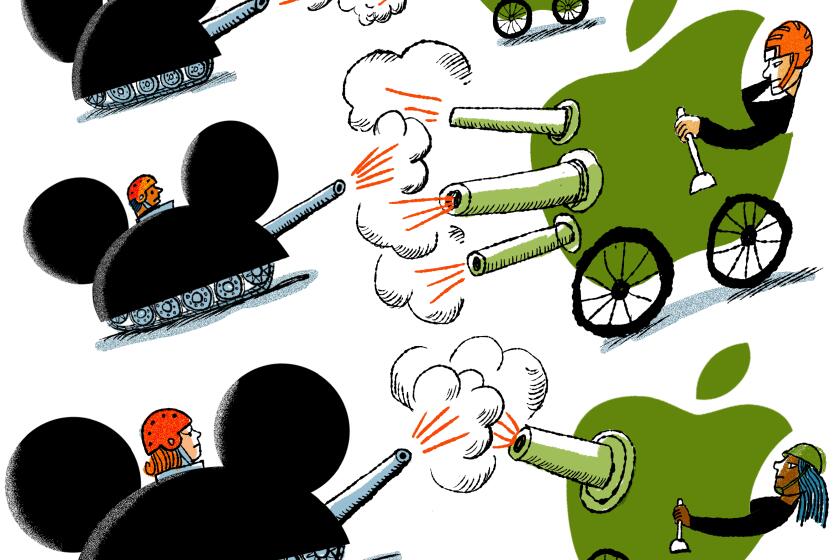

That’s the issue facing media and entertainment companies as the battle for streaming audiences settles into a new phase. During 2019 and 2020, studios launched Disney+, HBO Max, Peacock (which has both paid and free tiers), Apple TV+, Discovery+ and others, all betting on original, exclusive programming to draw users. The coronavirus crisis has been a boon for the streaming industry as movie theaters, concert venues and sports arenas continue to suffer.

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.

The problem is that, because they are so easy to cancel, those services are seeing a lot of people leave after they finish watching the shows that convinced them to sign up in the first place. That phenomenon, known in the industry as “churn,” is a growing headache in the streaming wars, according to a new report released Monday night by professional services giant Deloitte.

According to Deloitte’s survey of 1,100 people in October, 46% of respondents canceled at least one streaming service in the last six months. That’s a dramatic increase from the 20% who said in a similar January survey that they’d canceled a service in the previous year. Of the people surveyed who canceled a streaming subscription, 62% did so because they finished the show or movie that they had signed up to see, Deloitte said.

Disney takes on Netflix, as HBO Max, Peacock, Apple TV+ and Quibi prepare to enter the streaming fray. Not all will be able to thrive in the increasingly crowded market, analysts warn.

The data suggests it’s becoming harder for media and entertainment companies to retain subscribers as competition increases, said Kevin Westcott, Deloitte’s U.S. Tech, Media and Telecom leader, in an interview. With so many services available, having exclusive content alone isn’t enough to keep people on board.

Streaming subscribers reported having an average of five services in October, up from the three they reported having before the COVID-19 pandemic. The surge in streaming subscriptions may seem like good news for media and entertainment companies, but it also means people are dropping services faster as their budgets are strained.

“The competition for the streaming services is shifting to a different level,” Westcott said. “Over the last few years, the focus was on having exclusive, original content. In 2021, it’s going to come down to the user experience and do you feel like a special VIP for being a member.”

The top services have indeed kept their focus on growing their catalogs of movies and shows. Netflix, which reports quarterly earnings Tuesday afternoon, last week unveiled a 70-movie schedule for 2021 with a promotional video promising “New movies. Every week. All year.” The Los Gatos, Calif., company has taken pains to keep a steady flow of fresh series coming to the service, including “The Queen’s Gambit” and “Bridgerton.”

Disney+ is ramping up its programming schedule, with the aim of introducing 100 new titles a year. On Friday, the Burbank company introduced “WandaVision” from Marvel Studios, a clever offshoot series based on characters from its “Avengers” film franchise. AT&T’s WarnerMedia sought to boost HBO Max by moving its 2021 film slate to the service for no extra charge on the same day they hit theaters, including “Dune” and “In the Heights” (for a limited streaming run).

Executives recognize the fickle nature of the audience.

Ann Sarnoff, chair of WarnerMedia Studios and Networks, said last week at the Consumer Electronics Show that the streaming business forces companies to consider measures of success other than box office and other easily understandable metrics, such as ratings.

“In the streaming world, it is a completely different set of criteria,” she said in her Wednesday keynote interview with MediaLink founder and Chief Executive Michael Kassan, referring to factors including subscriber churn and “overall engagement with the service.”

Westcott predicts companies will increasingly try to improve users’ experience on their apps in 2021 by improving the use of data and recommendation technology. Streamers have far greater access to their customers’ preferences than traditional TV channels, which also should help them improve how they target advertising, if that’s part of their business.

Indeed, free, advertising-based services became increasingly popular during the pandemic as paid streamers stretched users’ entertainment spending limits, according to Deloitte. Well-known free services include Fox Corp.’s Tubi, ViacomCBS’ Pluto TV and the Roku Channel.

Deloitte reported 60% of respondents saying they use an ad-supported service in October, up from just 40% in January. Of those who dropped a streaming subscription, 23% said they did so because they could find the content they wanted to watch on a free, ad-based video-on-demand app, up from the 14% who said they did so in a May survey.

“The one thing consumers have told us over and over is, ‘I won’t pay more than I used to pay for linear television,’” Westcott said, referring to the cable and satellite TV bundles to which streaming services were supposed to be a cost-effective alternative. “People are finding that ad-supported platforms have good content.”

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.