Focus on results, not treatments

Alarmed by increases in healthcare costs, policymakers and insurers have adopted a series of reforms over the years -- such as price controls and HMOs -- whose savings proved to be temporary at best. With that history in mind, some experts say that the only sure way to control the growth in healthcare spending is for the government to cap it, a cure that would be worse than the disease. There may be no quick fix, but there certainly are ways to deliver and pay for healthcare that can give consumers more value for their money. If we undertake them now, the eventual result will be a higher-quality system that’s more sustainable and affordable.

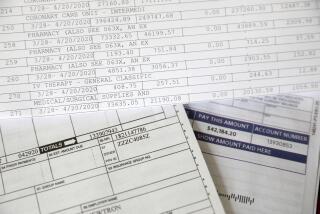

The cost problem has multiple causes, but a primary one is the overuse of medical services and technology. Today’s health insurance system gives physicians and hospitals little incentive to practice medicine cost-effectively. And as long as they can pass their costs on to consumers in the form of ever-rising premiums, insurance companies don’t need to be disciplined spenders either. To create the right incentives, insurers should move away from paying for each treatment or service performed for a patient -- an approach that rewards volume, not effectiveness -- and instead base reimbursements on the treatment plans that produce the best results.

It’s a fundamental shift that would take years to implement, in part because of the work healthcare providers must do to create and maintain treatment guidelines for doctors and hospitals. To help advance the process, Congress included $1.1 billion in the economic stimulus bill in February for research that compares the effectiveness of different treatments. There’s much that remains unknown about how best to treat various illnesses and injuries, and each new drug or device that’s developed raises new questions about effectiveness. There are significant issues too about how to enforce such guidelines. But the development of “best practices” could help doctors by providing a shield against malpractice claims, reducing the incidence of wasteful tests and other “defensive” procedures.

Another needed improvement would be to simplify the interaction between doctors and insurers. A recent study in Health Affairs magazine reported that for every three full-time physicians, two employees were needed to handle the billing and insurance paperwork. That’s an outrageous administrative burden that diverts money from delivering care. Doctors and hospitals, meanwhile, must update the way they collect, store and share information about patients and treatments. Computerizing medical records and integrating information technology into patient care promise to improve care and cut costs by eliminating duplication, averting errors and better monitoring chronic ailments, among other benefits. Congress promoted the effort with about $20 billion in subsidies for electronic medical records in the stimulus bill. But it’s an expensive and time-consuming process -- one estimate put the total cost at $150 billion -- and especially daunting for primary-care doctors in small practices.

A new approach to paying for care can also bring valuable improvements to the way healthcare is delivered. By bundling payments into a lump sum -- rather than reimbursing doctors, hospitals and specialists separately for what they do for a patient -- insurers can promote more coordinated, team-based care. Such techniques have helped such organizations as the Veterans Health Administration, the Mayo Clinic and Minnesota-based HealthPartners, a combined insurer and healthcare provider, deliver high-quality care while also cutting costs.

Just as the incentives for insurers and providers must change, so must the incentives for consumers. Far too many healthcare dollars are being spent on ailments that could have been prevented. Doctors typically start by citing America’s obesity problem -- this country has the highest obesity rate in the developed world by far, contributing to such costly chronic illnesses as diabetes and heart disease -- but they also point to simpler behavioral lapses, such as the high percentage of patients who don’t take their medications as directed. Grocery giant Safeway has demonstrated that employers can save themselves and their workers money by providing financial incentives for healthy behavior and making workers responsible for a meaningful share of their healthcare expenses. Other public and privately funded insurance programs should follow suit, with this caveat: The incentive system shouldn’t penalize those who get sick. After all, that’s one of the biggest shortcomings of private insurance today.

More broadly, the overhaul should help bring market forces to bear on healthcare costs. Most people are concerned about getting the best care, not the least expensive, yet there are few standards for measuring how well healthcare providers do their jobs. Healthcare providers -- not insurers -- need to take the lead in developing those measures to ensure that performance is gauged mainly by medical standards, not economic ones. Consumers could then seek out the best care at the lowest price. The same goes for insurance -- making it easier for consumers to compare insurance companies’ policies and performance would promote competition and restrain costs.

These changes are ambitious, but they could make a significant difference in costs even if they were implemented only for patients with the handful of chronic diseases that account for most healthcare spending. Insurers, hospitals and medical groups have already started testing most of these ideas, with some promising results. The federal government can do its part by promoting these reforms in Medicare and Medicaid. The entire healthcare system would benefit if Washington made those programs more efficient,rather than just slashing payments to doctors and hospitals again and shifting more costs onto other consumers.

More to Read

A cure for the common opinion

Get thought-provoking perspectives with our weekly newsletter.

You may occasionally receive promotional content from the Los Angeles Times.