Meet the new PG&E. It looks a lot like the old PG&E

Pacific Gas & Electric Chief Executive Bill Johnson promised his company would emerge from bankruptcy a “reimagined utility.”

But as PG&E prepares for life after Chapter 11 — a Bankruptcy Court judge filed a written decision Wednesday saying he would approve the company’s reorganization plan — it’s unclear there’s anything fundamentally different about the utility, which over the last decade has caused a deadly pipeline explosion, deadly fires and days-long power shut-offs affecting millions of people.

At the urging of Gov. Gavin Newsom, the California Public Utilities Commission approved PG&E’s reorganization plan only after adding several conditions designed to force the company to do better. PG&E is being required to revamp its board of directors and create local operating regions. The commission also set up a process by which it can revoke PG&E’s license to operate in the event the utility keeps causing deadly disasters or otherwise fails to live up to its legal responsibilities — in theory, a strong deterrent.

But PG&E is still a shareholder-owned utility, one of the nation’s largest. It is not the customer-owned cooperative envisioned by San Jose Mayor Sam Liccardo, or the public-private entity proposed by state Sen. Scott Wiener, or the purely public utility alluded to in a Bernie Sanders campaign ad. San Francisco will not have an opportunity to buy its portion of PG&E’s electric grid.

The monopoly utility will still be tasked with balancing the demands of shareholders and ratepayers as it works to deliver electricity and natural gas to 16 million people at affordable rates, upgrade an aging network of power lines and pipelines to reduce safety hazards and add growing amounts of solar and wind power to its resource mix to satisfy California’s renewable energy laws.

And all those tasks will be set against the backdrop of a warming climate, which is contributing to larger, more destructive fires.

Is the latest iteration of PG&E up to the challenge?

“There are important signs of change, but there are also enormous fundamental physical challenges that the company has to overcome in order to have a better safety record,” said Michael Wara, a Stanford University energy and climate law professor who was appointed by Newsom to a state commission on wildfire costs. “The proof will be in the pudding. Trust but verify.”

U.S. Bankruptcy Judge Dennis Montali said he would officially approve PG&E’s reorganization plan this week. In his decision Wednesday, he responded to concerns raised by William Abrams, a Tubbs fire survivor who opposed PG&E’s plan.

“Mr. Abrams’ desire for a better PG&E, for a better environment and a better Northern California, safe from wildfires, while aspirational and well-intended, is not something the Bankruptcy Code or this court can deliver,” Montali wrote.

The bankruptcy was PG&E’s second. The company previously filed for Chapter 11 protection in 2001, its finances wrecked by an energy crisis that saw Enron Corp. and other bad actors exploit California’s poorly designed deregulation of the utility industry.

This time, PG&E is grappling with the fallout from crises of its own making.

Your guide to our clean energy future

Get our Boiling Point newsletter for the latest on the power sector, water wars and more — and what they mean for California.

You may occasionally receive promotional content from the Los Angeles Times.

The company is still on federal criminal probation following a 2010 gas pipeline explosion that killed eight people in San Bruno.

In 2017 and 2018, wildfires ignited by the utility’s electric grid infrastructure killed more than 100 people, the vast majority of the deaths resulting from the Camp fire, which destroyed the town of Paradise. To reduce the likelihood of additional blazes while it upgrades its infrastructure, PG&E has turned to massive power shut-offs during fire season, angering customers and politicians.

PG&E filed for bankruptcy protection in January 2019 to shield itself from tens of billions of dollars in potential fire liabilities.

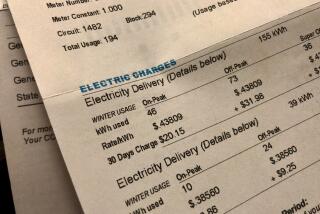

Although the company has restructured its debts and agreed to pay $25.5 billion in fire-related claims, it still faces huge risks. PG&E is exiting bankruptcy with $38 billion in debt, far more than the $22 billion with which it entered bankruptcy. And if it causes another catastrophic blaze anytime soon, investors and lenders might flee permanently, forcing California to take over the utility.

“The company has to have a stable period, or we are not out of this,” Wara said.

Wildfire-prevention outages by PG&E and Southern California Edison have thrown the reliability of the power grid into doubt.

PG&E will have access to a $21-billion wildfire liability fund made possible by state lawmakers last year under Assembly Bill 1054, a hastily approved bill that critics derided as a utility bailout. But another inferno like the Camp fire could drain even that fund.

Asked about PG&E’s finances and debt load, spokesman James Noonan said in an email that the utility “has made substantial progress toward emerging from bankruptcy as a financially stable company positioned to continue prioritizing safe operations and customer focus while meeting California’s energy needs and clean energy goals in a changed climate.”

Just this week, he noted, credit rating agencies assigned investment-grade ratings to the secured bonds the company is issuing as it exits bankruptcy.

“Additional progress includes making the necessary safety and wildfire mitigation investments in the coming years, partnering with the state in achieving its bold clean energy goals and implementing needed changes across our business to become a new and transformed company to meet our commitments to California and our customers,” Noonan said.

Despite those assurances, state Sen. Jerry Hill (D-San Mateo) is preparing for the possibility PG&E will fail once again.

Under Hill’s Senate Bill 350, which is advancing through the Legislature, PG&E would become a nonprofit public benefit corporation known as Golden State Energy if the company’s operating license is revoked by the Public Utilities Commission.

PG&E intends to “render this legislation unnecessary,” Noonan said.

To Hill — who has been one of the company’s leading critics since the San Bruno gas pipeline explosion in his district — the legislation “provides our state with a fail-safe in case the new PG&E falls short of expectations,” he told lawmakers this month.

That said, Hill is cautiously optimistic about PG&E’s future as a private company.

He thinks the local operating regions will help bring PG&E management closer to customers. He’s also hopeful the state’s newly appointed safety monitor — another condition imposed by the Public Utilities Commission — will provide critical oversight.

And he expects PG&E executives to take safety more seriously due to the threat of the company’s license being revoked.

“I have been struggling for the last 10 years to get my colleagues and others to understand the systemic problems” with PG&E, Hill said in an interview. “I believe that because of the governor’s history of being mayor of San Francisco, knowing the company as I’m sure he did, he had a similar insight.... He recognized after the wildfires, the explosions, that change was necessary.”

On Tuesday morning, PG&E CEO Bill Johnson formally entered guilty pleas on behalf of the company for 84 felony counts of involuntary manslaughter stemming from the devastating 2018 Camp fire, which was blamed on the company’s crumbling electrical grid.

Other observers are more skeptical. They say the utilities commission’s process for revoking PG&E’s license may be too long and cumbersome to act as an effective deterrent. They also note that an existing safety monitor — appointed as part of the utility’s probation from the San Bruno explosion — was watching PG&E during the 2017 wine country fires and the 2018 Camp fire.

PG&E also announced a new board of directors this month, to satisfy another requirement from the Public Utilities Commission. Eleven of the 14 members are new to the board, and eight are California residents. Gone are several hedge fund managers, replaced by veteran energy industry executives and a former administrator of the Federal Emergency Management Agency.

The board’s outgoing chair, Nora Mead Brownell, said in a written statement that the new directors are “a critical component of PG&E’s plan to emerge from bankruptcy as a re-imagined utility — one that is in touch with its customers and communities.”

But skeptics aren’t convinced the new board will make much of a difference on its own.

“To me it’s almost indistinguishable from a typical corporate board. So I’m not exactly sure what the point of that exercise was,” said Mark Toney, executive director of the Utility Reform Network, a public interest advocacy group based in San Francisco.

Toney thinks the utility’s future could hinge in large part on who the board selects as the company’s next chief executive.

Current CEO Bill Johnson will retire June 30 after little more than a year on the job, to be replaced on an interim basis by current board member Bill Smith. The replacement for Smith will be the fifth CEO since Geisha Williams took the helm in March 2017.

PG&E ratepayers need “a strong, dedicated, effective leader who is going to stick around for the long haul,” Toney said.

“That’s part of the problem we’ve had holding PG&E accountable, because nobody is held accountable to any of the promises of the past,” he said. “They say, ‘I didn’t make those promises. I can’t be held responsible.’ And then they’re gone in a year or two.”

Your support helps us deliver the news that matters most. Subscribe to the Los Angeles Times.

The magnitude of the challenges facing PG&E’s next CEO is daunting.

The company operates 125,000 miles of electric power lines, many of which run through rural, forested areas where faulty wires can ignite out-of-control blazes. PG&E has under-invested in maintenance for decades — and even now, after several years of wildfire-driven chaos, the utility is far from meeting its goals for fire prevention projects such as tree trimming and grid hardening.

Liccardo, who for five years has led San Jose, the largest city in PG&E’s service territory, doesn’t think the utility is up to the task.

“It appears to be a company that is financially weaker, with less access to capital, with greater need to borrow — all of which tells me that ratepayers, residents and wildfire victims are worse off today than they were a year ago,” the mayor said in an interview.

Liccardo built a coalition of more than 200 mayors, county supervisors, city council members and other local officials — together representing a majority of PG&E’s customers — who called for the utility to become a customer-owned cooperative. They made the case that a co-op structure would align the interests of the company and its customers, while allowing for lower rates because the utility wouldn’t have to generate profits for shareholders and could borrow money more cheaply than a private company.

Liccardo’s co-op proposal didn’t get traction with the bankruptcy court or regulators. But he isn’t giving up.

“There’s plenty of reason to question whether this company is going to be financially viable, whether or not capital markets will respond in such a way that will enable it to survive,” he said. “And then when that moment comes — if it’s back in bankruptcy — there may be an opportunity then to make a new bid.”

There’s no guarantee a government entity would do a better job than Pacific Gas & Electric.

Some experts say there’s no guarantee a customer-owned version of PG&E would provide safer, cleaner or cheaper electricity.

But there’s also no guarantee the shareholder-owned PG&E will emerge from bankruptcy any better at fulfilling those duties.

Public Utilities Commission President Marybel Batjer acknowledged as much when her agency approved the firm’s exit plan. PG&E, she said, “needs to transform into a well-run company that has at its core the safety, caring and knowledge of its customers.”

“In today’s proposed decision, we deploy a set of regulatory tools to help drive this company forward. But PG&E needs to embrace the need for fundamental change,” Batjer said before last month’s vote. “This takes leadership with a vision and discipline to transform the company into a model of good corporate citizenship, where Main Street is far more important than Wall Street.”

Although the commission voted unanimously to approve PG&E’s reorganization plan, Commissioner Martha Guzman Aceves applauded Hill’s legislation, saying it would give California “the tools to replace PG&E” should the company continue to fail.

“We now have a real backstop alternative in Golden State Energy,” Guzman Aceves said.

In addition to the changes imposed by the commission, at least one other shift is coming to PG&E. The utility said this month it will cut costs by moving its headquarters to Oakland from San Francisco, the city where it was founded more than 100 years ago.

Former Gov. Jerry Brown once made a similar shift, moving from San Francisco to Oakland after his failed 1992 presidential bid. He ended up reviving a moribund political career, getting elected mayor of Oakland and later winning two more terms as governor.

It’s yet to be seen if crossing the Bay Bridge will have a similarly transformative effect on PG&E.